In the dynamic global marketplace, SMEs encounter substantial financial challenges, notably in managing capital and mitigating risks associated with currency fluctuations. Strategic use of trade finance loans and FX hedging is essential for sustainable growth. Ebury offers a dual approach that uniquely positions us to support SMEs in efficiently managing funds whether they are at rest, in motion, or at risk, thereby fostering resilience and expansion in international trade.

Money at Rest: Enhancing Liquidity with Trade Finance Loans

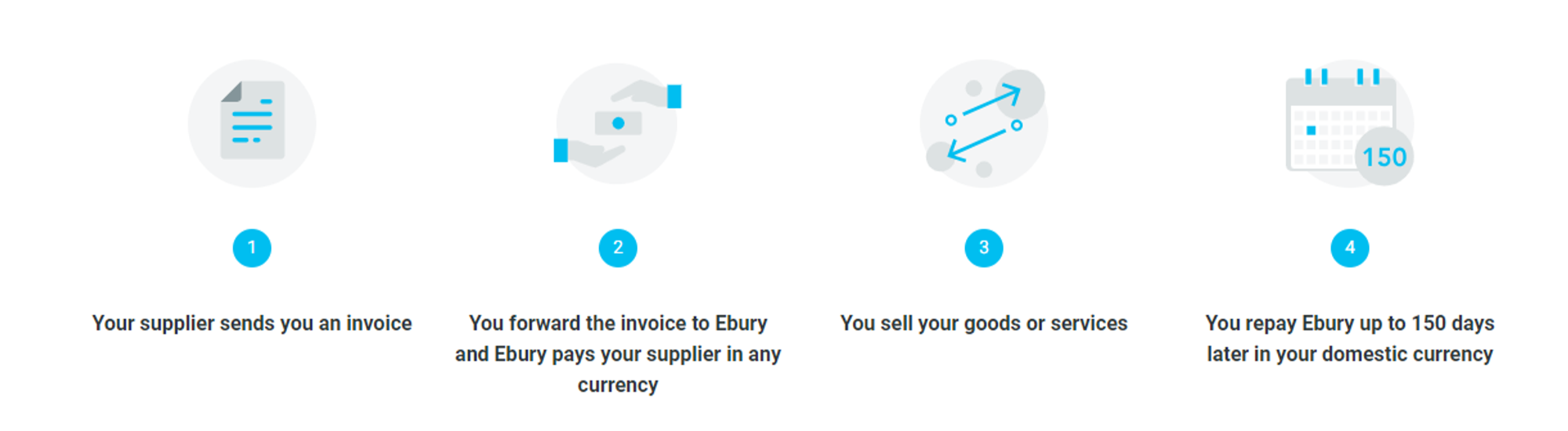

Figure 1: shows how Trade Finance product works at Ebury

Ebury’s trade finance loans are essential for SMEs to maintain liquidity, allowing them to purchase essential materials, manage inventory, and sustain production without depleting working capital. This financial tool helps stabilise a company’s foundational finances, enabling inactive money to be actively employed in generating further revenue without jeopardising the operational budget. By maintaining liquidity, Ebury empowers businesses to seize growth opportunities without the immediate financial strain.

Money in Motion: Streamlining Operations with FX Hedging

Navigating the complexities of foreign exchange is a significant challenge for SMEs involved in global markets. Ebury’s FX hedging strategies protect businesses from adverse currency movements, providing a predictable and stable financial environment. This stability is essential for maintaining competitive pricing and protecting profit margins against volatile market conditions, thereby ensuring that financial operations run smoothly.

Figure 2: shows how Ebury provides a risk mitigant against currency volatilely with its layered hedging

Money at Risk: Integrating Trade Finance with FX Hedging

Ebury’s integrated approach to trade finance and FX hedging provides a comprehensive solution for managing financial exposure while maximising international trade opportunities. This synergy ensures optimal utilisation of funds for procurement and production while mitigating associated financial risks. It acts as a safety net, allowing SMEs to pursue expansive market opportunities with minimised financial risk.

Figure 3: the problem is massive and growing

The solution

For SMEs aiming to broaden their international presence, leveraging Ebury’s dual services in trade finance and FX hedging is invaluable. This robust framework addresses liquidity, operational risks, and investment safety, providing SMEs with the tools necessary for securing their operations and positioning for future growth and success.

Engaging with Ebury, which offers this dual support, is pivotal, as it enables businesses to navigate the complexities of international trade, ensuring long-term sustainability and competitiveness.

Disclaimer

- *Credit line availability depends on business circumstances and may not be available in all countries. Please get in touch with your dedicated relationship manager to check the availability of this offering and your business eligibility.

The information provided herein is general in nature and should not be construed as financial or investment advice. The information provided here is not legally binding. - The information, data or views expressed here is for the exclusive use of the recipient and is subject to changes without any notice. You may ask the support team or your dedicated relationship manager to provide additional information regarding Ebury Partners UK Ltd products.

- For more details, please refer to our legal and privacy notice.