The main question on investors’ minds going into this month’s highly anticipated FOMC meeting is, has the August US labour report derailed plans for a September taper announcement?

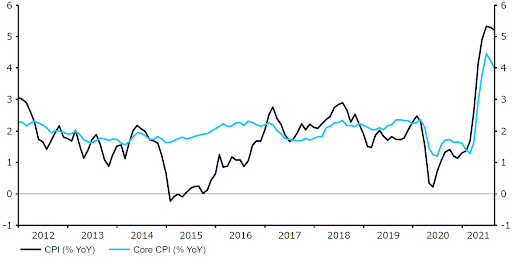

Figure 1: US CPI Inflation Rate (2012 – 2021)

Source: Refinitiv Datastream Date: 16/09/2021

Evidence of demand for workers continuing to far outstrip supply also suggests that these price pressures are unlikely to dissipate in the near-term. US job openings jumped to a record high 10.9 million in July (Figure 2) as many businesses struggle to fill vacant positions. This has sent wage growth sharply higher, as employers attempt to fill the aforementioned vacant positions by offering more attractive salaries. Rising inflationary pressures has been one of the main reasons as to why investors have increased bets that a normalisation in the Fed’s monetary policy is more likely than not by year-end.

Figure 2: US JOLTs Job Opening (2015 – 2021)

Source: Refinitiv Datastream Date: 16/09/2021

FOMC chair Jerome Powell struck a mixed tone during his speech at the annual Jackson Hole symposium in late-August, although he did appear to pave the way for tapering before the end of 2021. Powell stated that the pace of the US economic recovery had exceeded expectations, and that ‘clear progress’ was being made towards maximum employment. He also voiced concerns over rising inflationary pressures, although according to Powell these concerns have been tempered by a number of factors that suggest the elevated readings are of a transitory nature.

Since the conference, US macroeconomic data has, however, been slightly underwhelming, particularly the August nonfarm payrolls report. A net 235,000 jobs were created in the US economy last month, considerably fewer than the 750k consensus and well below the 1.1 million recorded in July (Figure 3). An increase in virus infection levels brought about by the spread of the highly contagious delta variant presents a downside risk to the outlook, and has contributed to much of the slowdown in job creation. So far, most central bankers have largely looked through the impact of the latest wave of infection, although the recent uptick in both caseloads and deaths does, at the very least, provide the Fed with a reason to be cautious when deciding when to remove its highly accommodative stimulus measures.

Figure 3: US Nonfarm Payrolls (2020 – 2021)

Source: Refinitiv Datastream Date: 16/09/2021

Aside from the bank’s communications on QE, market participants will be paying close attention to the release of the bank’s updated ‘dot plot’, which shows where members expect interest rates to be over the forecast horizon. With inflation running much hotter-than-expected when the last set of projections were unveiled in June, we think that another modest upward revision to the dots may be on the cards this month. Chair Powell has made it clear that rate hikes still remain some way off, but with inflation showing little signs of easing in the immediate-term, a handful of additional voting members may see hikes as needed before the end of next year. We think that this will raise the medium dot higher and bring hikes into the picture before the end of 2022. Yet, with the market already pricing in the first rate hike before the end of next year, we think that the US dollar reaction to the revised projections may be more limited than usual.

We expect the dollar to instead take its cue largely from Powell’s comments on tapering. Following the August employment miss, we think that an official taper announcement this month is now in serious doubt. Most FOMC members appear comfortable with policy normalisation commencing this year, but the clear labour shortages and uncertainty surrounding the delta variant may, we think, push the taper decision to November. This, in our view, may be bearish for the dollar, particularly should Powell voice heightened concerns around the impact of delta on the US economy, albeit this already appears largely priced in by the market.

On the other hand, confirmation at this month’s meeting that tapering will begin in either October or November would likely be bullish for the USD, and we would expect the currency to break out of its recent narrow range versus the euro. For the first time in a while, there appears to be a clear split among FOMC members. The doves seem on top for now, although that could easily change should upcoming inflation prints surprise to the upside and data on the labour market show that the August payrolls miss was merely a one-off. Uncertainty going into the meeting is therefore high, and we expect the dollar to react in a particularly volatile manner.