Tight ranges hold in currency markets with central banks in focus

( 3 min read )

- Go back to blog home

- Latest

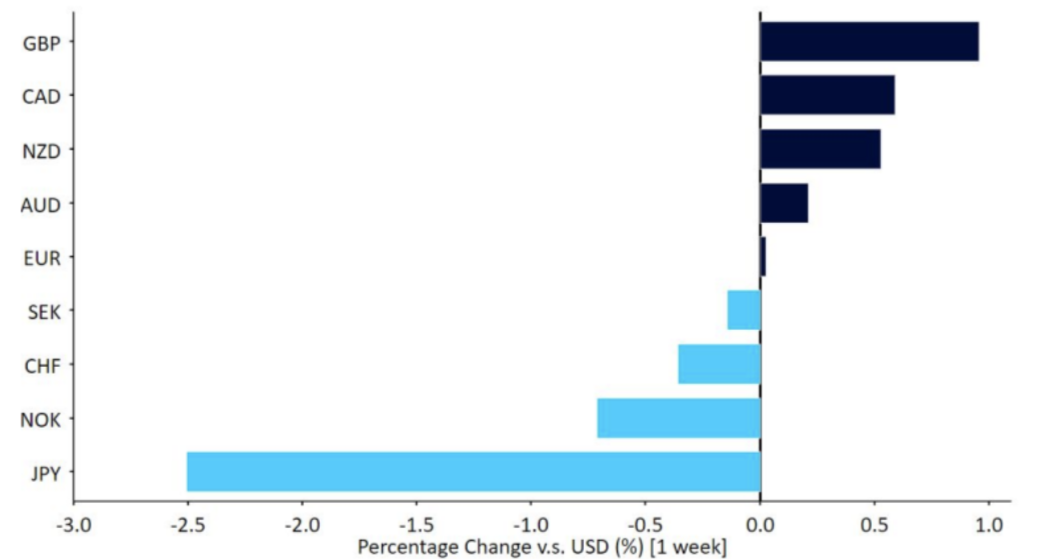

As expected, a data-light week saw muted moves among the major currencies, which almost all held to recent trading ranges.

This week is shaping up to be perhaps the most decisive one of the year so far. In addition to the Federal Reserve meeting on Wednesday, followed by the ECB one on Thursday, we have a deluge of critical data, including the monthly US labour market report and both the quarterly survey of Eurozone bank lending and the Eurozone inflation number for April on Tuesday. This means that some Council members will wait until the last minute to decide between a 25bp and a 50bp move, adding to the uncertainty and potential for volatile trading this week.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 30/04/2023

GBP

We are pleased with the outperformance in sterling so far this year, since we had flagged the pound as one of the most undervalued major currencies at the start of 2023. The mere absence of negative news flow out of the UK appears to have been enough to push it upwards last week, with the pound outperforming both the dollar and the euro. Recent communications from BoE members have also continued to strike a hawkish tone, and market participants appear increasingly confident that we could see UK rates top 5% later this year. The MPC won’t be meeting until next Thursday, so the business activity PMI data out this week could be important in guiding expectations for the decision.

We think that sticky inflation and rising wages will prevent the Bank of England from switching to a

wait-and-see mode any time soon and, as the Fed approaches the end of the current hiking cycle, we expect sterling to remain well supported.

EUR

As this is written, markets seem to be leaning to a 25bp at the ECB meeting on Thursday. Recent Euro Area activity data, notably the PMIs, has been rather strong, while core inflation has proved sticky, so even in the event of a smaller hike we would expect a hawkish tone in the bank’s communications. We also do not entirely rule out a 50bp move, which would clearly be bullish for the common currency given current market pricing.

However, with the quarterly bank lending survey and the April flash inflation report to be released soon before the event, anything can happen. Strategists are betting that we will see a slight pullback in the key core inflation data, but this has proven a stickier indicator in the Eurozone than in the US and market hopes have been disappointed before. Whatever the final decision, we expect communications to suggest that the Council decisions remain highly data dependent and that the hiking cycle in Europe will last for a few months longer.

USD

Macroeconomic news out of the US in the past week has been rather mixed. The first quarter GDP print was a clear disappointment, with growth slowing to just 1.1% annualised, almost half the consensus. More timely indicators of activity have painted a slightly more optimistic note, although signs of an easing in US inflation suggests that the Fed will likely deliver a final 25bp rate hike this Wednesday.

As things stand, markets have not yet completely ruled out the possibility of another move in June, although the key for the dollar will be the communications accompanying this decision. On the one hand, prices and wages are far from consistent with a return to 2% inflation. On the other, while the bank crisis seems to have been contained, its impact on credit availability adds to the significant monetary tightening carried out by the Fed. Labour market indicators have suggested some slowdown recently, albeit from a very fast pace. We think the main hope for the dollar would come in the form of significant push back from the Fed against the cuts priced in by markets later this year and/or a stronger than expected nonfarm payrolls report on Friday.

JPY

The Japanese yen was by far the worst performing currency in the G10 last week, crashing to its lowest level in a year against the dollar after the Bank of Japan stuck by its ultra-loose monetary policy stance. Friday’s announcement following the BoJ meeting failed to deliver any change – the interest rate remained negative (-0.1%), while the tolerance range for 10-year Japanese bonds was kept intact, remaining at 50bps above/below zero. While no rate hike was anticipated, investors had pondered a scraping of the yield curve control policy in the face of still relatively strong price pressures (3.5% of core CPI inflation in Tokyo in April),hence the sharp sell-off in the yen.

Weak labour market data also failed to help the yen last week. The unemployment rate unexpectedly rose to 2.8%, versus the 2.5% consensus, and the jobs/job applicants ratio fell to its lowest level since August (1.32).That said, domestic demand remains robust, with retail sales increasing by 7.2% in March. The coming days do not promise to be as exciting – both Wednesday, Thursday and Friday are public holidays in Japan, with no new macroeconomic releases, thus the currency is likely to move in line with market sentiment.

CNY

The yuan ended last week slightly lower against the US dollar. Recent economic news from China has not been particularly good. Industrial profits contracted by 19.2% year-on-year in March, underscoring the unevenness of the economic recovery. PMI data released on Sunday further emphasised this trend, showing somewhat disappointing activity in the non-manufacturing sector, accompanied by a slight downturn in manufacturing.The manufacturing PMI printed at 49.2, its lowest reading this year. The recovery in China’s economy is on track, but we could hope for more. China’s Politburo said on Friday that demand is ‘insufficient’, reaffirming that policy is set to remain supportive.

In the Labor Day ‘golden week’, we’ll continue to focus on the PMI data. The Caixin manufacturing PMI will be out on Thursday, followed by the services and composite PMIs on Friday.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk