Sterling endures another rough week; solid US jobs report brings Fed back into focus

- Go back to blog home

- Latest

Those looking for a silver lining in Sterling may take comfort in the fact that the pace of weekly falls in the Pound is slowing, and that it appears to be finding some support just below the 1.30 level. However, there’s no denying that the environment of political instability in the UK, together with the news that more real estate funds had suspended redemptions, were not kind to Sterling against most major currencies.

The good news from the US payroll report is one of the key reasons we expect to see the greenback resuming its ascent against the Euro.

Also strong last week were the Yen and the Australian dollar, with the New Zealand dollar best of all. Special mention to the rally in the Argentine peso, not a common sight among top performers. The current market environment shows a selective risk appetite, as investors shun European assets save for Government bonds, and pile up into stocks that are perceived as being relatively safe from Brexit fallout, notably US stocks which closed last week at an all-time record.

This week we will start receiving the first firm indications of the fallout from the referendum. Obviously, the Bank of England July meeting takes center stage. As important as the actual rate decision will be the minutes of the meeting.

Major currencies in detail:

GBP

Since no important data will come out next week that reflects the impact of the referendum, all eyes will be squarely on the Bank of England meeting Thursday. Consensus seems to be split between no change and a cut of just 0.25%, to 0.25%. We lean towards the latter, and we would not be that surprised to see rates brought all the way down to 0%. The minutes of the meeting will be just as important as the actual decision; they will provide the first detailed look at policymakers’ reaction to the referendum shocker. It is even harder than usual to forecast currency moves in reaction to this event. We do get the sense that aggressive easing of monetary policy has already been reflected in the Pound, and would expect it to retain decent support around current levels against the Euro. The fact that (so far) the freezing of redemptions in real estate funds has not spread to other asset classes is also a welcome sign of stabilization in UK financial markets.

EUR

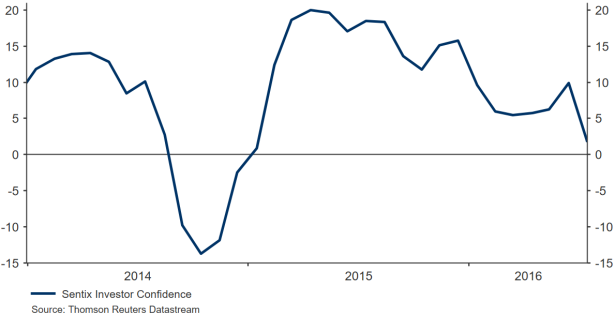

Last week we received the first hint of the impact of the referendum on confidence across the Eurozone, and it wasn’t pretty. The sentix index of investor confidence dropped a much sharper than the expected 7.2 points

, This is not as critical as the PMI reports coming out later in the month, but it provides further evidence that the impact of the referendum result in the Eurozone may have been underestimated by markets. The widening of the gap between economic performance, investor confidence and monetary policy between the Fed and the ECB should continue to put downward pressure on the Euro in the coming weeks.

USD

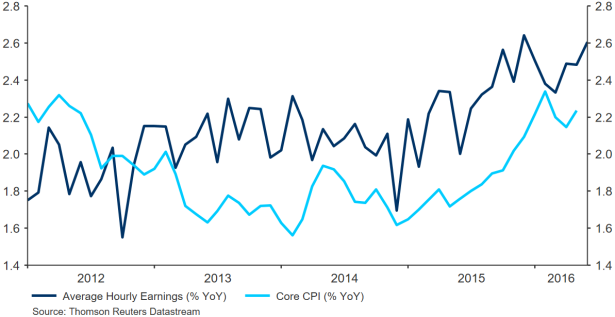

The strong payroll report out of the US last week should lay to rest any concerns about the possibility of a recession in the US. 287,000 net jobs were created, bringing the six month average up to 172,000. There were other sources of comfort. Although the unemployment rate rose 0.1% to 4.9%, this was entirely due to the labor participation rate ticking up to 62.7%. The underemployment rate also dropped to 9.6%, another low for the cycle.

The strong report brought market pricing of the likelihood of a 2016 hike from the Fed back up to 22%. We think this is way too low. The isolation of the US economy and financial system from the referendum fallout should enable the Fed to hike at least once again in 2016, and two or three times further in 2017. The resulting support should enable the dollar to outperform more or less all of its major peers over the coming months.

Receive these market updates via email