The Pound and Euro both strengthened against a broadly weaker US Dollar as markets opened for the week on Monday, with investors awaiting an action packed few days in the currency markets.

The Bank of England’s MPC will also be meeting this week, releasing its latest monetary policy decision this Thursday afternoon. We don’t think that data published in the past few weeks has given the MPC any reason to change its communication from its November message and think that almost all attention this week will be on tomorrow’s Fed meeting.

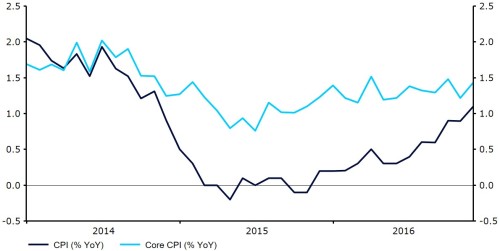

UK inflation data this morning came in slightly above forecasts. Headline inflation accelerated to 1.2% in the year to November from the 0.9% recorded in October (Figure 1). The effect of a weak Sterling is beginning to put upward pressure on domestic prices and we expect price growth to increase further in the first quarter of next year.

Figure 1: UK Inflation Rate (2014 – 2016)

Meanwhile, oil prices surged yesterday, with crude oil prices increasing around 4% from Friday’s close to their highest level in a year-and-a-half following the news that more non-OPEC member countries had agreed to cut output. The heavily oil driven Russian Ruble was the best performing currency in the world on Monday, soaring around 2.5% against the US Dollar to its strongest position since late-2015.

Major currencies in detail

GBP

Sterling strengthened 0.7% against the US Dollar on Monday on the back of broad US Dollar weakness ahead of Wednesday’s Fed meeting.

The British Chamber of Commerce (BCC) warned yesterday that the UK economy could be set to slow sharply next year, with the strong post-Brexit vote performance likely to prove temporary. The BCC warned that cautious consumers and uncertainty over the UK’s position in Europe could lead to a weaker 2017. The think tank revised its growth forecasts for next year downwards to just 1.1%, which would mark the weakest rate of growth since 2008 and the height of the financial crisis.

Meanwhile, house prices in the UK declined by 2.1% in November according to data released by Rightmove yesterday. The decline was largely driven by a surge in rented homes, particularly in London, which saw prices fall by 0.7% on a year previous, its largest annual fall since October 2010.

Core and headline inflation data could shift Sterling when released today. Sterling traders will have one eye on Thursday’s Bank of England meeting.

EUR

The Euro recovered around 0.4% versus the US Dollar yesterday, ending London trading at around the 1.06 level against the greenback.

Bank of France Governor Francois Villeroy spoke yesterday, claiming that Britain’s vote to leave the European Union would have limited effect on growth in the Eurozone. The Bank of France now expects the Eurozone’s second largest economy to grow by just 1.3% in both 2016 and 2017.

The monthly ZEW economic sentiment survey will be the only significant economic data released in the Eurozone today.

USD

A rise in oil prices and uncertainty over the Fed’s ‘dot plot’ sent the US Dollar 0.3% lower against its major peers on Monday.

Yesterday was void of any major economic data releases in the US, with investors in a fairly cautious mood ahead of the Federal Reserve meeting.

Economic news will also be light on the ground again today, with import and export prices unlikely to shift the US Dollar. Investors will be solely focused on tomorrow’s retail sales and, more importantly, the Federal Reserve rate decision. Of greater importance to the decision itself will be the updated ‘dot plot’, and the commentary from Janet Yellen on the likely pace of further interest rate hikes next year.