The dollar traded lower against almost all of its major peers again on Thursday, putting it on course for its worst week since May, as investors continued to digest this week’s dovish comments from the Federal Reserve.

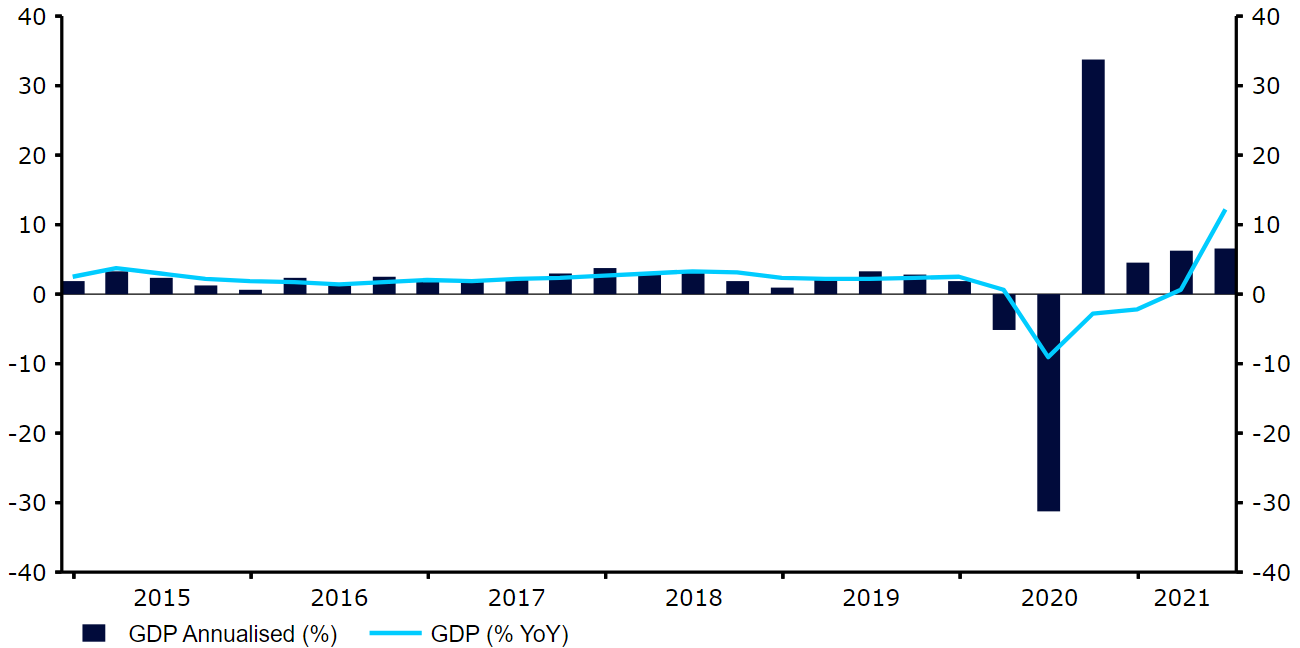

Macroeconomic news out of the US has also taken a slight turn for the worst, which has similarly soured sentiment towards the greenback. The preliminary second quarter GDP growth data out yesterday fell short of expectations. The US economy expanded by a solid 6.5% annualised in the three months to June, although this was well short of the 8.5% consensus. While equity markets largely looked past the lagging indicator, the dollar has continued to lose ground this morning and is now trading around a one-month low versus the basket of currencies making up the US dollar index.

Figure 1: US GDP Growth Annualised (2015 – 2021)

Source: Refinitiv Datastream Date: 30/07/2021

Sterling outperforms on surprise drop in UK virus cases

The recent weakness in the dollar has pushed every other G10 currency higher in the past week, notably the pound, which is now trading just shy of the 1.40 level. We attribute the outperformance in sterling to the recent drop in UK virus cases and optimism surrounding the country’s economic recovery now that almost all restrictions have been lifted.

Somewhat surprisingly, new caseloads have fallen by around a half in the second half of July from the peak of the third wave on 17th, despite the continued easing in restrictions. It is difficult to pinpoint the exact reason behind the drop in infection rates, although it has coincided with the end of Euro 2020, which is said to have led to a surge in cases, particularly amongst men. Regardless of the rationale, investors have breathed a sigh of relief, having initially sold the pound on fears that the easing in lockdown would lead to another move higher in cases and hospitalisations.

German inflation rises sharply in July

There hasn’t been a huge amount of economic news out of the Euro Area so far this week, although data that we did get yesterday was fairly encouraging. The main sentiment indices from the European Commission mostly beat expectations in July, despite recent concerns over the delta variant. News out of Germany has also been broadly impressive, notably yesterday’s sharp drop in unemployment (down 91k in July), and the big increase in this month’s inflation print (3.1% from 2.1%).

The euro has, however, continued to trade only around the midpoint of the G10 performance tracker in the past few weeks, in large part due to the dovish stance adopted by the European Central Bank. It will be interesting to see how they react should this increase in price pressure prove both widespread and sustained. Should the market see it as increasing the chances of a tapering in the ECB asset purchase programme, then the euro could start climbing up the performancing rankings in the coming weeks.

Go to our Blog for the latest expert market insight and updates to help you navigate the currency markets.