US economy grows at fastest pace in two years in Q2

- Go back to blog home

- Latest

The Dollar regained ground against its major peers on Wednesday after revised GDP data out of the US comfortably exceeded expectations in the second quarter.

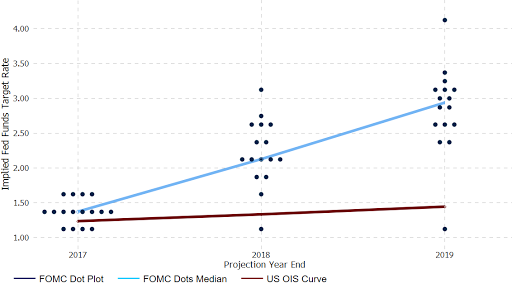

Figure 1: FOMC June Dot Plot vs. OIS Curve (2017 – 2019)

Moreover, yesterday’s ADP employment change number continued to suggest that the US labour market is performing well and at a level that is suitable for higher interest rates. The private sector of the US economy added 237,000 jobs in August, another massive beat on the 185,000 consensus.

While there is not a direct correlation between the ADP number and Friday’s nonfarm payrolls report, it bodes well for a strong number tomorrow which could reignite another wave of buying pressure in the greenback. Today’s PCE index, the Federal Reserve’s preferred measure of consumer inflation, will also be worth looking out for.

Draghi wary of common currency strength?

The Euro’s rally lost steam on Wednesday with investors potentially wary that the rapid appreciation in the currency may be coming to an end. Traders are beginning to speculate that President of the ECB Mario Draghi may be growth concerned about the single currency’s strength, given its negative effect on the competitiveness of European exports.

News out of the currency bloc yesterday was actually fairly encouraging, although almost completely dismissed by investors. Economic sentiment increased to its highest level in a decade this month according to the European Commission. The monthly index rose to 111.9 from a revised 111.3.

Economic data comes thick and fast in the Eurozone this week with the month unemployment and inflation numbers this morning likely to prove a market mover if we see any sort of positive or negative surprise. Headline inflation is expected to have ticked upwards to 1.4% in the year to August, with the jobless rate forecast to remain unchanged at 9.1%.

Sterling nurses losses ahead of PMI data

The Pound had a mixed session yesterday, although retraced some of its losses against the Euro after falling to an eleven month low. With Brexit talks ongoing and no significant developments on that front, Sterling was largely driven by events elsewhere.

Barring any news out of this week’s negotiations we think the Pound will continue to be driven by developments abroad ahead of tomorrow morning’s manufacturing PMI.