The big news story out of financial markets on Monday was undoubtedly the dramatic collapse in US oil prices, but what were the impacts on FX?

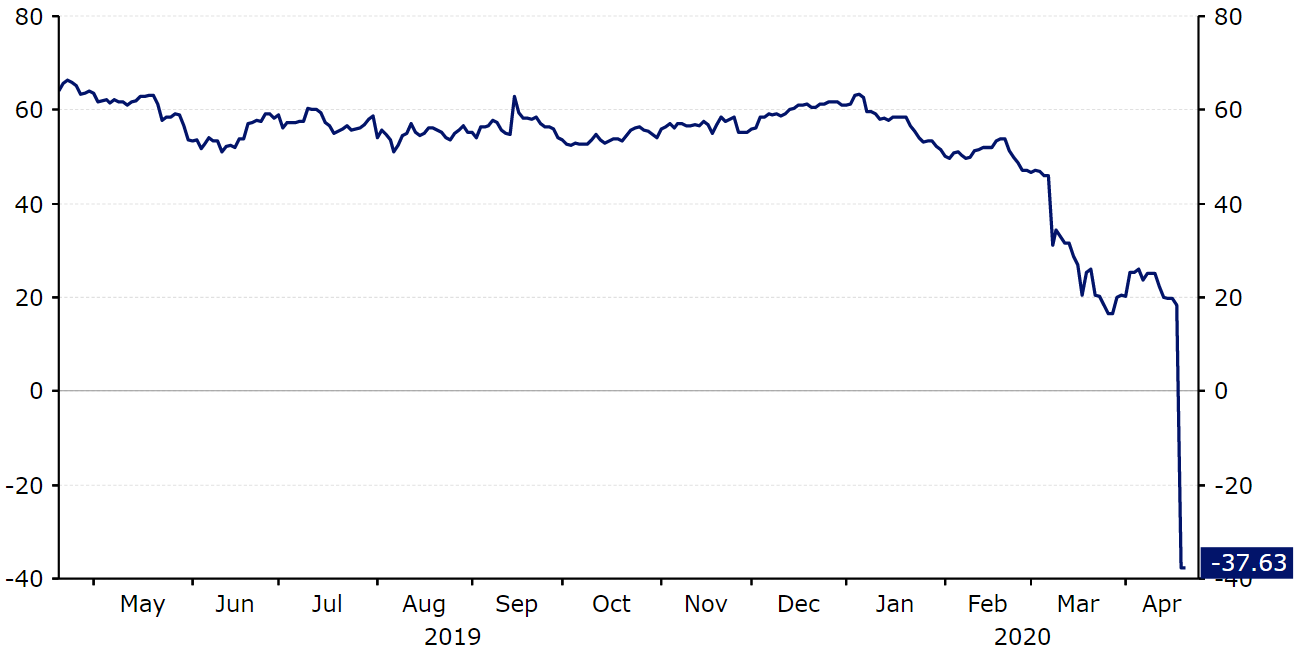

Figure 1: WTI Oil Prices (April ‘19 – April ‘20)

WTI Oil Prices

Source: Refinitiv Datastream Date: 21/04/2020

This is an extraordinary development and the first time in history that prices have tipped into negative territory – effectively meaning that oil producers are paying buyers to take the commodity off their hands. The main rationale for this bizarre turn of events is the fact that with demand for oil now all but dried up, storage facilities for the commodity are effectively at full capacity. This means that the cost of paying someone to take the oil off their hands is less than transporting the surplus oil and holding it in an overfill storage facility until demand picks up again.

Oil Storage tank and oil tanker in Tsing Yi, Hong Kong

The impact on FX was not, however, quite as dramatic as one would expect. We did see a bit of a rally in the dollar versus the euro during Asian trading, which tends to be the case when we see a meaningful move lower in oil. Commodity dependent-currencies also sold-off modestly, led by the Russian ruble, which is down around one-and-a-half percent so far today. Others, such as the Canadian dollar and Norwegian krone, have also lost ground in the past 24 hours or so, although not to a dramatic extent. It is worth noting that the global oil benchmark, brent crude oil, has fallen so far this week, although is holding up okay at present at around the $23 a barrel mark.

Pound falters, UK deaths ease to two-week low

Sterling edged lower against the dollar yesterday, although we note that this was largely a result of broad strength in the greenback, rather than fragility in the pound.

We are beginning to see some reason for optimism in the latest virus numbers in the UK. While the number of new daily cases remain high at around 5,000, this number appears to be stabilising and hopefully on the path to easing in the coming days. Deaths caused by the virus also fell to a two-week low 449 on Monday, although this is likely to be deflated by the fact that deaths over the weekend are often not reported until a few days into the week.

Labour data out of the UK on Monday was impressive, although it must be noted that this was for the pre-crisis period and is thus effectively null-and-void. We instead look to Thursday’s PMI data and Friday’s retail sales figures, which will give a more accurate read as to how the UK economy is coping under lockdown.