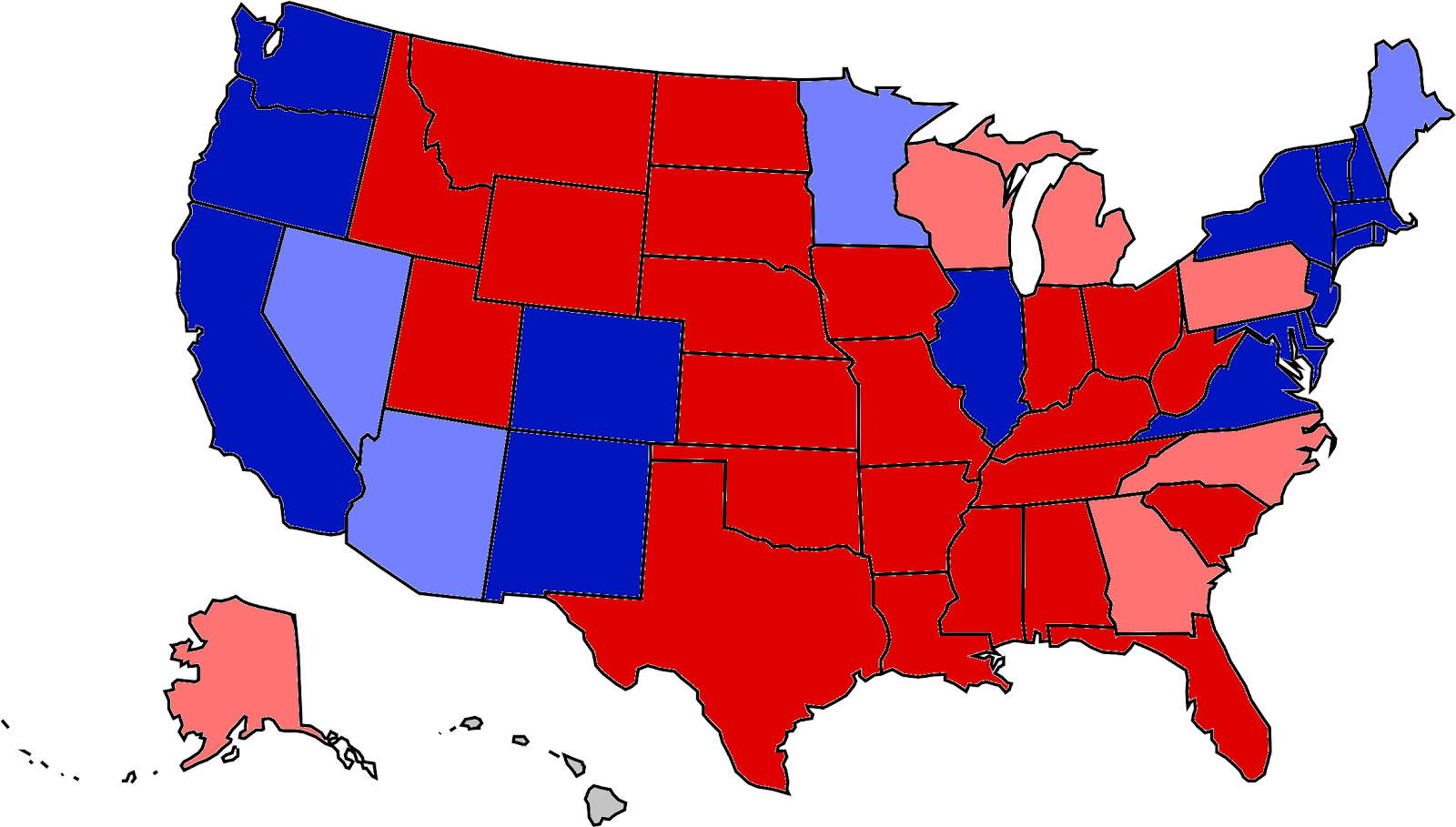

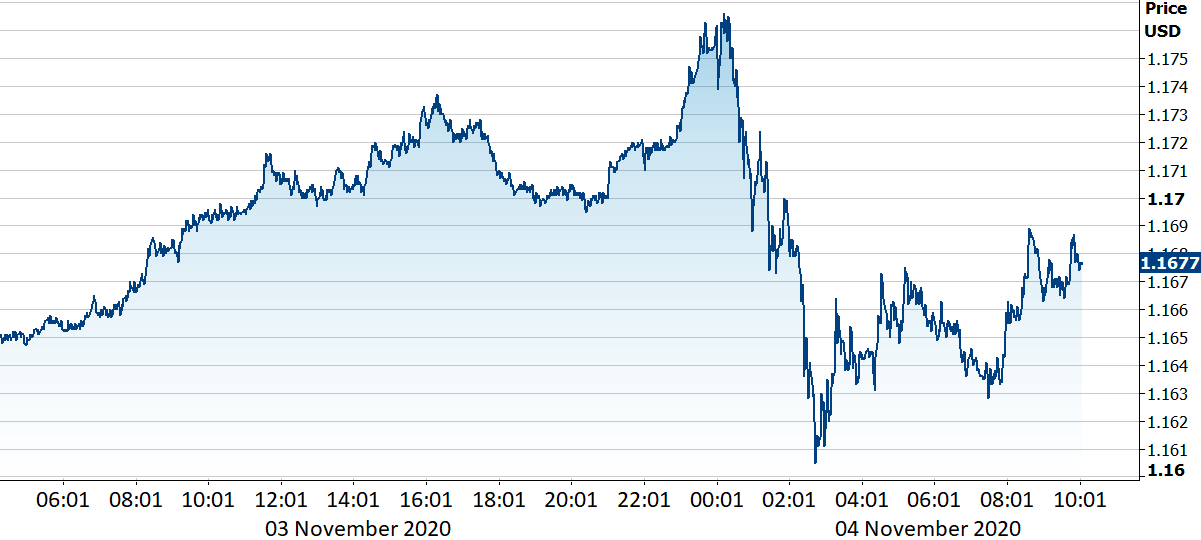

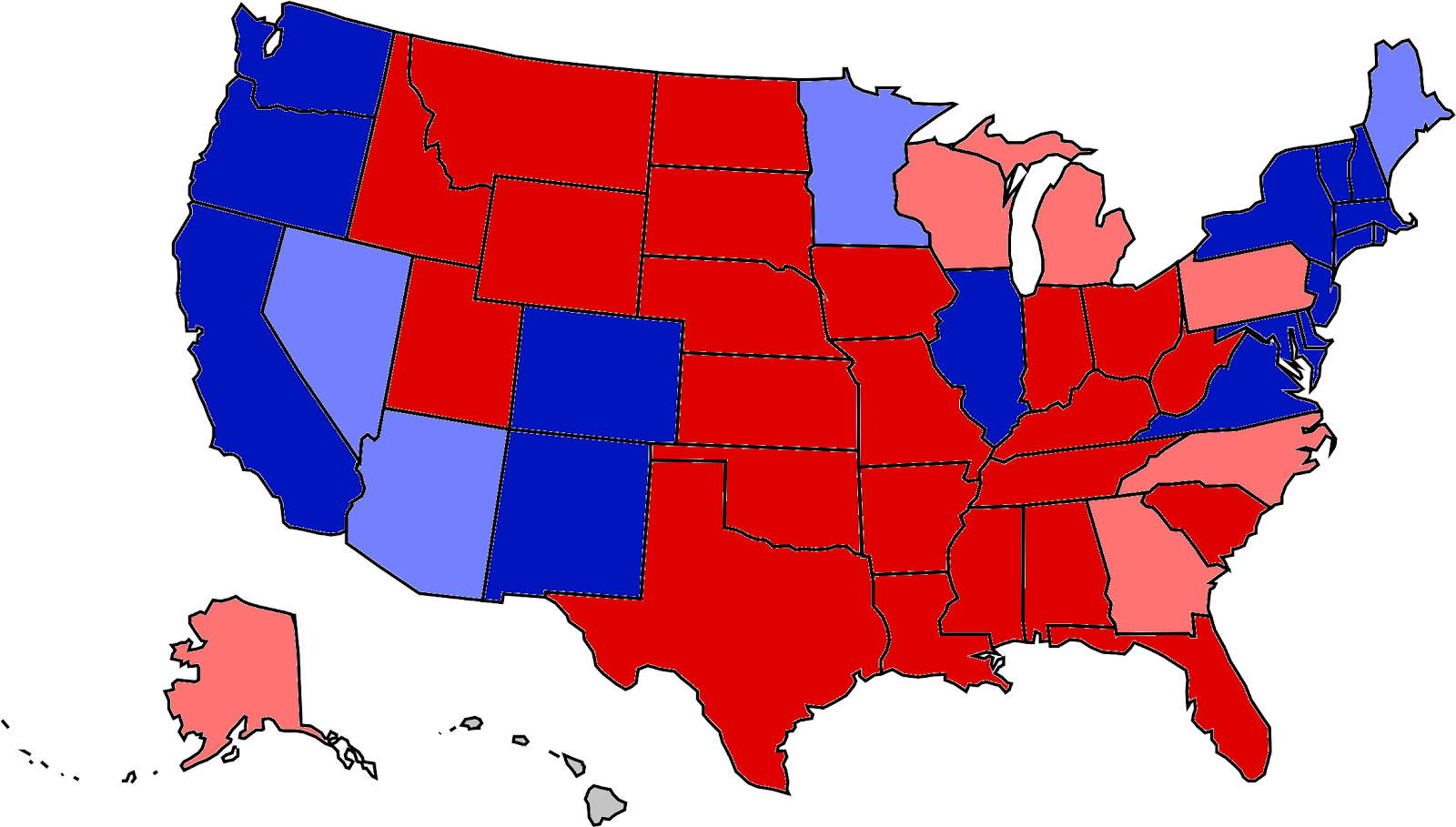

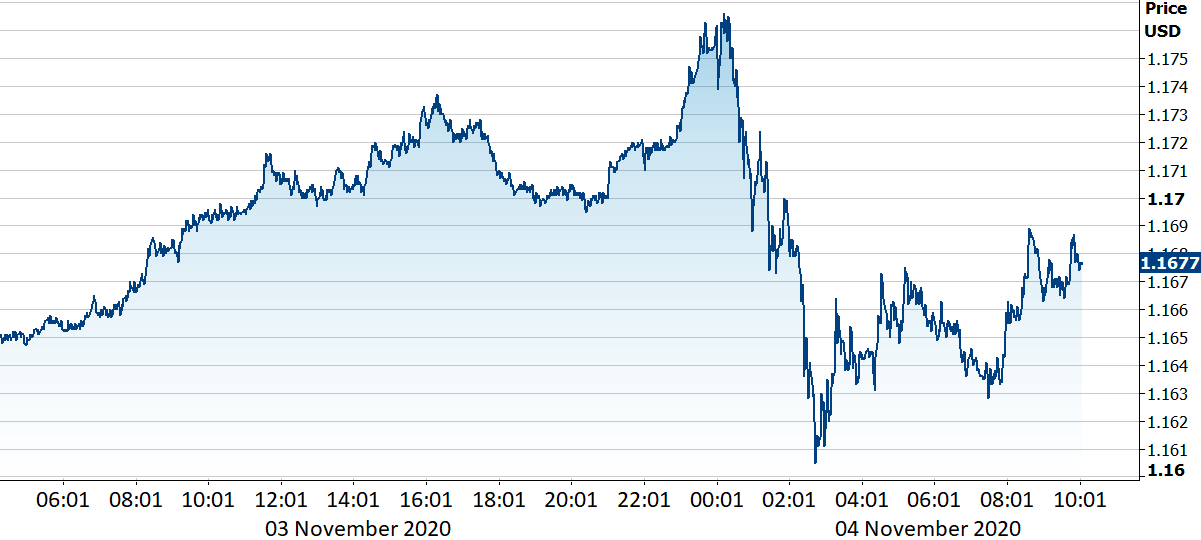

European financial markets opened this morning still none the wiser as to who had won the race to the White House in this year’s US presidential election after a tense night of ballot counting.Markets entered into a state of deja vu overnight, as early results showed a much tighter race than the opinion polls had suggested - as was the case at the 2016 election. The safe-haven US dollar strengthened overnight on the prospect of a close race after President Trump won in a handful of battleground states. The key swing state of Florida once again went to the Republicans at around 12:30 eastern time (05:30 GMT), with Trump claiming a big win in Texas not long after. With most votes counted, Ohio looks to be going to Trump, although Biden appears on course to win in Arizona.As things stand, results in 40 out of the 50 states have been called, with Biden ahead 220 electoral college votes to 213 (both still well shy of the 270 required for victory). Of the ten that remain, at least 70% of the votes have been counted in eight of them. The Republican stronghold of Alaska is one of them, with Trump also ahead in five of the other eight states. Should that remain the case with all ballots counted, he would have enough electoral votes to win a second term. Bookmakers, who were showing a rough 65% chance of a Biden win as polls closed, now have Trump as the favourite by a similar percentage.Figure 1: US Election Results Map (as it stands: 10:00AM GMT on 04/11) Source: Refinitiv Datastream Date: 04/11/2020The uncertainty arises, however, with millions of mail-in ballots that are yet to be counted in these crucial states. This is particularly the case in places such as Michigan and Wisconsin (both of which currently have Trump ahead) where the mail-in vote is said to strongly favour the Democrats. Should Biden take both Michigan (16 votes) and Wisconsin (10), then he would likely just have enough to win the required number of seats. A victory for Trump in either one of these states, combined with a win in Pennsylvania, North Carolina and Georgia (where he is currently ahead) would, however, likely be enough for a Republican triumph. Regardless, the market had positioned itself for a comfortable Biden victory and the big uncertainty going into the election, that the outcome would be delayed and/or contested, has come to pass. The result in both Pennsylvania and Michigan may not be available until Friday, so it could be a few days before the final result is known. Trump has already stated his view that voter fraud has taken place, so a Biden win would undoubtedly be contested by the President, which would drag the process even further into the future.So far, the FX market has actually reacted relatively calmly. The dollar sold-off as polls began to close in anticipation of a comfortable Biden win. As mentioned, the dollar then began to rally as the night progressed, albeit EUR/USD is now only back trading where it was at European open on Tuesday. Figure 2: EUR/USD (03/11/20 - 04/11/20)

Source: Refinitiv Datastream Date: 04/11/2020The uncertainty arises, however, with millions of mail-in ballots that are yet to be counted in these crucial states. This is particularly the case in places such as Michigan and Wisconsin (both of which currently have Trump ahead) where the mail-in vote is said to strongly favour the Democrats. Should Biden take both Michigan (16 votes) and Wisconsin (10), then he would likely just have enough to win the required number of seats. A victory for Trump in either one of these states, combined with a win in Pennsylvania, North Carolina and Georgia (where he is currently ahead) would, however, likely be enough for a Republican triumph. Regardless, the market had positioned itself for a comfortable Biden victory and the big uncertainty going into the election, that the outcome would be delayed and/or contested, has come to pass. The result in both Pennsylvania and Michigan may not be available until Friday, so it could be a few days before the final result is known. Trump has already stated his view that voter fraud has taken place, so a Biden win would undoubtedly be contested by the President, which would drag the process even further into the future.So far, the FX market has actually reacted relatively calmly. The dollar sold-off as polls began to close in anticipation of a comfortable Biden win. As mentioned, the dollar then began to rally as the night progressed, albeit EUR/USD is now only back trading where it was at European open on Tuesday. Figure 2: EUR/USD (03/11/20 - 04/11/20) Source: Refinitiv Datastream Date: 04/11/2020Whether this lack of volatility remains the case is unlikely. We think that the longer the process drags on, the more support we’ll likely see for the safe-havens (including the dollar) at the expense of just about every other currency. Either way, we expect some fairly sharp moves in financial markets in the next 48 hours or so, as more ballots are counted and investors get a clearer picture as to who has actually won.

Source: Refinitiv Datastream Date: 04/11/2020Whether this lack of volatility remains the case is unlikely. We think that the longer the process drags on, the more support we’ll likely see for the safe-havens (including the dollar) at the expense of just about every other currency. Either way, we expect some fairly sharp moves in financial markets in the next 48 hours or so, as more ballots are counted and investors get a clearer picture as to who has actually won.

Source: Refinitiv Datastream Date: 04/11/2020The uncertainty arises, however, with millions of mail-in ballots that are yet to be counted in these crucial states. This is particularly the case in places such as Michigan and Wisconsin (both of which currently have Trump ahead) where the mail-in vote is said to strongly favour the Democrats. Should Biden take both Michigan (16 votes) and Wisconsin (10), then he would likely just have enough to win the required number of seats. A victory for Trump in either one of these states, combined with a win in Pennsylvania, North Carolina and Georgia (where he is currently ahead) would, however, likely be enough for a Republican triumph. Regardless, the market had positioned itself for a comfortable Biden victory and the big uncertainty going into the election, that the outcome would be delayed and/or contested, has come to pass. The result in both Pennsylvania and Michigan may not be available until Friday, so it could be a few days before the final result is known. Trump has already stated his view that voter fraud has taken place, so a Biden win would undoubtedly be contested by the President, which would drag the process even further into the future.So far, the FX market has actually reacted relatively calmly. The dollar sold-off as polls began to close in anticipation of a comfortable Biden win. As mentioned, the dollar then began to rally as the night progressed, albeit EUR/USD is now only back trading where it was at European open on Tuesday. Figure 2: EUR/USD (03/11/20 - 04/11/20)

Source: Refinitiv Datastream Date: 04/11/2020The uncertainty arises, however, with millions of mail-in ballots that are yet to be counted in these crucial states. This is particularly the case in places such as Michigan and Wisconsin (both of which currently have Trump ahead) where the mail-in vote is said to strongly favour the Democrats. Should Biden take both Michigan (16 votes) and Wisconsin (10), then he would likely just have enough to win the required number of seats. A victory for Trump in either one of these states, combined with a win in Pennsylvania, North Carolina and Georgia (where he is currently ahead) would, however, likely be enough for a Republican triumph. Regardless, the market had positioned itself for a comfortable Biden victory and the big uncertainty going into the election, that the outcome would be delayed and/or contested, has come to pass. The result in both Pennsylvania and Michigan may not be available until Friday, so it could be a few days before the final result is known. Trump has already stated his view that voter fraud has taken place, so a Biden win would undoubtedly be contested by the President, which would drag the process even further into the future.So far, the FX market has actually reacted relatively calmly. The dollar sold-off as polls began to close in anticipation of a comfortable Biden win. As mentioned, the dollar then began to rally as the night progressed, albeit EUR/USD is now only back trading where it was at European open on Tuesday. Figure 2: EUR/USD (03/11/20 - 04/11/20) Source: Refinitiv Datastream Date: 04/11/2020Whether this lack of volatility remains the case is unlikely. We think that the longer the process drags on, the more support we’ll likely see for the safe-havens (including the dollar) at the expense of just about every other currency. Either way, we expect some fairly sharp moves in financial markets in the next 48 hours or so, as more ballots are counted and investors get a clearer picture as to who has actually won.

Source: Refinitiv Datastream Date: 04/11/2020Whether this lack of volatility remains the case is unlikely. We think that the longer the process drags on, the more support we’ll likely see for the safe-havens (including the dollar) at the expense of just about every other currency. Either way, we expect some fairly sharp moves in financial markets in the next 48 hours or so, as more ballots are counted and investors get a clearer picture as to who has actually won.

.svg)

.svg)

.svg)