The Pound sank by over one percent against the US Dollar on Monday afternoon, sent sharply lower by Theresa May’s announcement that Tuesday’s proposed parliamentary Brexit vote would be delayed.

The Prime Minister instead stated that she would be returning to European Union leaders in the coming days to seek reassurances over the Irish border. Those reassurances would entail confirming that the so-called Irish ‘backstop’, which guarantees no hard Irish border in the event that negotiations fail, would not be in place for an indefinite period. While no exact timetable for the vote was given, it would need to take place no later than 21st January.

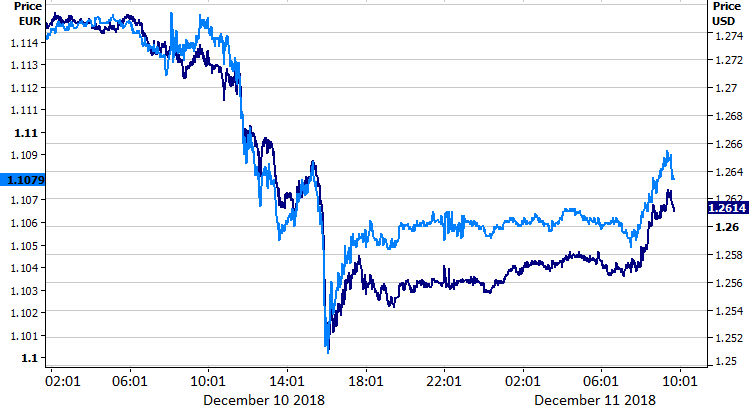

Sterling reacted in an unsurprising fashion to the news, sinking to its lowest level since April 2017 versus the greenback, while also dragging the EUR/USD rate around half a percent lower. It has, however, recovered some of these losses this morning after European Council President Donald Tusk claimed that it was ready to discuss how to smooth the ratification (Figure 1).

Figure 1: GBP/USD & GBP/EUR (10/12/18 – 11/12/18)

Yet, with a sizable section of government firmly against the PM’s current deal, the market is unlikely to take an optimistic view that any reassurances from the EU on the backstop would in any way increase the likelihood of her deal passing in a delayed vote. For this reason, the UK currency may remain on the back foot in coming days, as Britain’s political future grows increasingly uncertain.

Will the ECB revise its inflation and growth projections this week?

Brexit dominated all else in the currency markets yesterday, with the EUR/USD rate driven almost entirely by developments out of the House of Commons.

Attention in the Eurozone now turns tentatively to Thursday’s meeting of the European Central Bank. Following a bout of very underwhelming economic data in the Eurozone, there has been some speculation that President Mario Draghi may be set to extend the quantitative easing programme, due to be wound to zero at the end of this month. We do, however, think that this is very unlikely and instead expect a possible downward revision to short term growth and inflation forecasts.