The Euro edged back above the 1.14 level against the US Dollar on Thursday, with the release of the European Central Bank’s June meeting accounts suggesting that the ECB’s large scale stimulus programme could soon be coming to an end.

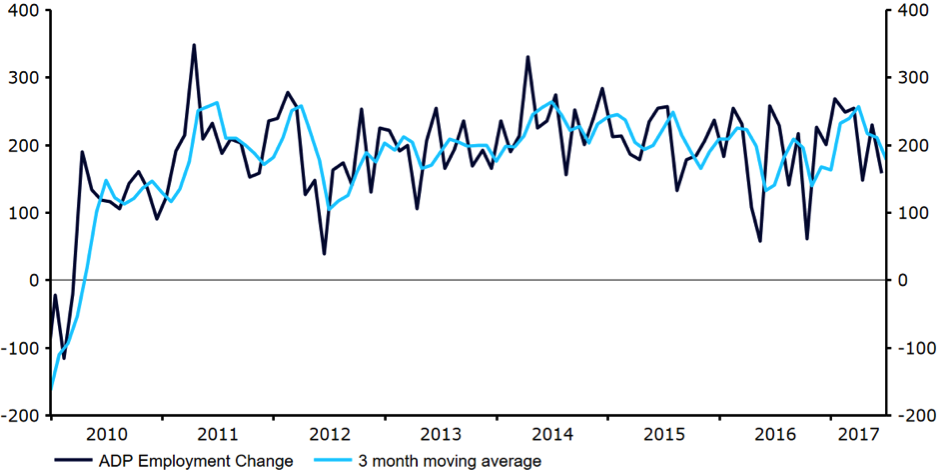

Today’s labour report will undoubtedly be the main economic data release of the week when announced at 1:30pm UK time. Unemployment and earnings are both expected to remain unchanged, with the main nonfarm payrolls number forecast to come in at around the 179k mark.

Sterling edges higher as traders ignore poor activity data

Sentiment towards the Pound remained fairly solid on Thursday, with investors mostly overlooking this week’s underwhelming set of business activity PMIs that suggested the UK economy put in another sluggish performance in the second quarter. The currency edged modestly higher against a broadly weaker US Dollar and now appears poised to make another push towards the psychological 1.30 mark on Friday. Despite the weak economic news, investors continue to bet that the Bank of England will hike interest rates sooner rather than later. Financial markets are now pricing north of a 50% probability that the BoE will increase borrowing costs before year end.

Sterling will likely be driven largely by this afternoon’s nonfarm payrolls report in the US. In the meantime, the latest manufacturing and industrial production numbers this morning are expected to show a modest improvement on previous. Governor of the Bank of England Mark Carney will also be speaking at the G20 meeting in Hamburg.

Yesterday afternoon’s bumper non-manufacturing PMI from ISM did little to stem the sell-off in the currency, despite coming in well above consensus. The index pointed towards a much healthier performance in the services sector in Q2, rising solidly to 57.4 from 56.9, well above the six month average.

Today’s labour report will undoubtedly be the main economic data release of the week when announced at 1:30pm UK time. Unemployment and earnings are both expected to remain unchanged, with the main nonfarm payrolls number forecast to come in at around the 179k mark.

Sterling edges higher as traders ignore poor activity data

Sentiment towards the Pound remained fairly solid on Thursday, with investors mostly overlooking this week’s underwhelming set of business activity PMIs that suggested the UK economy put in another sluggish performance in the second quarter. The currency edged modestly higher against a broadly weaker US Dollar and now appears poised to make another push towards the psychological 1.30 mark on Friday. Despite the weak economic news, investors continue to bet that the Bank of England will hike interest rates sooner rather than later. Financial markets are now pricing north of a 50% probability that the BoE will increase borrowing costs before year end.

Sterling will likely be driven largely by this afternoon’s nonfarm payrolls report in the US. In the meantime, the latest manufacturing and industrial production numbers this morning are expected to show a modest improvement on previous. Governor of the Bank of England Mark Carney will also be speaking at the G20 meeting in Hamburg.