What to expect from this week’s Jackson Hole conference

( 2 min )

- Go back to blog home

- Latest

This afternoon’s annual two-day Jackson Hole meeting of central bank heads is shaping up to be the main event in the currency markets this week.

The main focus may, however, be on any comments from Powell on how the Fed views US inflation, specifically whether the bank will adopt average inflation targeting in the not too distant future. This would imply that the Fed would look past short-term above 2% inflation and would act as a signal to the market that US interest rates would likely be kept low for an even longer period of time than currently envisaged. Needless to say, this would be a negative development for the US dollar.

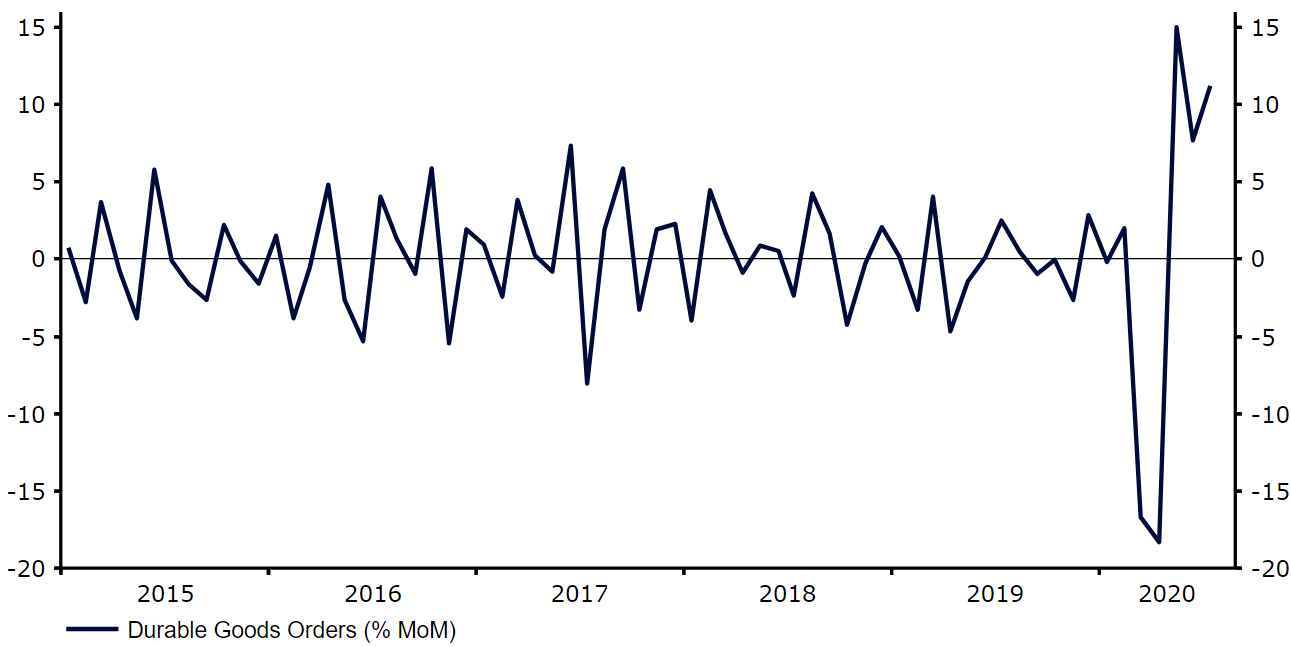

Ahead of the Jackson Hole conference, US economic data surprised to the upside yesterday. Orders for durable goods leapt by 11.2% in July after investors had eyed a 4.3% increase. The data was, however, quickly forgotten, with EUR/USD ending largely unchanged for the third straight day after a brief dollar rally. Revised third quarter GDP data for the US will also be out this afternoon, although this is unlikely to prove a big market mover.

Figure 1: US Durable Goods Orders (2015 – 2020)

Source: Refinitiv Datastream Date: 27/08/2020

Pound rallies ahead of Bailey’s keynote speech

The pound was one of the best performing major currencies yesterday, rallying back up above the 1.32 level versus the dollar. There weren’t any major catalysts driving the move, which we attribute mostly to technical factors and shifts in general market sentiment more than anything else.

The main event risk for sterling this week will be on Friday, with Bank of England governor Andrew Bailey set to deliver a virtual keynote speech during the Jackson Hole meet. With an apparent lack of appetite among the MPC to lower interest rate any further, and with the bank’s quantitative easing programme unlikely to be ramped up again in the immediate future, we don’t expect too much new information to come out of the speech. Bailey may instead touch on how effective the bank’s monetary policy measures have been in protecting the UK economy during the COVID-19 pandemic thus far.