There were no surprises from yesterday’s Prime Ministerial announcement, with former London Mayor Boris Johnson emerging as the clear victor.

While we remain confident that a deal can be done at some point between now and November, the appointment of pro-Brexiter Johnson certainly increases the possibility of a ‘no deal’ Brexit, widely regarded as the worse case scenario for the Pound. During his victory speech yesterday the new Prime Minister, who will head to number 10 to name his cabinet later today, reiterated his pledge to take the UK out of the EU by the 31st October deadline.

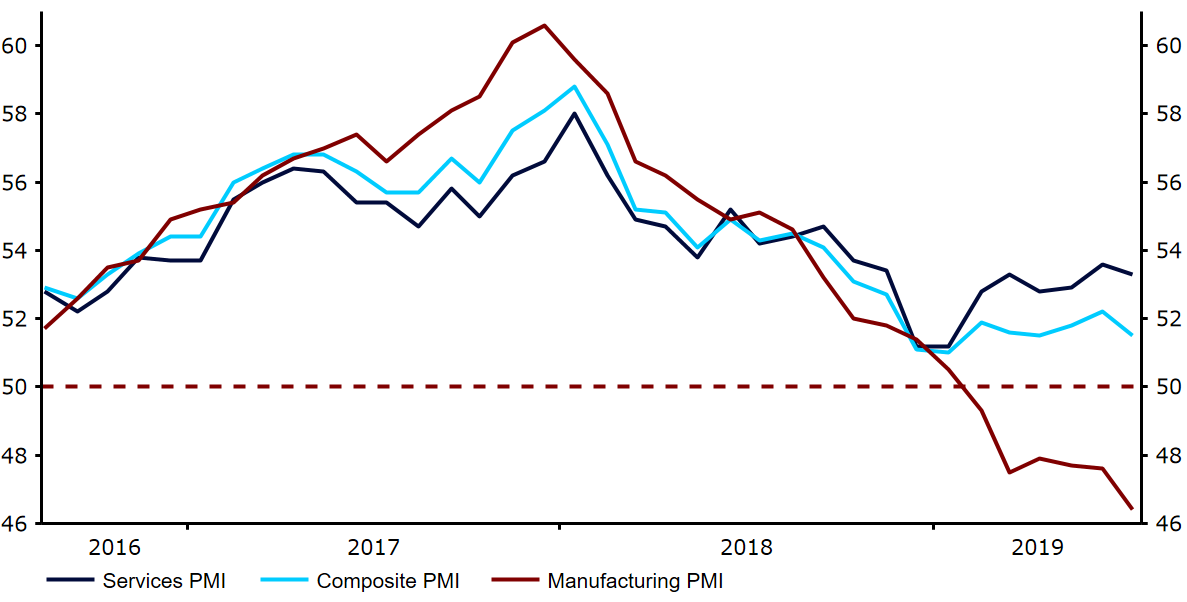

Euro dragged to fresh lows on soft PMI data

The common currency was sent to a fresh two month low against the US Dollar on Wednesday morning after the latest Eurozone PMI data came in short of expectations. While activity in the services sector held up relatively well (53.3 versus 53.6 previous), the manufacturing index fell even further into contractionary territory in July (46.4 versus 47.6). The latter was driven largely by a fairly disastrous performance of the German manufacturing sector, the index of which sank to its lowest level in seven years.

This will be a concerning development for the ECB ahead of its July meeting on Thursday. While we don’t expect any immediate policy action from the central bank, we do think that the ECB will keep its options open to potentially ease policy later in the year should economic conditions take another turn for the worse. A dovish turn from policymakers this week, that hints at a policy move as soon as September, could force the Euro below its two-year lows around the 1.11 mark.

Figure 1: Eurozone PMIs (2016 – 2019)