Volatility returns with a vengeance on Fed hawkishness

( 5 min )

- Go back to blog home

- Latest

Interest rates are going up everywhere, hard and fast, and markets are finding it increasingly difficult to ignore the consequences.

The focus in markets this week will be on April inflation data out of the US. Any sign that inflationary pressures are peaking could prompt a sharp countertrend sell-off in the dollar and rates, both of which have been rising in tandem for a while now. The euro could receive further support from hawkish commentary from ECB officials, which are starting to sense how far behind the inflation curve they have fallen.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 09/05/2022

GBP

The Bank of England managed to deliver yet another negative surprise for sterling. Last week, they hiked rates as expected, but combined the move with a uniquely downbeat message that the UK faces stagflation, and that inflation will continue to rise while the economy goes into recession later in the year.

The Pound dropped sharply to end the week dead last among major currencies, in sharp contrast with the euro’s stability. We think the messaging was excessively negative, and this week’s GDP data should remain fairly positive and provide support for a currency that has become the cheapest among G10 ones, with the possible exception of the Japanese yen.

EUR

The euro bucked the general currency trend last week and managed to eke out some gains against the US dollar, making it the best performing currency in the G10 last week for the first time in a good while. No doubt the chorus of hawkish statements by ECB officials suggesting that a hike in July is a done deal and that June cannot be ruled out helped, as did the increasingly stretched market positioning, where the euro has come to be seen as a one-way bet and traders are increasingly short.

Expect more ECB officials, including President Lagarde on Wednesday, to reinforce this narrative and potentially help the euro stabilise.

USD

The Federal Reserve meeting on Wednesday provided some very short-lived relief to markets when Chair Powell appeared to take 75 basis point hikes off the table for now. However, risk assets and US Treasuries reversed course quickly and resumed their sharp sell-off the following day, and tech stocks and speculative favorites generally got pummelled for the rest of the week.

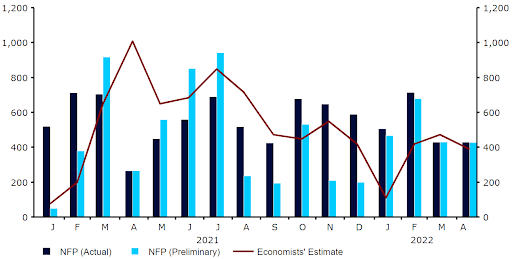

The payrolls report on Friday sent the same message of the last few months: the US is at or beyond full employment, no further help will come from expanding the labour force, and wages continue to lag prices. The latest one could be a silver lining of sorts for the Fed and, should we see any signs that price pressures are peaking in Wednesday’s CPI report, as markets expect, Treasury markets could see some relief, and the relentless dollar rally could falter.

Figure 2: US Nonfarm Payrolls (2021 – 2022)

Source: Refinitiv Datastream Date: 09/05/2022

CHF

The Swiss franc was among the worst-performing G10 currencies last week, second only to the pound. Although the overall risk sentiment was negative, which is typically good news for the franc, the currency seems to have been pressured lower by the widening rate differentials between Switzerland and other countries. The franc seems particularly sensitive to shifts in US long-term yields, and we indeed saw some sharp increases. The 10-year yield has jumped above the 3.15% level.

Economic data out of Switzerland last week did not rock the boat. Inflation ticked up to 2.5% in April. While it was the highest level since 2008, it seems the Swiss National Bank is still nowhere near tightening monetary policy in any significant manner. It means that there’s now an increasing divergence between most major central banks and the SNB. We think that it should continue to pressure the Swiss franc in the medium term. With no important releases from Switzerland on tap this week we’ll focus on outside news.

AUD

Last week’s interest rate hike from the Reserve Bank of Australia was not enough to prevent a sell-off in the Australian dollar, although AUD was one of the better performers among the G10 currencies.

The Reserve Bank of Australia surprised the markets by raising interest rates by 25 basis points at its May meeting, as markets were expecting a 15 basis points hike – the first hike since 2010. RBA Governor Philip Lowe said the time was right to start withdrawing monetary support, as inflation has picked up faster than expected. In its statement, the Reserve Bank of Australia noted that it is committed to doing what is necessary to ensure that inflation in the country returns to target and signalled that there will be further increases in the future.

With no major economic data due out of Australia this week, AUD may be mostly driven by generalised risk aversion and events elsewhere.

CAD

The Canadian dollar traded at its lowest level since December 2021 against the US dollar this morning, largely due to the generalised strength of the USD.

On domestic data, the April jobs report was mixed. On one hand, the unemployment rate in Canada fell to a record low of 5.2% in April. But on the other hand, the Canadian economy added 15.3K jobs in April, well below market expectations, and job additions in March. Together with the high inflation rate in the country, the unemployment rate data reinforces the hawkish stance of the Bank of Canada. We think this strengthens the case for the BoC to tighten policy more aggressively this year, and opens the door to another 50 basis point hike at the June meeting.

With no major economic data due out of Canada this week, CAD may be mostly driven by market risk aversion and events elsewhere.

CNY

The yuan continued selling off last week and underperformed most of its peers in the week shortened by the Labour Day holidays. The currency remains pressured lower by internal issues, as well as a relentless US dollar rally. That said, it did receive some help from the PBoC, after the bank sett a stronger-than-expected fixing on Thursday. This is another indication that the central bank may not want to see the currency weaken too rapidly.

With no end to the zero-covid policy in sight, the future of the yuan will largely depend on the country’s success in battling the virus. Shanghai’s outbreak seems to be close to being contained, but Beijing has tightened restrictions, as it on the verge of lockdown. Last week’s business activity data showed a more pronounced than expected decline in the Caixin services PMI, which does not bode well for growth in the second quarter.

This week will see a release of a number of economic prints from China, including April’s inflation data out Wednesday. The PBoC will also set its 1-year MLF rate, and may deliver a cut of 5-10 basis points.

Economic Calendar (09/05/2022 – 13/05/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports