The US Dollar fell by almost one percent against the Euro on Wednesday evening after the Federal Reserve effectively called an end to its current interest rate hike cycle.

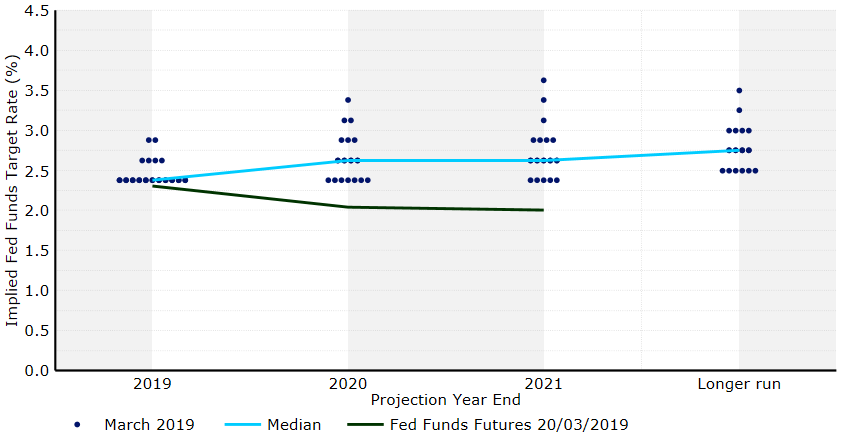

Figure 1: FOMC March ‘Dot Plot’

The Fed’s statement highlighted muted inflation, slower household spending and softer fixed business investment, with growth forecasts were slashed to 2.1% for 2019 versus the previous 2.3%. Chair of the FOMC, Jerome Powell, also struck a cautious tone during his press conference, stating that it ‘may be some time’ before the central bank needs to adjust policy. A deeper than expected decline in inflation, trade uncertainty, Brexit and twin deficits were all cited as risks to growth.

Despite the Fed’s clear dovish U-turn on policy in recent months, we far from believe that an interest rate cut is on the horizon. By Jerome Powell’s own admission, the US economy remains in a good place, while a strong labour market and solid jobs gains provide reason to be optimistic. We are firmly in the camp that the Federal Reserve will hold true to its pledge to remain ‘patient’ on policy, and do not expect any change in the FOMC’s main interest rate at all in 2019.

The market, however, rushed to price in rate cuts from the Fed in the next two years, driving the US Dollar lower against every other major currency on Wednesday evening.

Theresa May calls for short A50 extension

Sterling was firmly on the back foot on Wednesday with traders left disappointed, albeit not entirely surprised, by Theresa May’s insistence on calling for only a short extension to Article 50.

In a letter to the EU, May outlined her intention to call for a delay to Article 50 to 30th June, while noting plans to hold another vote on her withdrawal agreement in the House of Commons at some point next week. There have, however, been suggestions that the EU, of which has been an advocate of a long Brexit delay, could reject her proposal unless she guarantees that her Brexit deal will pass.

As we mentioned following last week’s MP vote in favour of rejecting a ‘no deal’ Brexit, the Pound is far from out of the woods just yet. No decision will be made by the EU on the extension at today’s EC meeting and if European leaders see no possibility that such a short delay could yield a breakthrough, the possibility of a ‘no deal’ Brexit remains firmly on the table.