US dollar hits 2022 highs as Fed signals March interest rate hike

( 3 min )

- Go back to blog home

- Latest

The US dollar broke to its strongest position against its major peers so far in 2022 on Wednesday evening, after the FOMC delivered a hawkish message following its January meeting.

Powell’s press conference was, on the whole, a very hawkish one. He noted confidence the US recovery would not be hurt by higher rates, while also stating that officials were willing to raise rates faster than they did at the beginning of the last hiking cycle in 2015. Powell cited ‘remarkable’ progress seen in the US labour market and an economy that ‘no longer needs sustained high levels of monetary policy support.’ He said that ‘most’ participants, himself included, now agree that labour market conditions are consistent with maximum employment. The bank also sees excessively high inflation as the main risk to the US outlook.

During his press conference, Powell noted ‘supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation’.

Going into the meeting, the bar for a hawkish surprise was high and, as we had noted in our preview report, we thought that we would need to see something special from the Fed to see any meaningful gains in the dollar. Contrary to some expectations, the bank confirmed that net asset purchases will be wound down to zero as planned in early-March. A reduction in the bank’s balance sheet, known as quantitative tightening, will also commence ‘after the process of increasing the target range for the federal funds rate has begun’. The details on the possible pace and timing of QT were rather vague, although we would expect the Fed to begin the process after it has raised interest rates on at least a couple of occasions, i.e not until at least the July meeting.

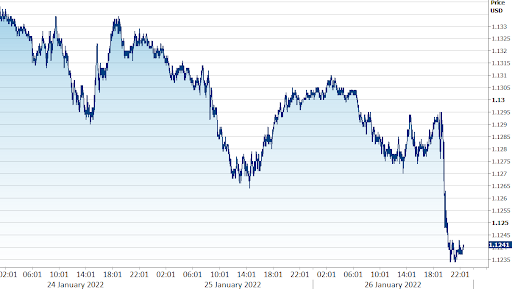

Perhaps the most hawkish element of the FOMC’s communications was, however, Powell’s comment that he did not rule out the Fed raising interest rates at every meeting during the remainder of the year. While we see this as unlikely, the acknowledgement that every meeting from now on is a ‘live’ one is a clear signal of intent that policymakers are firmly committed to controlling US inflation. After a muted response to the Fed’s statement, it was this rhetoric that sent the dollar rather sharply higher against all of its peers, with EUR/USD down around half a percent to its weakest positions since 19th December (Figure 1). As one would expect, equities sold-off with yields up sharply – the 2-year Treasury yield, for instance, increased by a whopping 14 basis points.

Figure 1: EUR/USD (24/01/22 – 26/01/22)

Source: Refinitiv Datastream Date: 04/11/2021

All in all, a very hawkish message from the Fed on Wednesday, that exceeded the market’s already lofty expectations. A first rate increase in the pandemic era is now all but certain in March – we continue to think that a 25 basis point move is on the way, with a total of four hikes in 2022 now a bare minimum. Powell’s acknowledgement that every meeting is a ‘live’ one would suggest that an even more aggressive pace of tightening is not out of the question should inflation continue to far exceed the central bank’s target. Financial markets have been quick to react, and are now pricing in more than a 50% chance of five hikes over the course of the year.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports