We’re thrilled to share Ebury’s outstanding performance in Bloomberg’s latest FX forecast accuracy rankings.

Ebury secured the #2 spots for the Malaysian ringgit and Thai baht, and were ranked as the third most accurate forecaster for the Polish zloty, Colombian peso and Singapore dollar. We are also proud to have sealed a coveted top 10 spot for GBP/USD, one of the world’s most traded currency pairs and among the most competitive in Bloomberg’s FX rankings.

Commenting on this exciting announcement, Matthew Ryan, Head of Market Strategy at Ebury, says,

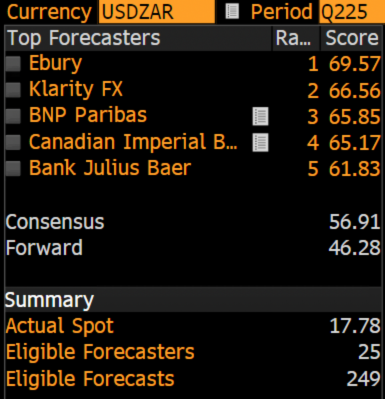

“We are delighted to once again be recognised by Bloomberg as one of the leading forecasters for several major and emerging market currencies in the second quarter of the year. Achieving the number one ranking for the South African rand is particularly gratifying, especially as it coincides with our recent strategic expansion into the country.

These milestone achievements underscore the strength of our analytical capabilities and our commitment to delivering precise, actionable insights in the foreign exchange market. We are more determined than ever to further enhance and diversify our market analysis to help better provide our clients with a deeper knowledge and understanding of the FX market”.

Full list of all of our Q2 2025 rankings:

USD/ZAR #1

USD/MYR #2

USD/THB #2

EUR/PLN #3

USD/COP #3

USD/SGD #3

EMEA #4

USD/TRY #4

USD/PLN #5

USD/SEK #5

GBP/USD #10

Dive into our latest FX analysis for July: Click to explore the G3 FX Outlook and Africa FX Outlook.

📩 Click here to subscribe to our latest market insight and updates to help you navigate the ever-changing global currency markets. Or head to our Blog to read our latest Market Updates.