The US Dollar rallied to its strongest position in seven weeks this morning following Donald Trump’s long awaited speech to Congress overnight and some hawkish comments from Federal Reserve officials.

President of the San Francisco Fed John Williams said that a March hike was up for “serious consideration”, while Dudley suggested that the case for tightening monetary policy had become “a lot more compelling”. A string of hawkish rhetoric from Fed members in the past few days has ramped up expectations that interest rates in the US will be raised later this month. Fed futures are now pricing in around an 80% chance of this being the case compared to a mere 30% as recently as last week.

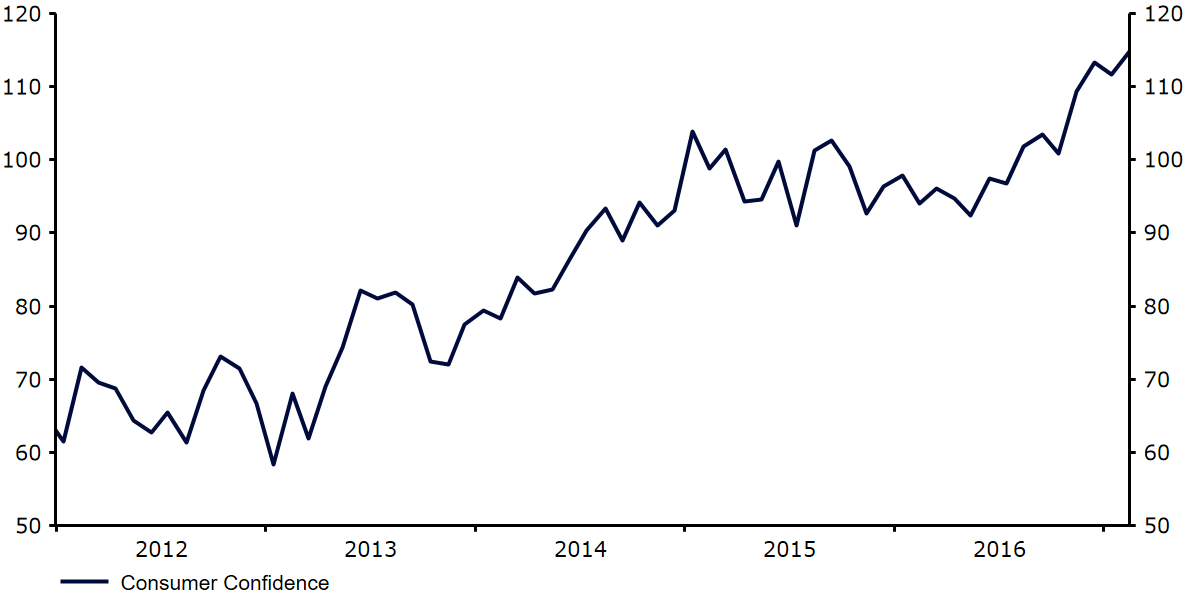

Traders mostly overlooked the very impressive release of the latest consumer confidence index that suggested activity in the world’s largest economy is on course to pick up pace in the coming months. The monthly index soared to its highest level since July 2001 in February (Figure 1), with consumers in the US more upbeat about future prospects for both business and labour market conditions. This bodes particularly well for growth prospects in the US in the coming quarters.

Figure 1: US Consumer Confidence (2012 – 2017)

Sterling remained under pressure for a second day against the Euro on Tuesday. Scottish First Minister Nicola Sturgeon claimed in a newspaper article that the “sheer intransigence” on the part of the government over the Brexit process could lead to a second independence referendum. While talk of another referendum could be unsettling for the Pound in the short term, we think the British government is unlikely to green light one while the Brexit negotiations are ongoing.

Federal Reserve members Kaplan and Brainard will be speaking this afternoon. Manufacturing PMI’s are also due for release across both sides of the Atlantic.

Major currencies in detail

GBP

Sterling traded within a fairly narrow range yesterday, although fell 0.3% against the Dollar overnight on ramped up Fed hike expectations.

A lack of any economic data releases in the UK whatsoever on Tuesday meant that the Pound remained stick within a tight band throughout much of trading. New Bank of England Deputy Governor Charlotte Hogg spoke yesterday, claiming that her dependence on above-target inflation would depend on the events that triggered higher prices. She also hinted that the central bank remained a long way off unwinding its existing quantitative easing programme launched in the wake of the financial crisis.

This morning’s manufacturing PMI for February is expected to dip slightly on previous when released this morning.

EUR

The Euro rose for the second day against the US Dollar yesterday, although fell off sharply 0.5% during Asian trading.

Inflation data out on Tuesday was consistent with the theme of a general improvement in economic conditions in the Eurozone. Consumer price growth in Italy accelerated to 1.5% in February from 1.0%, while inflation in France increased month-on-month, having declined in January. This bodes fairly well for Thursday’s Euro-wide inflation data which is expected to show prices accelerated by above 2% year-on-year for the first time in four years.

The monthly manufacturing PMI in the Eurozone is expected to remain unchanged when released this morning.

USD

Concerns about Trump’s speech overnight caused the Dollar to end London trading lower, although it rallied sharply 0.5% against its major peers on Wednesday morning, buoyed by comments from Fed officials.

The GDP estimate for the fourth quarter in the US was revised modestly downwards yesterday. Growth in the final three months of last year came in at a reasonably healthy 1.9% annualised. While slightly disappointing the report revealed that consumer spending remained robust at the end of last year, with investors optimistic that domestic activity could receive a boost from Donald Trump’s infrastructure spending later this year.

Trump’s comments last night are likely to drive trading for much of today. The ISM manufacturing PMI at 15:00 UK time will be the main economic data release on Wednesday.