As anticipated by investors, the European Central Bank stepped up its efforts to rein in rising European bond yields at its monetary policy meeting on Thursday.

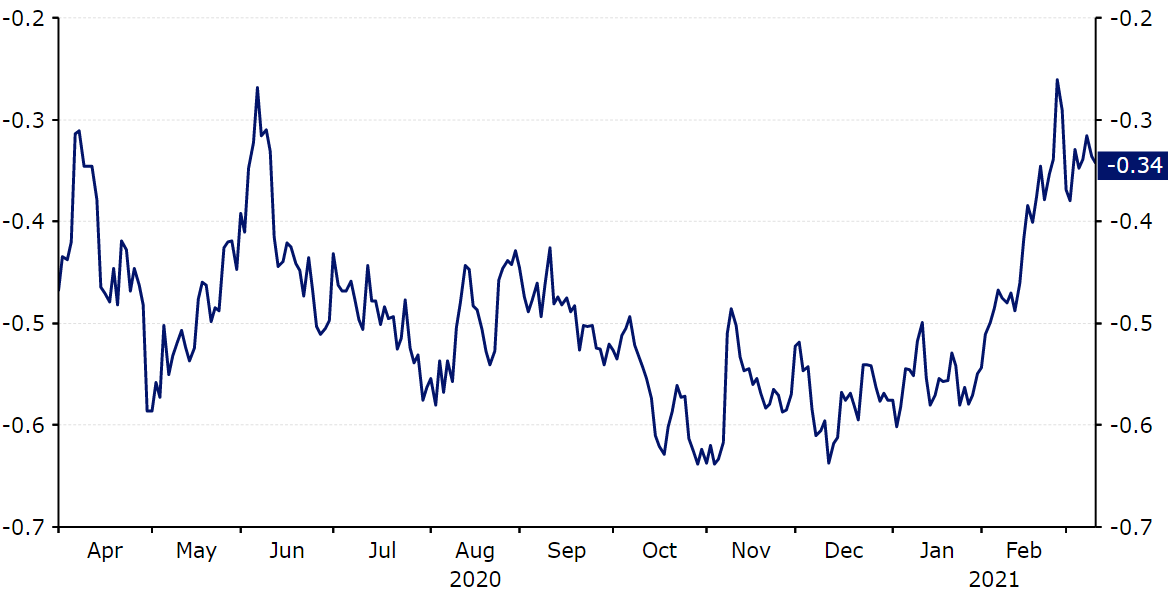

Unlike their counterparts at the Federal Reserve, ECB members have grown increasingly vocal of late in their concern for the recent increase in bond yields. Government bonds have sold-off rather aggressively around the globe so far in 2021, sending the yields on those bonds sharply higher. The yield on the 10-year German Bund has, for instance, risen by approximately 25 basis points year-to-date (Figure 1), which presents a slight downside risk to a recovery largely dependent on the success of the bloc’s COVID-19 vaccine rollout. There had been some speculation that the bank’s aversion to rising yields could trigger another expansion in the PEPP, but with the mammoth programme already set to run through to March 2022, this was unlikely to be the case. We think that the bank’s pledge to front-load its asset purchases instead emphasises its willingness to put a lid on bond yields, without making any sweeping alterations to policy that could disrupt market stability.

Figure 1: German 10-Year Government Bond Yield (March ‘20 – March ‘21)

Source: Refintiv Datastream Date: 11/03/2021

In her statement, President Lagarde struck a modestly dovish tone. She noted that persistently high virus numbers and lockdowns would weigh on growth in the short-term and that incoming data pointed to continued economic weakness in Q1. The bloc is now firmly on course to enter into a ‘double-dip’ recession in the first quarter, having contracted in Q4 2020. The bank’s GDP forecasts were, however, kept broadly unchanged from December, with the ECB pencilling in growth of 4% in 2021 (3.9% in December), 4.1% in 2022 (4.2%) and 2.1% in 2023 (unrevised). Given the so far disappointing vaccine rollout in the bloc, we are slightly surprised by both the modest upward revision to the 2021 GDP forecast and the shift in the risk assessment from ‘tilted to the downside but less pronounced’ to ‘more balanced’.

Meanwhile, the inflation forecast for this year was also revised higher to 1.5% from 1.0% (1.2% in 2022 and 1.4% in 2023), although according to Lagarde this is expected to be temporary and driven largely by an increase in oil futures in the coming months. Lagarde also stressed that the bank would look through any temporary acceleration of inflation.

Figure 2: ECB Inflation Projections [March 2021]

Source: Refintiv Datastream Date: 11/03/2021

Bond investors reacted to today’s announcement by sending yields marginally lower, with the German 10-year yield briefly touching its lowest level since 18th February. The reaction in the FX market was also largely subdued – EUR/USD sold-off only modestly following Lagarde’s press conference. We think that the announcement to front-load purchases has not come as any surprise to market participants, given recent dovish rhetoric from policymakers. This lack of tolerance for higher yields does, however, present a bit of a downside risk to the euro in the immediate-term, particularly versus the dollar. The Federal Reserve has so far appeared unconcerned about rising US Treasury yields, although we should get more clarity on its stance when the FOMC announces its latest policy decision this coming Wednesday.