The Pound fell by its most so far in 2019 on Thursday, with news on a short delay to Brexit causing investors to ramp up bets for a ‘no deal’ Brexit.

The next vote is reportedly set to take place on Tuesday. Should this again fail, an emergency EU summit would likely be required. We would probably see more weakness in the Pound as investors brace for the possibility that the UK leaves the EU on 12th April with no WA in place. It is worth noting that should Theresa May go back the Brussels and again ask for A50 to be punted to the end of June or beyond, this would still require all 27 EU members to vote in favour of it.

Amid all the Brexit noise, the Bank of England released its latest monetary policy announcement yesterday. Unsurprisingly, policymakers reiterated more of the same, warning of the no deal Brexit risks and suggesting that policy will remain unchanged until the outcome of Brexit is known. Their suggestion that future hikes will be both ‘gradual and limited’ suggests that they remain ready to raise rates, should Theresa May secure a smooth and orderly Brexit.

Dire manufacturing PMIs spark EZ recession fears

The Euro sank by around three-quarters of a percent against the US Dollar this morning, sending EUR/USD to its weakest position in a week, after the March manufacturing PMI numbers came in well short of expectations.

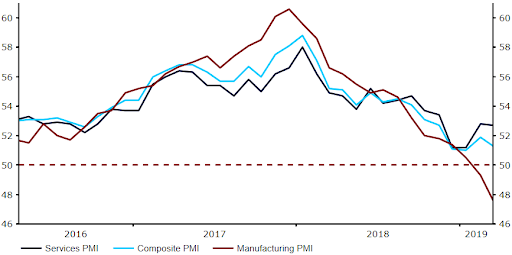

Manufacturing activity contracted sharply according to Markit, with the Euro-wide index falling further into negative territory. The index declined to just 47.6, well below the level of 50 that denotes flat growth and its lowest level since the Eurozone economy was last in recession in 2013. This softness was driven largely by an appalling performance in the German manufacturing sector, the index of which sank to just 44.7 after investors had eyed a reading of 48.0. This marked the eighth consecutive month of declines, while taking the measure to its lowest level in seven years (Figure 1).

Figure 1: Eurozone Composite PMI (2016 – 2019)

While the bloc services index is holding up much better, this is a concerning downward trend that has reignited concerns that the Eurozone economy may be heading for a recession in 2019. It does, in our view, certainly put an extra nail in the coffin for any faint hopes that the ECB could raise interest rates at some point this year. The prospect of which is likely to keep the Euro at its currently suppressed levels during the course of trading today.