Sterling soars as Rishi Sunak reassures financial markets

( 7 min )

- Go back to blog home

- Latest

Risk assets were steady to higher worldwide last week, as markets price in a modestly lower terminal rate from central banks and yields fall.

This week will be a crucial one for currency markets, and financial markets in general. The Federal Reserve meets on Wednesday, followed by the Bank of England on Thursday. The Fed is expected to hike another 75 bps, as is the Bank of England. However, the key in both cases will be the accompanying communications to markets. Central banks in Canada and Australia already have shifted to a slower pace of hikes, so we would not be surprised to see Fed officials leaning that way. The Bank of England is different in that a lot depends on the as yet undefined details of Sunak’s fiscal plans. Eurozone flash CPI data on Monday, and the US payrolls report on Friday, will round up an unusually busy week for currency markets.

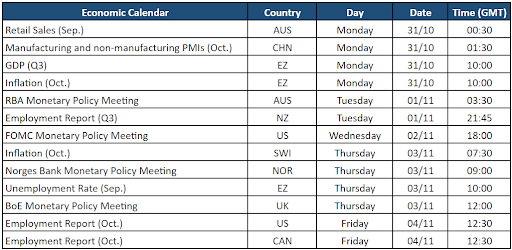

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 31/10/2022

GBP

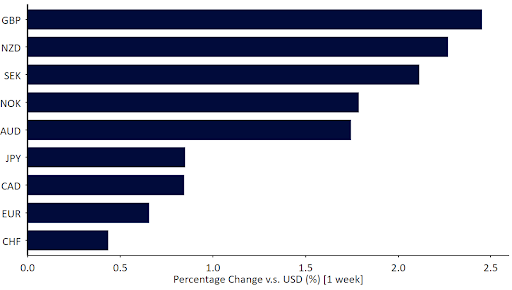

We saw the first signs that the budget mayhem had impacted business confidence in weaker-than-expected PMI numbers for October. Other macroeconomic data was more mixed, coming slightly above admittedly subdued expectations. However, sterling trading remains fixated on politics.

Figure 2: UK PMIs (2019 – 2022)

Source: Refinitiv Datastream Date: 31/10/2022

Prime Minister Sunak’s premiership is off to a solid start, with the pound trading above where it was before the disastrous budget announcement. Forecasting the Bank of England’s decision and communications is even more difficult than usual because Sunak’s budget announcement has been pushed back to November, and the MPC’s stance will be clearly dependent on the Government fiscal plans. We see a strong possibility of another three-way split vote on interest rates among MPC members this Thursday, making the task of calling the magnitude of the hike an extremely difficult one. Expect plenty of volatility this week as a result.

EUR

The PMIs of business activity weakened again in the Eurozone during October, but actual GDP data came stronger than expected in Germany. The ECB hiked by 75 bps and appeared to attempt some sort of muddled dovish pivot by tweaking its communications. In its statement, the bank dropped the language ‘over the next several’ meetings, in favour of expecting to raise rates ‘further’, though the reaction in the euro was not overly aggressive.

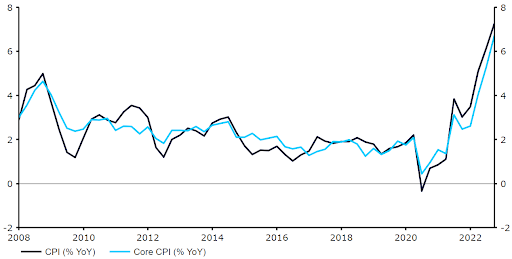

As if on cue, German inflation came out much higher than expected at a knee-bending 11.6% annual rate – a full 10% higher than the ECB overnight rate after last week’s hike. Both headline and core inflation are expected to continue their march higher in October, and we think that President Lagarde will have to soon backtrack yet again on her perceived dovishness.

USD

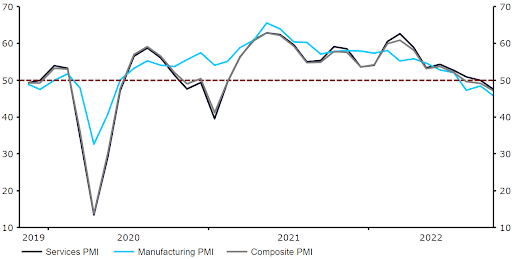

Second tier data in the US from the housing market, consumer confidence and durable good orders all suggested that Fed hikes are finally beginning to have an effect. Weak tech company earnings also contributed to the sense that we may be reaching a pivot point, at least in the short-term, and that the Fed may be able to start easing off the brakes soon. The key, however, remains the labour market, where no signs of easing are evident yet.

Figure 3: US House Price Index (2000 – 2022)

This week’s nonfarm payrolls report comes after the Fed November meeting, where another 75 bp rate hike is a done deal and the only question is whether Chair Powell hints that the central bank is comfortable with current expectations for a terminal rate near 5% next year. Any hint of the long awaited dovish pivot from the Fed could bring about a sharp dollar sell-off.

JPY

The Bank of Japan once again stuck by its highly dovish monetary policy stance during its meeting last week, remaining the outlier among all the world’s major central banks. Rates were kept unchanged, with the BoJ continuing to pledge to keep the 10-year yield at 0% by purchasing unlimited amounts of bonds. The core inflation forecasts were revised higher, with policymakers noting that risks to the Japanese economy were ‘skewed to the downside’.

Still, the yen was able to post modest gains against the broadly weaker US dollar. Expectations that the BoJ will continue to intervene to prop up the battered currency, having likely spent a record amount on intervention in October, should provide support for the yen in the coming weeks. Whether this will be enough to trigger a meaningful recovery in JPY remains to be seen, but we suspect it won’t be enough, barring a reversal on monetary policy from the BoJ, which doesn’t appear forthcoming.

CHF

Yet again, the Swiss franc was among the worst-performing G10 currencies last week. Its behaviour has been in line with broader changes in risk sentiment, which has been supported by a decline in European gas prices and easing in Fed rate hike expectations. The former has helped the franc outperform its safe-haven peers in recent weeks, albeit it has also meant that the currency has underperformed its higher risk European counterparts. Dovish signals from the ECB meeting allowed the franc to recover some of its losses on Thursday, although the EUR/CHF pair is now edging close to parity.

Sentiment data from Switzerland out last week was mixed. The key KOF economic barometer did, however, dip further in October (90.9), pointing to sluggishness ahead. This week will see quite a few economic data releases from Switzerland. We’ll focus largely on consumer price data for October, out on Thursday.

AUD

Tuesday’s RBA meeting will be the main event risk for financial markets in Australia this week. Another 25bp rate increase is widely expected by markets, the same as the previous meeting. The upside surprise in Q3 inflation, which rose to 7.3% (7.1% expected) could make for an interesting discussion among ratesetters, and there is a small chance that the bank could surprise with a half a percentage point hike. This would be a very bullish development for AUD, as markets are only pricing in around a one-in-five chance of such a move.

Figure 4: Australia Inflation Rate (2008 – 2022)

Source: Refinitiv Datastream Date: 31/10/2022

Assuming the Reserve Bank of Australia sticks to the script this week, which we suspect that they will, the dollar may take its cue from a handful of macroeconomic data releases out in the coming days. The services PMI (Wednesday) is expected to remain in contractionary territory, while Q3 retail sales (Friday) is predicted to show near flat spending in the three months to September. Downside surprises here, and a dovish message from the RBA, would likely dispel any expectations of a return to a 50bp hike during the rest of the tightening cycle.

NZD

The New Zealand dollar outperformed its Australian counterpart last week, finishing as the second best performer in the G10, just behind the pound. A broad improvement in risk sentiment has provided good support for NZD so far in October, with the currency posting its best month in around a year at the time of writing. Unlike the RBA, the Reserve Bank of New Zealand is yet to deliver a dovish pivot, and markets are increasingly confident it will announce at least another 50bp rate hike at its November meeting.

We will be looking for developments in macroeconomic data this week that could cement these already aggressive interest rate expectations. The Q3 employment and wage growth numbers on Tuesday are likely to be highly important. Economists are eying a modest uptick in job creation, which would be the first positive quarter of employment growth since the third quarter of 2021.

CAD

A dovish pivot from the Bank of Canada weighed on the Canadian dollar last week, causing it to be one of the worst performers in the G10. The BoC unexpectedly slowed the pace of policy tightening, delivering just a 50bp rate hike, after markets had expected a 75bp one. Its communications were also equally dovish. Governor Macklem stated that the bank was close to ending the hike cycle, citing the heightened risk of a slowdown and possible recession. We see this as a pretty clear signal that the bank will likely revert back to a ‘standard’ 25bp rate increase in December, and could end the tightening process either following the meeting, or in January, dependent on economic news in the interim.

A handful of BoC members will be speaking in the coming days, though they are merely likely to reinforce the message from last week. This Friday’s labour report will likely be an important one. A downside surprise here could cement the case for a smaller hike at the last BoC meeting of the year in December.

SEK

The Swedish krona appreciated against most of its major peers last week, trading at its highest level since the start of the month against the euro. Macroeconomic news out of Sweden of late has been mixed, to say the least. The flash third quarter GDP print, out on Friday, was much stronger-than-expected, with the economy posting solid 0.7% QoQ expansion, well above the 0.1% contraction that economists had pencilled in.

However, more up-to-date data points suggest that activity is slowing. According to data released last week, retail sales fell by 0.4% in September, the fifth consecutive monthly decline. In addition, the manufacturing PMI, to be released on Tuesday, is expected to remain in contraction territory for the second consecutive month. It appears that high domestic inflation, together with the aggressive tightening cycle undertaken by the Riksbank, are beginning to weigh on activity in the private sector. This could weigh on SEK in the coming weeks, particularly should the Riksbank disappoint at its 23rd November meeting.

NOK

The Norwegian krone appreciated against the euro last week, supported by expectations that Norges Bank will raise rates by 50 basis points again at this Thursday’s policy meeting.

Markets are fully pricing in a 50 basis point rate hike this week, so anything less than a half a percentage point move would be a disappointment for markets and likely trigger a fall in NOK. Moreover, a 50 basis point hike, accompanied by dovish rhetoric suggesting that the central bank may ease the pace of tightening from the next meeting onwards, would be perceived as particularly bearish for the currency. Risks to the krona are elevated this week, and the bank will likely have to be extremely aggressive for the currency to receive any meaningful support.

CNY

The Chinese yuan was one of the worst-performing currencies last week, selling-off slightly against the broadly weaker US dollar. Sentiment towards the currency has been soured by the recent consolidation of power from President Xi’s Communist Party. This poses questions about the prospects of the private sector, and ensures that zero-Covid is likely here to stay. On Tuesday, however, the yuan posted one of its largest one-day gains in recent years on news of reported FX intervention. A report from Reuters indicated that Chinese banks were active that day, selling dollars to boost the yuan. Nevertheless, the currency faile to hold onto its gains during the rest of the week.

Today’s official PMI data does nothing to help the currency’s fortunes. Both the manufacturing and non-manufacturing readings surprised to the downside and dropped below the level of 50. To some extent, this reflects softer global demand. The decline in the services sector activity was, however, particularly significant, suggesting that disruptions related to zero covid continue to weigh on domestic consumption. We’ll focus on the Caixin PMI data this week, which will complete the picture of Chinese business activity in October. The manufacturing print will be out on Tuesday, with the services index out on Thursday.

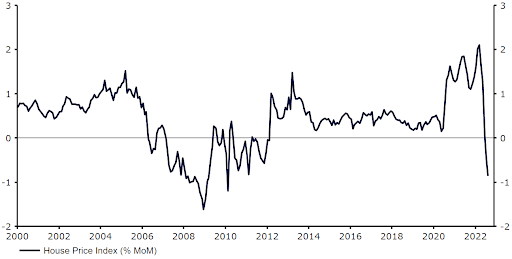

Economic Calendar (31/10/2022 – 04/11/2022)