The Supreme Court caused no major surprises on Tuesday morning by announcing that Prime Minister Theresa May must seek parliamentary approval before the formal EU exit talks can take place. The judgement could possibly delay the triggering of Article 50, which sets the two year clock ticking on Britain’s process of leaving the European Union.

Moreover, it was unanimously ruled that the Scottish Parliament and Welsh and Northern Ireland assemblies did not need a say, thus potentially removing a major stumbling block to Theresa May’s plans to trigger Article 50 before the end of March. We think the March date is likely to be met, although yesterday’s announcement ensures this remains in balance. A delay in Britain’s exit process would undoubtedly provide decent support for Sterling in the coming weeks.

Markets are now in wait and see mode to determine the full impact of the Brexit vote on the UK economy. The UK currency quickly recovered its losses yesterday to trade around its highest level since early December.

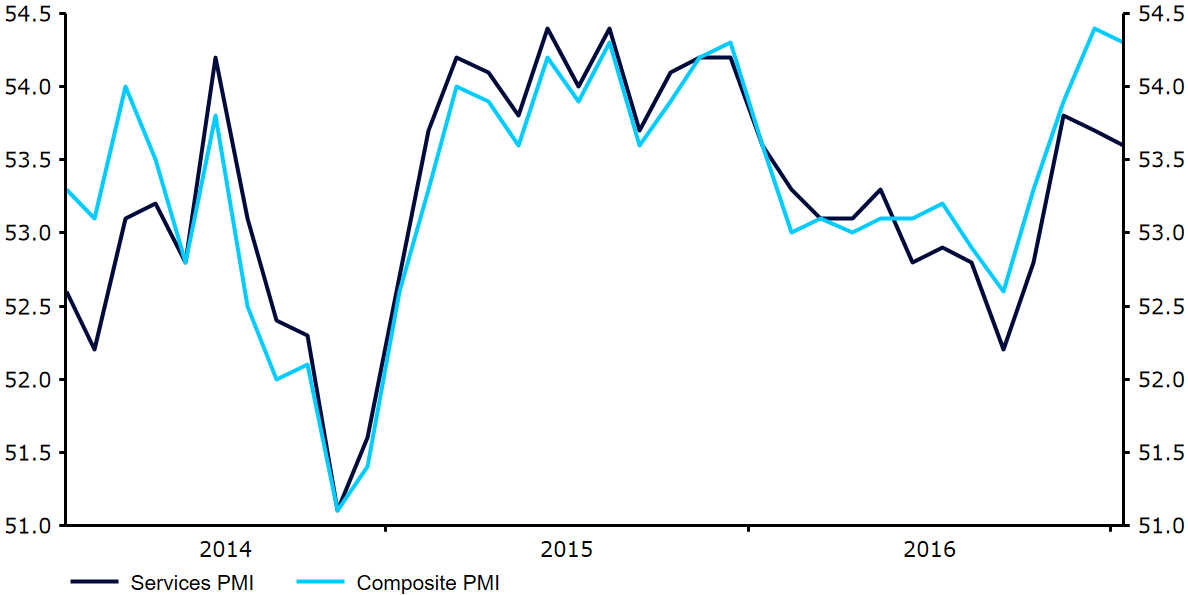

Away from the UK, the Euro was little changed during the course of trading yesterday, hovering around its strongest position against the US Dollar since the beginning of December. Traders gave Monday’s business activity PMI’s little attention. The manufacturing PMI soared to its highest level in five years, while the composite PMI remained around a multi-month high (FIgure 1).

Figure 1: Eurozone PMI’s (2014 – 2016)

Major currencies in detail

GBP

Sterling rose 0.4% during London trading on Tuesday as investors digested yesterday’s decision by the Supreme Court to reject the UK government’s Article 50 appeal.

Away from political news yesterday, public sector borrowing in the UK fell in December unexpectedly. Borrowing fell by £0.4 billion to £6.9 billion in the final month of last year, meaning that borrowing for the year of £63.8 billion was over £10 billion lower than for the same period twelve months ago.

The Confederation of British Industry’s industrial trends survey will be the only economic data release today. Sterling continues to be driven almost exclusively by political factors.

EUR

The Euro rose 0.1% versus the US Dollar on Tuesday, remaining around its strongest position against the greenback in around seven weeks.

Yesterday’s business activity PMI’s were fairly mixed. The composite PMI fell unexpectedly to 54.3 from 54.4 this month, due in part to a sharp decline in services activity in Germany, which slipped to its lowest level in 4 months. Manufacturing in the Eurozone, however, continues to go from strength to strength. The PMI rose to 55.1 from 54.9, its highest level in five years. This was underpinned by a robust level of employment growth in the sector.

This morning’s IFO business sentiment indices will be worth looking out for this morning. Sentiment is expected to remain mostly unchanged this month and is unlikely to shift the Euro today.

USD

The US Dollar index traded within a narrow band on Tuesday due to a lack of any major news out of the US, ending 0.2% lower.

Economic data releases yesterday were mostly second-tier. Manufacturing activity picked up pace this month according to the latest manufacturing PMI from Markit. The index increased above forecasts to 55.1 from 54.3, its highest level in almost two years. The manufacturing sector in the US economy appears to have got off to a decent start in 2017, due largely to a sharp increase in new orders, which expanded at their fastest pace since September 2014.

Mostly second-tier housing data in the US this afternoon are unlikely to be major market movers. Focus in the US remains heavily on Donald Trump as investors look for clues as to future fiscal spending plans.