US Dollar rally continues, UK trade balance falls further into negative

- Go back to blog home

- Latest

The US Dollar continued to strengthen against its major peers on Monday, with last Friday’s impressive nonfarm payrolls figure causing the market to seriously consider the possibility of as many as two interest rate hikes by the Federal Reserve before the end of the year.

Following recent interest rate cuts in Australia and most notably the Bank of England in the UK, the Reserve Bank of New Zealand is overwhelmingly expected to follow suit on Wednesday. This could prove the most important event risk in the currency markets this week.

A broadly stronger Dollar kept Sterling pinned around its three week low. Sterling fell further overnight after Bank of England policymaker Ian McCafferty claimed in a newspaper interview that more quantitative easing could be required if the UK’s economic outlook was to worsen.

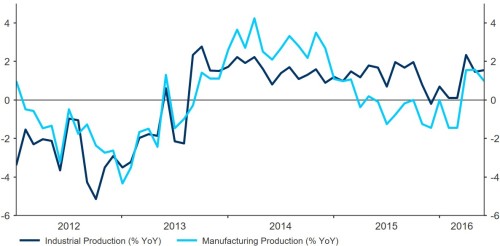

Economic data out of the UK this morning was also fairly poor. Manufacturing production fell to 0.9% YoY, with industrial production unchanged at 1.6% (Figure 1). The UK’s trade balance also fell further into negative territory, with the trade balance for goods now perilously close to a record high deficit.

Figure 1: UK Industrial & Manufacturing Production (2012 – 2016)

The Euro also traded lower on Monday despite better than expected confidence data out of the Eurozone. The Sentix investor confidence index rose above forecast, suggesting that worries in Europe about Britain’s vote to leave the European Union could prove temporary.

Elsewhere, commodity currencies received a boost yesterday after the price of oil rallied almost 3% amid renewed speculation that OPEC would attempt to restrain output and ease worries of oversupply.

Major currencies in detail:

GBP

Sterling extending its losses since last week’s Bank of England interest rate cut, falling by 0.5% to back below the 1.30 mark against the US Dollar.

Following the BoE’s cut, investor bets against the Pound rose to a fresh record high last week, suggesting that further weakness in the currency could be on the way. However, with the Bank of England now in ‘wait and see’ mode, this steady monetary policy stance could mean we’re establishing a tentative bottom in GBP/USD.

Retail sales defied expectations of a post-Brexit slump in July according to the British Retail Consortium this morning, with their latest report showing that sales increased 1.9% in the month. Warmer summer weather was likely a major factor, with a significant increase in spending in pubs and restaurants contributing to the overall increase in spending.

EUR

The Euro was little moved on Monday, ending the London session 0.1% lower versus the Dollar.

Economic news out of the Eurozone was mostly positive yesterday. Industrial production in Germany rose more than expected, increasing by 0.8% in the month to June versus the 0.7% expected. The Sentix investor confidence index also increased to 4.2 from July’s fairly dire 1.7 reading.

Concerns stemming from June’s Brexit vote appear to be dissipating, with the devaluation of Sterling and monetary easing from the Bank of England expected to boost sentiment further in the Eurozone.

Economic announcements out of the Euro-area remain few and far between this week, with attention on monetary policy announcements elsewhere. This Friday’s second quarter growth estimate will be the main focal point of the week.

USD

Renewed expectations for an interest rate hike by the Federal Reserve this year sent the Dollar 0.2% higher against its basket of currencies yesterday.

Financial markets have brought forward their expectation for the next Fed rate hike following last week’s impressive data. Fed funds futures are now placing around a 50% chance that rates will go up at the FOMC’s December meeting.

We look to Chair Janet Yellen’s appearance at the Jackson Hole conference at the end of the month as a major opportunity for the central bank to spell out the likely timing of its next monetary policy move.

Friday’s retail sales data will be the next major economic release across the pond. In the meantime, we expect sentiment toward the US Dollar to remain heavily dependent on expectations for the next Federal Reserve interest rate hike.

Receive these market updates via email