The US Dollar rose to a nine month high against its major peers on Monday, with growing expectation for a US interest rate hike and the increased likelihood of a Hillary Clinton Presidential Election victory providing good support for the currency.

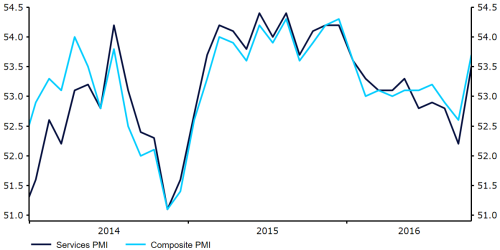

A better-than-expected set of business sentiment surveys also lifted the Euro off its recent lows. The Eurozone’s composite PMI, which measures growth in both the services and manufacturing industry, soared to a 10 month high of 53.7 in October from 52.6 in September, ending the recent run of declines that has seen the index fall to its weakest level since the beginning of 2015 (Figure 1).

Figure 1: Eurozone Purchasing Managers’ Indexes (2014 – 2016)

Yesterday’s impressive data will fuel hope of an economic recovery in the Eurozone in the final quarter of the year and could alleviate pressure on the European Central Bank to ease its monetary policy in the coming months.

Meanwhile, Sterling ended the day mostly unchanged, despite the release of a report from the Confederation of British Industry that showed the largest drop in factory orders since February.

The main events in the currency markets today come in the form of central bank speeches, with Governor of the Bank of England Mark Carney and President of the European Central Bank Mario Draghi both making public appearances. Draghi will be speaking in Berlin during a lecture on monetary policy at 16:30 UK time, while Carney will be talking at the Economic Affairs Committee at 15:30 UK time.

Major currencies in detail:

GBP

Sterling continued to trade within a relatively narrow band yesterday, having last week stabilised around the 1.22 mark against the US Dollar. The Pound dipped 0.1% for the day.

Yesterday’s industrial trends survey from CBI made for grim reading. The over index fell sharply from -5 to -17, with employment in the sector declining for the first time in six years in the third quarter despite rising orders and output.

Meanwhile Prime Minister Theresa May looked to alleviate concerns of an economically detrimental Brexit yesterday. May reiterated that there would be a series of parliamentary debates on the EU exit, while claimed there were no suggestions Britain was heading for a ‘hard’ Brexit.

Mark Carney will be the main focus today. The initial estimate of third quarter growth on Thursday will also be under the spotlight this week and is expected to show a meagre 0.3% growth.

EUR

The Euro steadied itself off its recent four month low, rallying 0.1% against the US Dollar after an impressive set of economic data in the Eurozone.

The latest services and manufacturing PMI’s provided some welcome relief for the Eurozone economy yesterday with both measures bucking the recent downward trend that has seen growth grind to a near standstill in the Euro-area. The services PMI rose to 53.5 from 52.2, while the manufacturing index increased to 53.3 from 52.6, boosted by impressive growth in Germany which experienced its second fastest expansion this year.

Business sentiment data out of Germany this morning is expected to remain mostly unchanged in October. Any significant policy comments from Draghi this afternoon could also shift the Euro today.

USD

The Dollar index rose to its highest level since February on Monday, increasing 0.2%.

Manufacturing activity in the US surged in October, growing for the fifth straight month and its fastest pace in a year. We think this continues to cement the case for a rate hike in the US this year, with markets currently pricing in a December hike at around 70%.

St Louis Federal Reserve President Bullard also spoke yesterday, although struck a fairly dovish tone by claiming that just a single rate hike in the US was necessary for the time being.

Friday’s GDP numbers will be the main economic announcement in the US this week. This afternoon’s housing and consumer confidence numbers could receive some attention.

Receive these market updates via email