The pound gave up some of its gains during Asian trading on Monday and into the early London session yesterday, with investors starting the week slightly less hopeful that a Brexit agreement could be reached before the end of the month deadline.

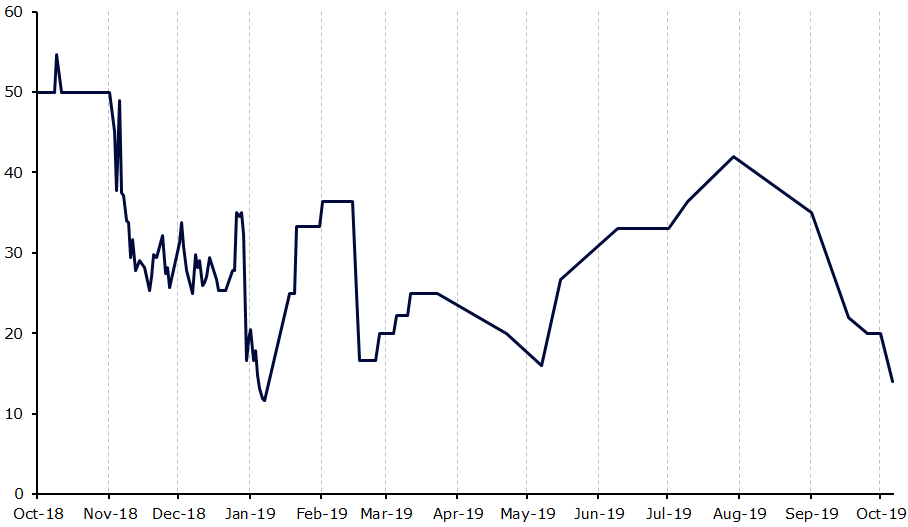

Boris Johnson is required by law to ask for a three-month delay to Brexit on the 19th, baring some sort of obscure legal loophole. This ensures that the chances of a ‘no deal’ Brexit at the end of the month are slim. Betting markets are now placing a mere 14% chance of a ‘no deal’ by the end of October, the lowest this measure has been since January (Figure 1).

Figure 1: Bookmaker Implied ‘No Deal’ Brexit Odds (Oct ‘18 – Oct ‘19)

Receding odds of a ‘no deal’ have been reflected in sterling, which this morning was trading just shy of the 1.27 mark, in part due to some more upbeat comments from EU Chief Brexit negotiator Michel Barnier who claimed that a deal was possible this week.

This morning’s labour report will probably go largely under the radar given the full attention the market is placing on Brexit developments. Until Brexit is sorted, macroeconomic news out of the UK is likely to mostly take a back seat.

Markets ignore news of US-China trade ‘deal’

The recent positive noises out of the Brexit discussions has also helped buoy the euro in the past few sessions, although the common currency has spent much of the past 24 hours fairly range bound against the dollar.

News of a ‘phase 1’ trade deal between the US and China over the weekend has so far had little impact on the FX market. Investors have largely viewed the so-called deal as more of a temporary truce, lacking in detail and depth. President Xi has also not yet signed the deal, given it even less weight. According to Bloomberg, talks will continue at the end of the month.

We’ve had little on the data front in the past couple of days across either side of the Atlantic. We did have industrial production numbers out of the Eurozone yesterday, which came in fairly mixed. Output in the sector grew more-than-expected month-on-month in August, although remained deep in contractionary territory on an annual basis. This is very much around the levels that would encourage policymakers at the ECB to maintain its accommodative monetary policy stance for some time yet.