What to look out for in this week’s FOMC meeting

( 3 min read )

- Go back to blog home

- Latest

Since the onset of the COVID-19 pandemic, the Federal Reserve has unveiled a wide range of easing measures designed to support the US economy. This has included cutting interest rates to zero and pledging to purchase an unlimited amount of bonds to drive down yields and keep financing costs as low as possible.

We outline below the keys to the Fed meeting this week:

- 1) Fresh economic projections

It is widely expected that the US and indeed global economies will contract by unprecedented magnitudes this quarter. The key question is the depth of the contraction and how long the downturn will last.

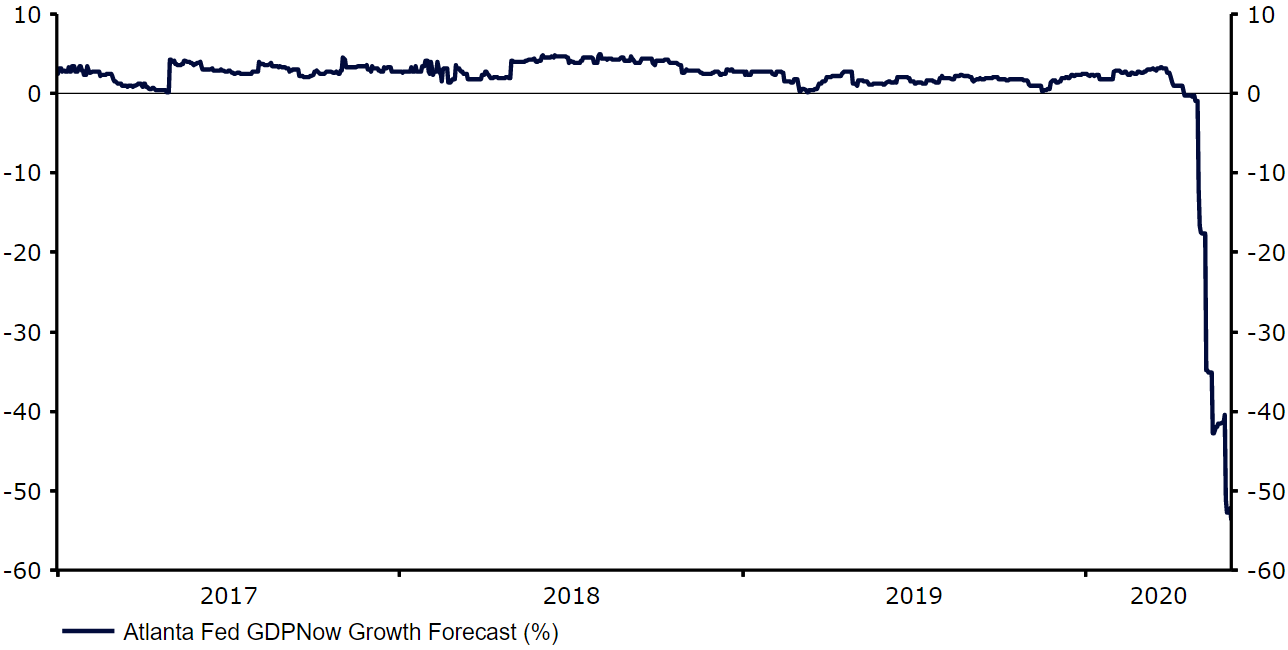

Regarding the former, the Atlanta Fed’s GDPNow model paints a pretty grim picture, suggesting that the US economy is on track to contract by more than 50% in Q2 (Figure 1). Should the FOMC indicate that a contraction of this scale is on the cards, then we may see weakness in the dollar. More important will be the Fed’s view on how quickly the economy bounces back from the downturn. Chair Jerome Powell may warn over the risks of a prolonged period of high unemployment and the possibility of a retightening in restrictions should the US experience a second wave of infections.

Figure 1: Atlanta Fed GDPNow Forecast (2017 – 2020)

Source: Refinitiv Datastream Date: 08/06/2020

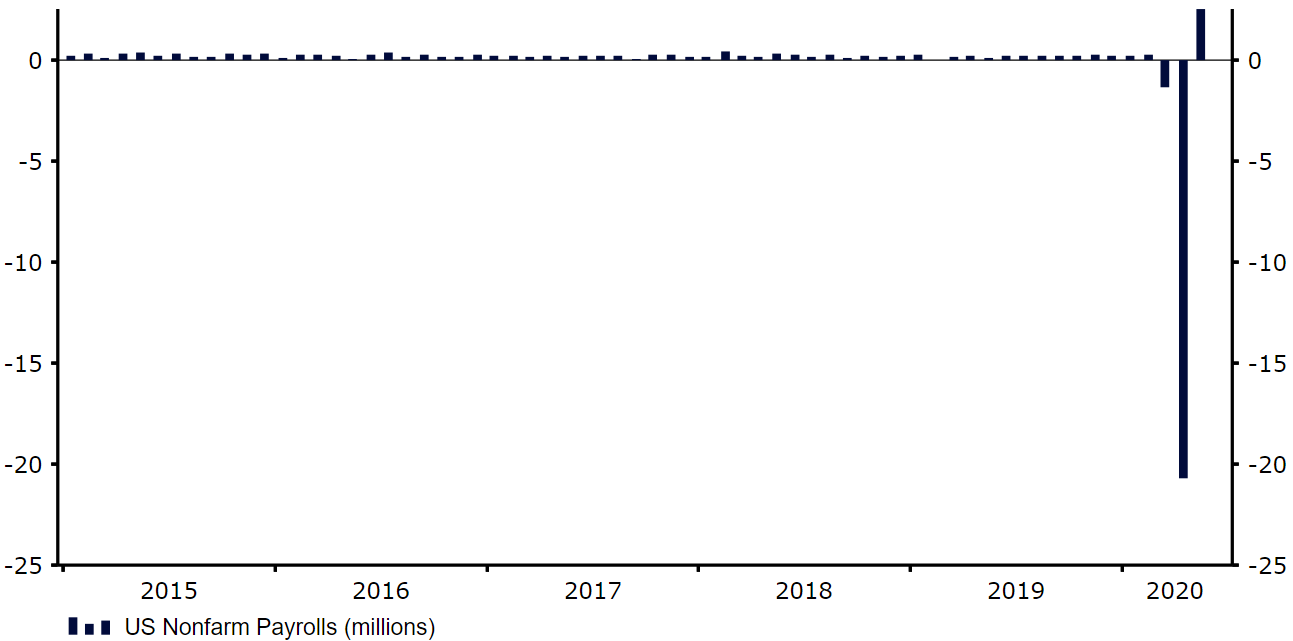

An important takeaway from the meeting will be how the Fed views the recent rebound in equity, commodity and credit markets, as well as last Friday’s impressive nonfarm payrolls report. The latter surprised significantly to the upside, with a total of 2.5 million net jobs created in May (Figure 2), against the 7.5 million contraction that economists had anticipated. Should the Fed indicate that they see this report as evidence of a faster-than-expected V-shaped economic recovery, then the dollar would likely rally. Should they downplay the data and see it as nothing more than a minor correction, investors would likely view this as a bearish signal for the greenback.

Figure 2: US Nonfarm Payrolls (2015 – 2020)

Source: Refinitiv Datastream Date: 08/06/2020

- 2) Forward Guidance

An option for the central bank to reassure households and businesses could be to adopt more formal forward guidance, i.e by pledging to keep interest rates at zero for the foreseeable future. Regarding the bank’s quantitative easing programme, we expect the bank to reiterate that it stands ready to continue purchases ‘in the amounts needed to support smooth market functioning’. While this programme has been tapered significantly since the height of the pandemic, policymakers are likely to keep their options open to increase the quantity of purchases should financial market conditions deteriorate. If the recent reaction in currency markets to increased stimulus is anything to go by, we think that the dollar would more likely than not respond favourably to this.

Aside from that, there is speculation that the Fed could follow in the Bank of Japan’s footsteps in introducing yield curve control – a mechanism where it caps yields at a certain level through to a specific duration. We do, however, think that the introduction of this as soon as this week’s meeting is unlikely, although the Fed may indicate that discussions were had regarding its implementation.

- 3) The updated ‘dot plot’

Alongside its updated GDP projections the Fed will, for the first time since December, provide an updated ‘dot plot’ chart, showing where each member of the committee expects interest rates to be in the years ahead.

Chair Jerome Powell has already stated that officials are ‘not going to be in any hurry’ to unwind their easing measures. We are, of course, facing the biggest hit to the global economy in decades, with conditions that would warrant an increase in rates a considerably long way off. We think that the dot plot will show this lack of appetite for a change in the status quo and indicate that the medium Fed member believes rates will remain at current levels throughout the forecast horizon. We would expect the market to be bracing for much of the same, with a dot plot showing anything other than rock-bottom rates through to the end of 2022 likely to catch investors off guard. We do not think that the Fed will entertain the notion of lowering rates into negative territory – something that Powell appeared to rule out during a recent communication in May.

As is customary, the Fed’s interest rate decision will be announced at 7 p.m. BST on Wednesday, with Powell’s press conference to follow half an hour later.