The euro made a positive start to the week on Monday, briefly rallying back above the 1.12 mark against the US dollar, after the release of yesterday morning’s upwardly revised Eurozone PMI data.

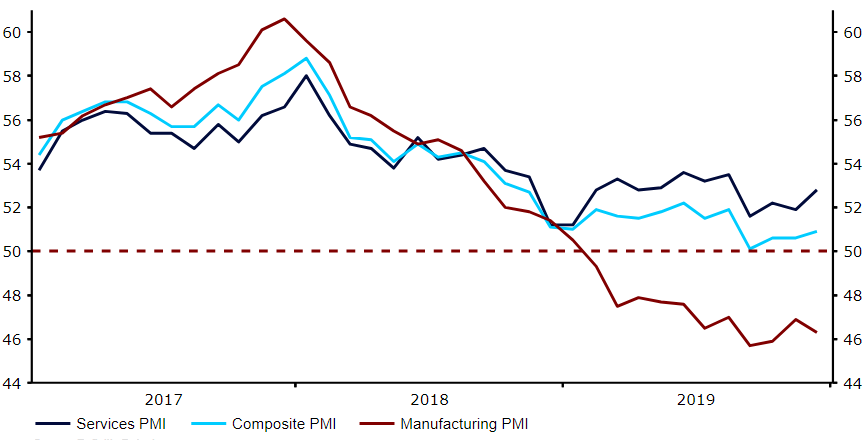

Figure 1: Eurozone PMIs (2017 – 2019)

While this, of course, provides reasons to be optimistic, overall activity remains worrying low. According to Markit’s chief business economist Chris Williamson ‘another month of subdued business activity in December rounded off the euro zone’s worst quarter since 2013’. We expect overall growth in the final quarter to have remained positive, although the bloc looks likely to have expanded by no more than 0.1-0.2% quarter-on-quarter.

Arguably the main focal point of trading today will be this morning’s preliminary Euro Area inflation numbers for December. We will be looking for continued signs of a pick-up in the main headline measure and whether or not it is showing any meaningful advances towards the European Central Bank’s elusive 2% target. The latest retail sales numbers could also be a market mover, although this data is running on a bit of a lag and so may be overlooked by investors.

UK services PMI revised sharply higher

Sterling has also had a very good start to the week, rallying sharply against the US dollar yesterday morning and then again as London trading opened on Tuesday.

Similarly to the Euro Area, we had a sharp upward revision to the UK’s December services PMI. The index was revised up a massive 0.8 points to 50.0, although this still only represents flat growth. Clarity over Brexit following the general election and news of a US-China phase 1 trade deal are undoubtedly behind much of the revision, in our view.

With only second tier data out in the UK during the week, the pound is likely to be driven by sentiment towards Brexit and geopolitical risk during in the coming days.

US-Iran concerns ease on lack of bad news

Much of the strength in the euro and pound can also be attributed to a reversal in safe-haven flows in the past 24 hours or so. The yen and the franc both pulled back from recent highs, while higher risk currencies gained as investors became less concerned regarding a full-blown conflict between the US and Iran. Markets have calmed since last week’s drone attack, partly due to the lack of any additional negative headlines on that front.

Next up will be this afternoon’s US non-manufacturing PMI from ISM. This indicator has had a more significant impact on the US dollar than usual in recent months, so investors will be paying close attention to its release.