A sharp jump in confirmed cases of the coronavirus (now officially named COVID-19) jolted the FX market during Asian trading again last night.

FX markets reacted in a similar fashion to what we’ve witnessed in the past few weeks , with traders buying the safe-haven yen and selling the higher risk emerging market currencies. The magnitude of the moves were, however, relatively limited in nature and contained to a maximum of around one-quarter of a percent. We believe that the rationale for the lack of a more meaningful reaction in the market is the following:

1) The broader definition of the virus – Much of the increase in the number of confirmed cases can be attributed to the broader definition adopted to diagnose people.

2) Virus remains contained – The vast majority of new cases remain contained within China. The percentage of cases outside the border is now back at less than 1% of the overall number.

3) Recovery rate on the up – While the jump in the death toll is, of course, grabbing all the headlines, this increase is still being outstripped by the growth in the number of total recoveries. The ratio of those totally recovered to deceased now stands at around 4.5:1, up on the 4.33:1 recorded on Wednesday.

Ugly industrial production data weighs on euro

Among the main currencies, the main news story continues to be the seemingly relentless move lower in the euro against its major peers. The common currency extended its losses to over 1.5% versus the dollar in February alone on Wednesday on both concerns surrounding the coronavirus and some contrasting economic data across both sides of the Atlantic.

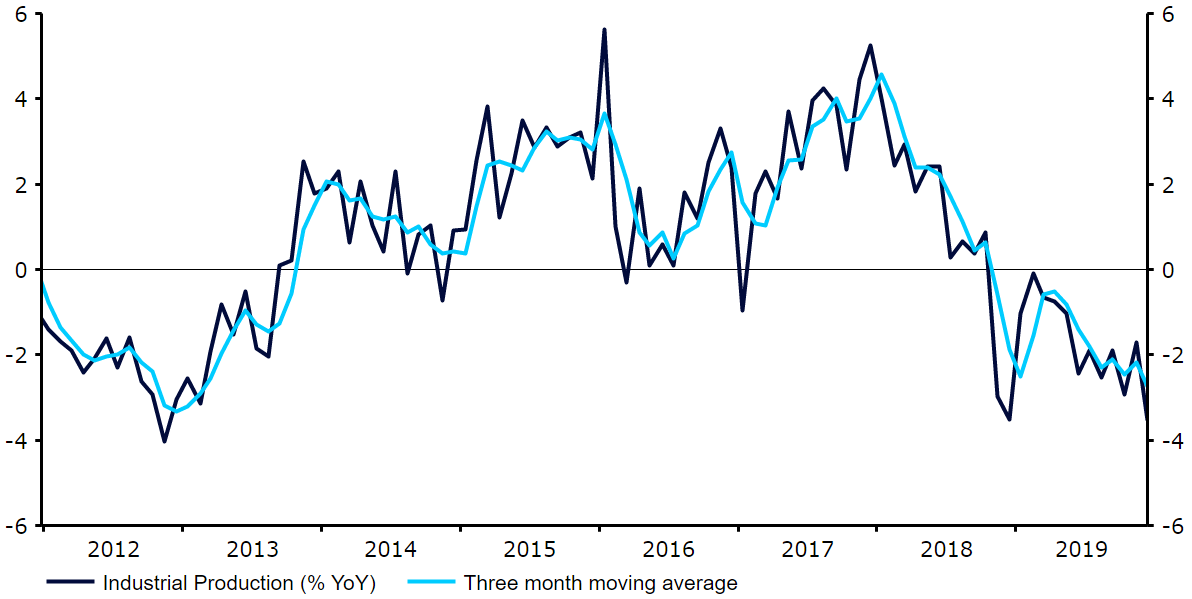

Industrial production data out of the Euro Area on Wednesday morning was ugly, with output in the sector contracting by 4.1% year-on-year in December (Figure 1). Not only was this the largest yearly drop in the measure since late-2018, but it extends a concerning downtrend over the last two years that has shown no signs of abating. Declines in activity were broad based, with Germany, France, Spain and Italy all notching sharp contractions in excess of 2%.

Figure 1: Euro Area Industrial Production (2012 – 2019)

Source: Refinitiv Datastream Date: 13/02/2020

We do, however, think that the reaction in the market has been slightly exaggerated and, at current levels, the EUR/USD exchange rate looks oversold.

UK house prices jump in month after election

Elsewhere, Sterling was relatively range bound on Wednesday amid a lack of major market moving news on either the macroeconomic front or regarding Brexit.

We did, however, see a modest bounce in the pound this morning following data overnight that showed a sharp increase in UK house prices. The monthly house price index from Royal Institution of Chartered Surveyors’ (RICS) jumped to +17 in January, its highest reading since May 2017 and well above all expectations.

This provides further evidence that the removal of the short-term ‘no deal’ uncertainty is having a positive impact on domestic economic activity which, we believe, should begin to filter its way through to a modestly stronger pound in the coming months.