Trade Finance

Flexible lending solution: Ebury Trade Finance. Our lending solution provides you with credit to help finance your international goods and services.

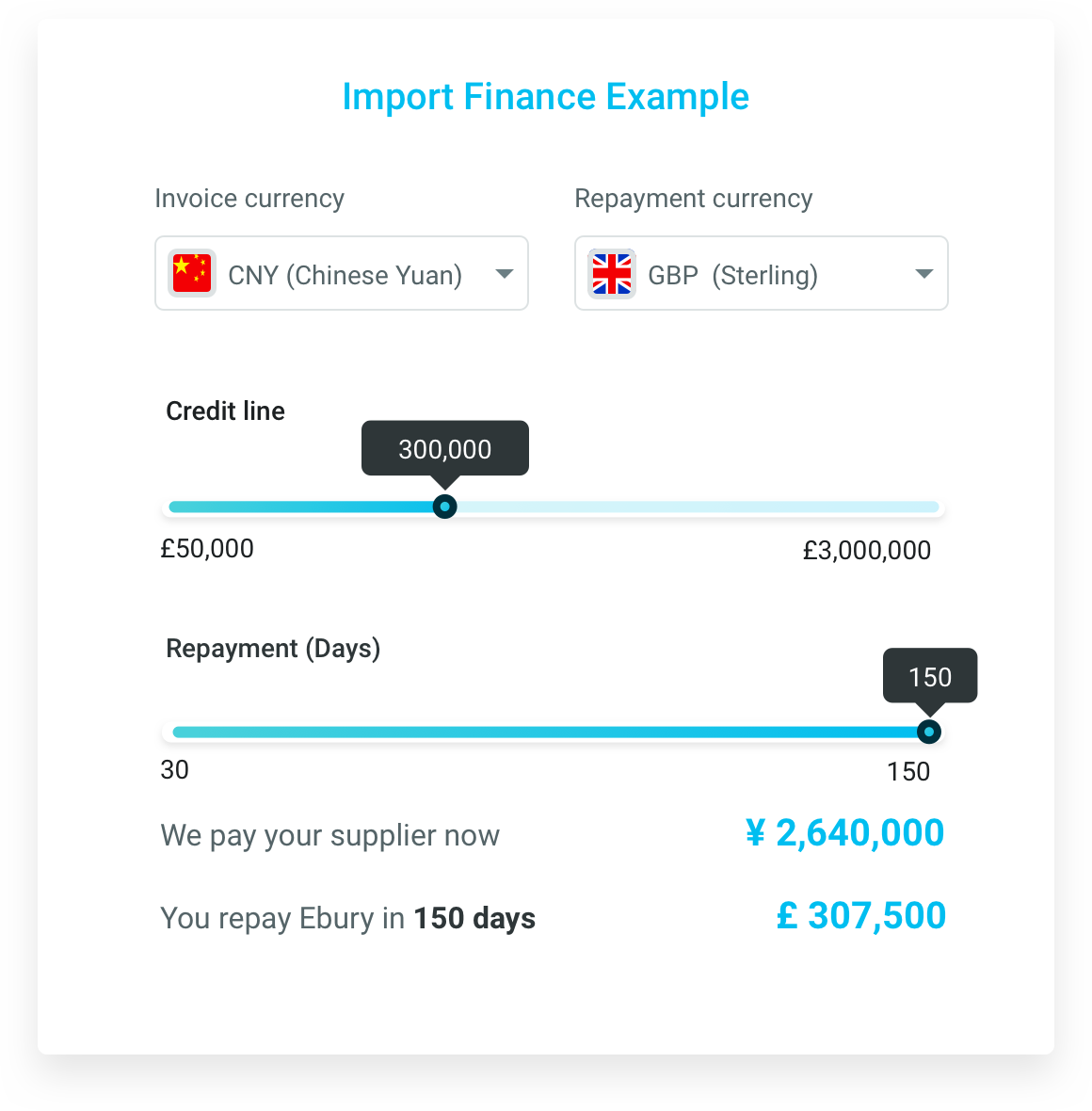

*Representative example of 0.5% per month funding cost and GBP/CNY = 8.80

Reduce your cash-flow gap

Get credit to help finance your international goods and services

- Pay as you go: There are no up front or hidden fees, meaning you can use the facility whenever you like without incurring unnecessary costs

- Pay us back 150 days later: Reduce your liquidity needs with our longer payment terms

- Your goods are yours: We take no collateral, which means there’s no impact on any existing credit lines you have

WHY CHOOSE EBURY’S TRADE FINANCE?

How does trade finance work?

Your supplier sends you an invoice

You forward the invoice to Ebury and Ebury pays your supplier in any currency

You sell your goods or services

You repay Ebury up to 150 days later in your domestic currency

FAQs

Got a question? We are here to help you.

If you can’t find answers to your questions, our team would be more than happy to assist you.

If the annual revenue of your business is more than £1M, has a tangible net worth of £100,000, and displays a healthy trading record for at least two years – you can apply for our lending solution.

We do not take the title over your goods or any security against you or the business. In rare cases, we may require a personal or cross-company guarantee to provide financing.

We require the following documents to assess your business – two years of full accounts, monthly (or quarterly) management accounts for the past 12 months and a list of aged debtors and creditors. We also require financial monitoring on an ongoing basis to further use the line.

Once you have submitted all the required information, the process can take up to two weeks, but we always strive to expedite the process.

Interest is quoted per-30-day basis and applied daily following a minimum 30-day period. For example, if you use £100,000 of financing at 1% per 30 days and repay after 150 days, you will repay £105,000. If you repay after 60 days, you will repay £102,000.