Time for the ECB to do more

( 3 min read )

- Go back to blog home

- Latest

The European Central Bank will announce its latest policy decision this coming Thursday, with investors bracing for the unveiling of another increase in monetary stimulus.

“The Governing Council is fully prepared to increase the size of the PEPP and adjust its composition, by as much as necessary and for as long as needed”.

We therefore think that it is likely that they will announce an increase in the PEPP (the Pandemic Emergency Response Programme launched in March) at this week’s meeting.

Since the last meeting, communications from the Governing Council have further opened the door to additional action. The April meeting minutes, released on 28th May, stated

“It was underlined that past experience showed that a loss of confidence in financial markets had to be avoided and pre-emptive action was preferable”.

ECB members Lane and Schnabel also both talked up the possibility of an increase in stimulus measures last week as the bank looks to soften downside risks posed by the COVID-19 virus.

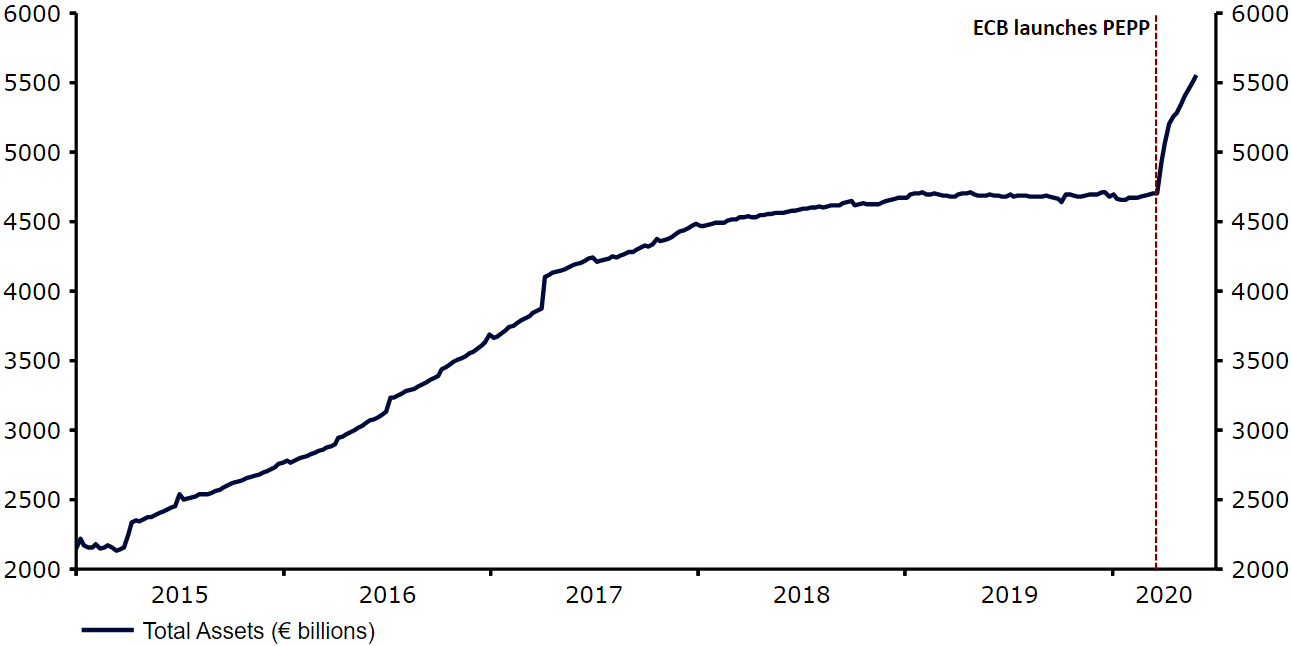

With an immediate increase in the PEPP well telegraphed by the ECB and largely expected by the market, the main question is the magnitude of the programme’s increase. While the current envelope of €750 billion is undoubtedly sizeable, this still only equates to around 6% of the Euro Area’s GDP, suggesting that there is scope to do a fair bit more. At the current pace of purchases (Figure 1), the existing 750 billion euro programme is also set to run dry by October – an insufficient time frame for the global economy to bounce back to more normal levels of capacity, in our view.

Figure 1: ECB Balance Sheet (2015 – 2020)

Source: Refinitiv Datastream Date: 01/06/2020

We are therefore expecting the ECB to increase its pandemic purchasing programme by 500 billion euros this week. This, we think, will be sufficient to absorb the expected issuance from peripheral sovereigns through at least the end of 2020. We think that the end date for the programme will also be pushed from the end of the year until a few months into 2021, perhaps mid-next year.

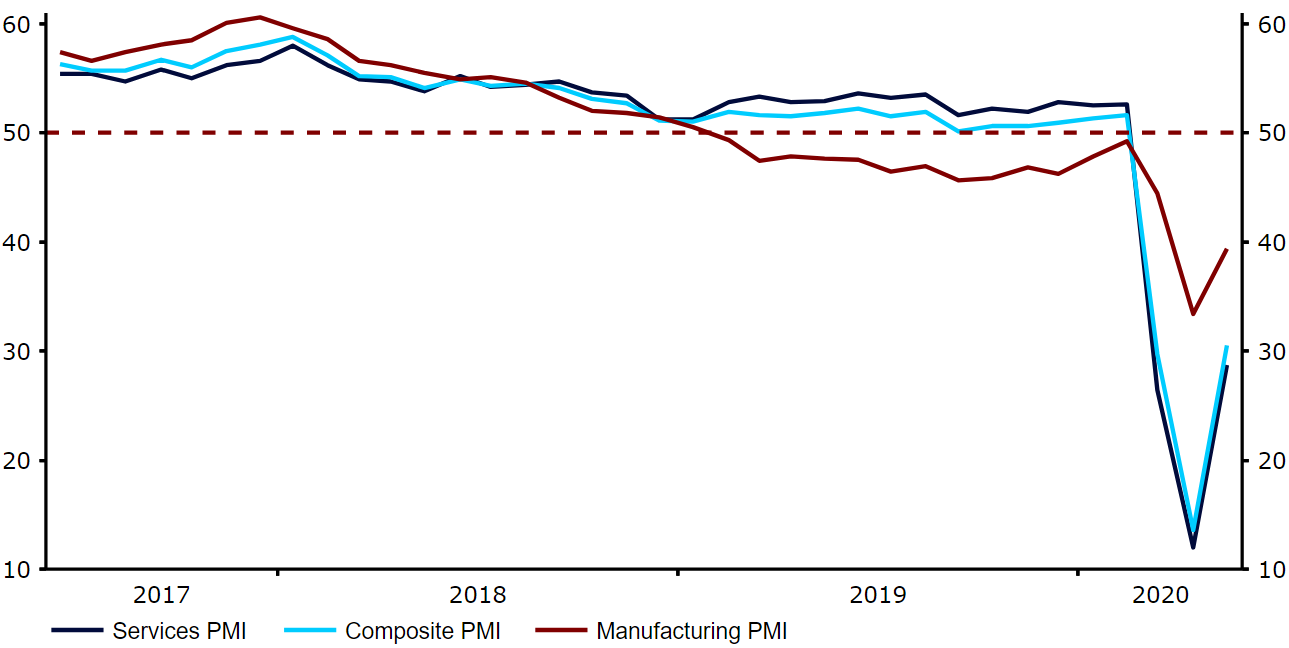

Aside from the policy decision itself, the market will be paying close attention to the bank’s economic projections. There has been limited hard economic data that covers the second quarter of the year, but soft indicators of activity for April and May have been dismal, most notably the business activity PMIs (Figure 2). Speaking last week, ECB President Christine Lagarde noted that the bank’s mild scenario for the Euro Area economy laid out in April was now unrealistic and that the actual GDP contraction this year would be closer to the medium to worst case scenario (an 8-12% contraction). A downgrade in the bank’s base case GDP projection for 2020 to similar levels now seems on the cards, in our view.

Figure 2: Euro Area PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 01/06/2020

As for the euro’s reaction, we think that both the size of the increase in the PEPP and the magnitude of the ECB’s revised GDP projections could shift the common currency. We remain fairly bullish on the euro going into the meeting. While a more sizable-than-expected downward revision to the outlook is entirely possible, we think that a hefty increase in the bank’s asset purchasing programme would be more than enough to offset this pessimism.

Currency markets want to see credible commitments to stimulus and economic recovery in the different currency areas, so we expect these announcements from the ECB will have a positive impact on the euro. Conversely, should the ECB fail to act now, then the euro would likely sell-off sharply.