Chinese authorities are suggesting that they intend to catch up with the time lost during the zero-COVID experiment by buoying consumption, and the direct beneficiaries of higher Chinese demand are celebrating.

Focus this week will be almost entirely on central bank meetings. The Federal Reserve leads the way Wednesday, with the European Central Bank and the Bank of England following suit the next day. Markets expect a downshift in Fed tightening to 25bps, while the ECB and BoE are forced to hike by 50bs due to the lack of any downward trend in core inflation in either economic area. The ECB meeting will be preceded by the Eurozone flash inflation report for January, which is unlikely to show a meaningful easing of core inflation pressures, in contrast with the clear downtrend we are seeing in the US. All in all, expect a volatile week of currency trading.

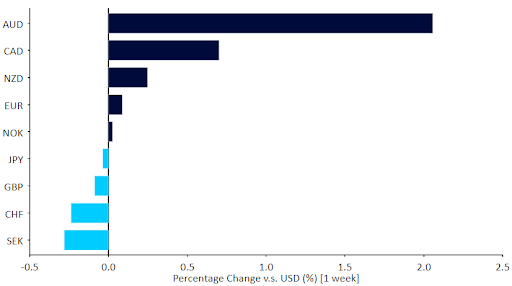

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

GBP

A spate of uncharacteristically poor macroeconomic data dragged sterling down last week. The PMIs of business activity for January under-performed expectations, largely due to weakness in the UK’s key services sector. Moves in the pound were, however, relatively modest under the circumstances, and all eyes are now on the Bank of England meeting on Thursday.

The MPC appears to have executed the latest of many turnarounds in mindset in this hiking cycle, and seems to be leaning towards hawkishness, as data hold up better than expected and core inflation pressures refuse to go away. A 50bp hike is expected, but the reaction in sterling will be highly dependent on the voting split among committee members, the updated economic projections and guidance for the next meeting. Another three-way split vote appears highly likely, although we expect a few more dovish dissenters than at the December meeting.

EUR

The Eurozone PMIs of business activity jumped sharply in January and are now consistent with modest expansion, confirming that the Eurozone is unlikely to enter a recession any time soon. This will enable the ECB to focus squarely on the inflation issue at its meeting on Thursday. A 50bp hike is universally expected, but the key will be the guidance for the next meeting. A clear dove-hawk split has developed among council members, across the national lines as one would expect, but we think that the hawks will carry the day and another 50bp hike in March will be signalled by President Lagarde.

Figure 2: Euro Area PMIs (2019 – 2022)

In an unusually busy week we will also see a handful of key macroeconomic data releases, notably fourth quarter GDP growth on Tuesday and flash inflation for January on Wednesday. We expect more of the same: confirmation that the Eurozone is not in a recession, and that we are yet to see any let up in core inflation pressures.

USD

With Federal Reserve official communications restricted by the blackout period before next week’s meeting, attention in the US was mostly focused on the PCE inflation report. Since this came in line with expectations and the earlier CPI report, the US dollar traded mostly off of news elsewhere. Interest rates were mostly flat, and risk assets continued their 2023 rally.

Figure 3: US PCE Inflation Rate (2013 – 2022)

With a 25bp hike universally expected, the key to the Fed meeting next week will be Powell’s communications during the post-meeting press conference. The economy has given mixed signals lately, but with jobless claims near an all-time low, and little sign that job market tightness is easing, we expect Chair Powell to suggest that terminal rates will be at or above 5%. However, the positive trend in inflation means that the Fed will be able to adopt a wait-and-see attitude very soon, unlike its counterparts across the Atlantic.

JPY

The yen ended last week mostly where it began it against the US dollar, in large part due to the lack of any major newsflow out of the Japanese economy. Last week’s inflation report for January was a highly anticipated one, although this came in largely in line with expectations. The headline rate broke to its highest level since the early 1990s, while the Bank of Japan’s preferred measure of core inflation (which strips out fresh food, but not energy), rose to a four decade high. This is likely to heap additional pressure onto the BoJ to finally tighten monetary policy at some point in the coming months, with investors convinced this will happen once the current governor steps down in April.

December retail sales, industrial production and unemployment data will all be released later on today. In the absence of any major surprises here, we suspect that the yen will largely be driven by central bank decisions elsewhere this week, notably Wednesday’s FOMC announcement.

CHF

Last week was characterised by little volatility in EUR/CHF. The pair continued hovering around parity, spending most of the week just above that level. There were no major data releases of note, and little communication from central bankers, though SNB vice president Schlegel did reiterate that ‘it is too early to sound all clear’ on inflation, noting the persistence of underlying price pressures.

This week’s calendar is more data-rich. Today’s KOF leading indicator rose again to its highest level since mid-2022 (97.2), which bodes well for the future, suggesting that the outlook for the next six months or so may not be as gloomy as previously thought. Looking ahead, focus will be on December retail sales data (Tuesday) and the forward-looking PMI numbers for January (Wednesday). EUR/CHF will, however, likely be most sensitive to global central bank meetings, particularly Thursday’s ECB communications.

AUD

Once again, the Australian dollar topped the G10 FX performance rankings last week, extending its year-to-date rally to more than 4% – by far the largest appreciation among the major currencies. China’s reopening has yet to be fully reflected in the value of currencies globally, or fully priced in by financial markets, hence the rally in AUD continues to find more room to run. In tandem, last week’s Q4 Australian inflation data surprised to the upside, which has further raised expectations in favour of higher RBA rates and supported the dollar against most currencies.

We contest that the outlook for RBA policy is not necessarily clear cut but, following last week’s CPI print, another 25bp hike now appears likely at next week’s meeting. The bank’s rhetoric on inflation and the need for further tightening will, however, be the key for the dollar reaction. We think that the end to zero-covid in China could open the door to more hikes than currently priced in, which may provide scope for additional upside in AUD in the coming months.

NZD

The New Zealand dollar again lagged behind its Australian counterpart last week, partly a consequence of the slight divergence in inflation rates between the two countries. Unlike in Australia, the headline measure of CPI inflation in New Zealand has stabilised just above 7%, and has actually printed below the RBNZ’s projections. This has led to a bit of a retracement in rate hike expectations, albeit markets continue to see rates topping out in May around 100bps higher than current levels.

Figure 4: New Zealand Inflation Rate (2013 – 2022)

This Tuesday’s labour report for Q4 will be the main economic data release in New Zealand this week. Markets are bracing for a modest, but positive employment change number, with the unemployment rate expected to remain unchanged at 3.3%.

CAD

In line with our expectations, the Bank of Canada signalled a pause to its hiking cycle following its policy meeting last week. Rates were raised by another 25bps, though the bank explicitly noted that it plans to hold the policy rate at current levels. In its communications, the BoC attempted to sound as hawkish as possible, although we believe that this was largely an attempt to calm the market reaction, rather than signal additional hikes may be on the way. Canadian inflation has eased markedly, and the BoC has revised lower both its inflation and growth projections, which limits room for additional tightening.

CAD held up rather well last week, despite the dovish pivot, and managed to rally against the US dollar amid optimism over higher global commodity demand. November GDP data (Tuesday) runs on a lag, so we don’t expect too much volatility around its release. The monthly manufacturing PMI on Wednesday will also likely be overlooked in favour of the Fed’s latest policy announcement on the same day.

SEK

Data released in Sweden last week came in worse than expected, which caused the krona to fall against the euro. Retail sales fell more than expected in December (-8% YoY), the eighth straight drop in activity, and by 1.8% on a monthly basis. Labour market data was also a touch worse than anticipated, with the unemployment rate rising more than expected to 6.9% in December.

High inflation and rising interest rates seem to be hitting the Swedish economy. Still, high inflation and hawkish comments from some Riksbank members make it very likely that the central bank will raise interest rates again at its February meeting. No major data will be published this week, so we suspect that SEK will largely trade in line with other risk assets.

NOK

The Norwegian krone ended last week lower against the euro, as the currency continues to come under pressure due to lower gas prices and the moderation of the Norges Bank, which has already paused its tightening cycle.

Moreover, Norwegian activity data released last week came in worse than expected, with retail sales falling by 3.6% month-on-month in December, the biggest drop since August 2021. However, it was also reported last week that the unemployment rate fell to 3.1% in the fourth quarter of 2022. In our view, a strong labour market should continue to be the main driver of Norwegian growth this year, with the economy at among the lowest risk of entering into a recession in the G10. No major data will be published this week, so we suspect that NOK will largely trade in line with other risk assets.

Figure 5: Norway Retail Sales (2017 – 2022)

CNY

Mainland China resumed trading after a week-long Lunar New Year holiday today, during which most of the key markets in Asia were closed for at least part of the week. Overall trading appears rather mixed, but CNY has opened the week a tad stronger on the dollar, following a recent mild appreciation in the offshore market.

Remarks from China’s premier Li Keqiang at the State Council meeting, published on Saturday, suggest that authorities will put an emphasis on boosting consumption. Nevertheless, it remains to be seen how successful they will be in translating words into action, as this has long been a rhetorical focus of officials. Covid concerns ahead of the Lunar New Year seem to have eased, albeit we’ll continue to follow the headlines over the next few weeks. Other than that, our main focus this week will be the January PMI data. After months of meagre performance, we are expected to see at least most of the indexes rise back above the key 50 level, signifying an expansion in business activity.

Economic Calendar (30/01/2023 – 03/02/2023)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports