The worldwide inflationary episode continues to upend expectations and historical correlations.

Inflation data takes front and center this week, particularly in the Eurozone, where we expect the flash inflation number for March to soar to a fresh record on Friday. The US PCE inflation report is out Thursday, but it is for February so won’t provide much fresh information. Finally, the payroll report out of the US will be released Friday afternoon. The main focus there will be the evolution of wages, which so far have been lagging prices and fueling voter discontent with the Democratic administration in Washington.

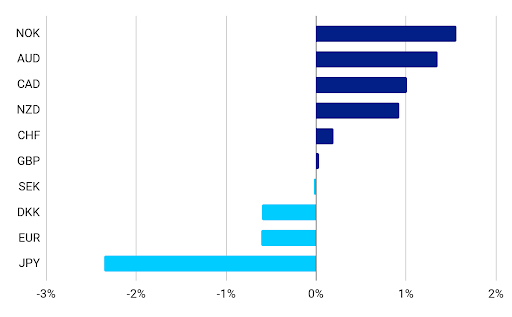

Strategists continue to revise upward their forecasts for commodity currencies, in line with our long-standing bullish views. The inflationary environment is here to stay and should provide a tailwind to emerging markets and G10 currencies of countries that are net commodity exporters.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

GBP

As fast as economists are revising upwards their forecasts for UK inflation, the actual data continues to surprise to the upside. In February, prices rose 6.2% on the year. Sterling weakened after the news. Markets are starting to doubt the Bank of England’s resolve in getting inflation under control after the MPC dovish communications at its latest meeting. This week sees a slew of speeches from MPC members. Traders will be scrutinising them closely for further clarification of the muddled communications from that meeting. We wouldn’t be shocked by yet another change in tone that aligns the Bank of England better with other central banks and provides much-needed support for the pound.

EUR

The PMI indices of business activity were stronger than expected and consistent with only a modest slowdown in economic activity in the Eurozone as a result of the war in Ukraine. The ifo sentiment numbers were worse, but we think the PMIs are a better guide to future economic growth. Monetary and fiscal policy will remain very stimulative for the foreseeable future, and we think a recession remains very unlikely. March inflation numbers out Thursday could well top 7% on the back of sharp increases in energy prices. The core index is also expected to jump. We remain increasingly sceptical that the ECB can wait until late 2022 to hike, as markets are pricing in, and think it’s quite possible that incoming data will force the central bank to move before the summer. As and when markets price that in, the euro should find support.

Figure 2: Eurozone PMI indices [2019 – 2022]

USD

The bloodbath in the US bond market has brought about the fastest repricing of Treasury yields in many decades, and losses in broad bond indices so far this year are the highest ever. This blowout in yields has brought the US dollar less support than it did in previous episodes. Fed officials are out in force telegraphing to markets that not only will there be hikes in every meeting, but those hikes could well be double the usual rations, at 50 basis points. PCE inflation report and the payroll numbers this week are all expected to be very strong and therefore should not stand in the way of further Fed hiking, but the market has already priced a lot of tightening this year and it will be hard to price in more, so the impact on the dollar should be subdued.

CHF

The Swiss franc ended the week higher against a broadly-weaker euro and around the middle of the G10 currency dashboard.

Swiss National Bank meeting did not stir the boat last week. As we expected there were no major changes in its rhetorics regarding the exchange rate in the communication following the policy meeting. The conditional inflation forecast was revised significantly higher in the near term and somewhat higher in the longer term, with the bank now expecting inflation to peak in the first half of 2022 at 2.2% before returning below 2% in the fourth quarter. At the same time, its growth assessment for this year was revised down to 2.5% from 3% in December.

Contrary to another safe-haven peer, the Japanese yen, the franc holds its ground and remains stronger than before the Russian invasion of Ukraine. With elevated inflation, it seems that allowing some nominal appreciation of the franc wouldn’t be at odds with the central bank’s policy goal. The behaviour of the Swiss currency should continue to depend on news regarding the war in Ukraine but as time passes, it will likely be increasingly influenced by the shifting macroeconomic conditions in Europe and globally.

AUD

The Australian dollar was among the best-performing G10 currencies and ended last week near its highest level in five months against the US dollar. The rise in commodity prices continues to support the AUD. March PMI data released last week suggest the expansion in the services sector was the strongest in 10 months. The index rose to 57.9 from 57.4 in February, marking the second month of continued expansion of the sector. The manufacturing PMI rose slightly to 57.3 from 57.0 last month. Tuesday will see a release of February retail sales data, but the Australian dollar will likely continue reacting to shifts in commodity prices.

CAD

The Canadian dollar was among the best-performing G10 currencies and ended last week higher against the US dollar as improved sentiment and rising commodity prices supported the currency. Monthly producer inflation in Canada (IPPI) accelerated to an over four-decade high of 3.1% in February, bolstered by energy products and raw materials. The relentless rise in prices strengthens the case for the Bank of Canada to continue its tightening cycle, with another increase expected in April.

On Thursday, we’ll focus on the release of January GDP data. The Canadian dollar will likely continue being driven by shifts in commodity prices.

Figure 3: Canada IPPI inflation [MoM] [2010 – 2022]

CNY

The Chinese yuan ended the week little changed against the dollar and around the middle of the EM dashboard. The relative stability of the exchange rate follows some sharp shifts in the past few weeks. It has been allowed by what appears to be stable coronavirus situation: the number of new cases remains high but they did not spike in a substantial manner in recent days. The picture of China’s restrictions is constantly changing, with some places emerging from lockdown (i.e. Shenzhen) while others see it being imposed (i.e. Shanghai). The situation is likely going to continue weighing on the exchange rate in the near term, but the relative stability in the number of new cases continues to provide some optimism.

In addition to news on the coronavirus front, this week we’ll focus on March business activity prints. Thursday will see a release of official numbers focused on large public enterprises, while on Friday, Caixin manufacturing print, oriented towards smaller, private firms will be out.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports