Banking as a Service

Modular access to our global transaction banking platform, tailored to your needs

Future-proofed global transaction banking

Whether you are a FinTech looking to expand your offering or licensing coverage, or a Bank searching for new ways to transform your global transaction banking proposition, our Banking-as-a-Service solution gives you seamless, API-driven access to our capabilities

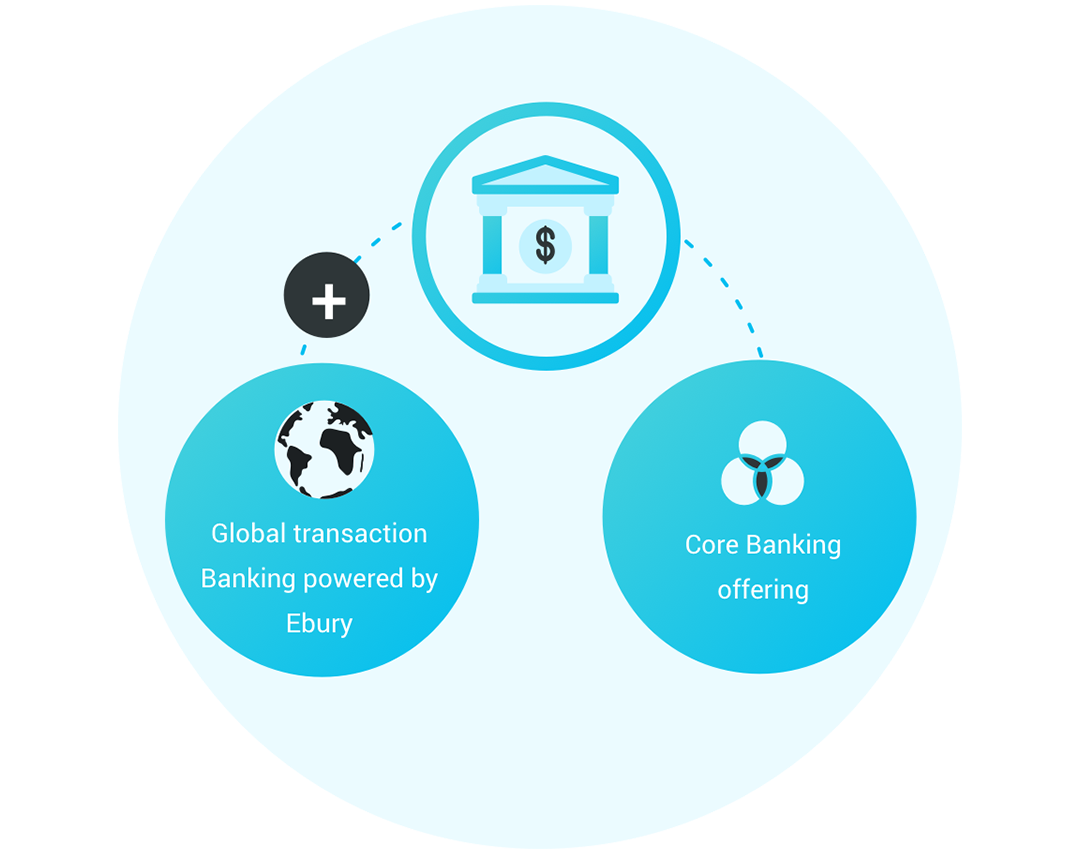

BANKING AS A SERVICE

Modular access to our global transaction banking platform

Our proposition to Financial Institutions ranges from selected elements of Ebury's infrastructure, all the way to the complete transaction banking stack coupled with support from Ebury Risk Management specialists.

International cash management solutions

Local accounts and domestic settlement in over 30 countries, with dedicated IBANs issued for your clients within hours

FX hedging solutions in over 130 currencies

Pre-approved forward credit lines for tenors up to 5 years

Trade Finance lending

Unsecured working capital lending up to £3m

Why Ebury?

Global infrastructure

With our broad set of regulated capabilities and local expertise, you can expand your proposition to your clients

Flexibility to fit your specific needs

We work with every financial institution to tailor a collaboration that fits its goals

Seamless connectivity

Our API delivers reliable connectivity that won’t affect your services

No investment required

Expand the proposition to your clients while reducing costs

Get in touch!

Contact us today to become an Ebury partner