Today bodes to be one of the busiest, and perhaps most volatile, that we’ve seen in the currency markets for a number of weeks.

Thursday is also a very hectic one in terms of economic data. Arguably the most important will be this afternoon’s US retail sales figures for June, which should give us a more clearer idea as to how well the economy is bouncing back from the height of the shutdowns. Following May’s record high jump in sales, another similarly lofty number would be unrealistic. Spending should have been stronger last month given the ongoing unwinding in lockdown measures, although investors are eyeing an easing in the month-on-month number to 5% from May’s record 17.7% expansion.

China GDP jumps, but retail sales paint gloomy picture

In the build-up to today’s announcements, EUR/USD ended trading on Wednesday roughly where it began it, retreating from its highest level in four months.

The pair continued to move lower during Asian trading hours following the release of a host of Chinese economic data. China’s GDP data for the second quarter was actually highly impressive. The economy rebounded well in the three months to June, expanding by 11.5% quarter-on-quarter (3.2% year-on-year). Investors, however, focused more on the details, notably the relatively weak levels of consumer spending activity in the country post-lockdown. This does not bode all that well for the developed world, most of which relies much more heavily on consumer demand than China.

Today’s GDP numbers were also tempered by a disappointing set of retail sales numbers for June – given extra weight by currency traders due to its timeliness. Sales in China fell unexpectedly by 1.8% in June, perhaps a result of the reintroduction of some of the virus containment measures, notably in Beijing. The result was a souring in global market sentiment, with investors favouring the safe-haven dollar overnight and selling higher risk assets such as the euro.

UK labour numbers stronger-than-expected

The pound similarly fell overnight, although seems to have found a foothold this morning following some encouraging UK employment figures.

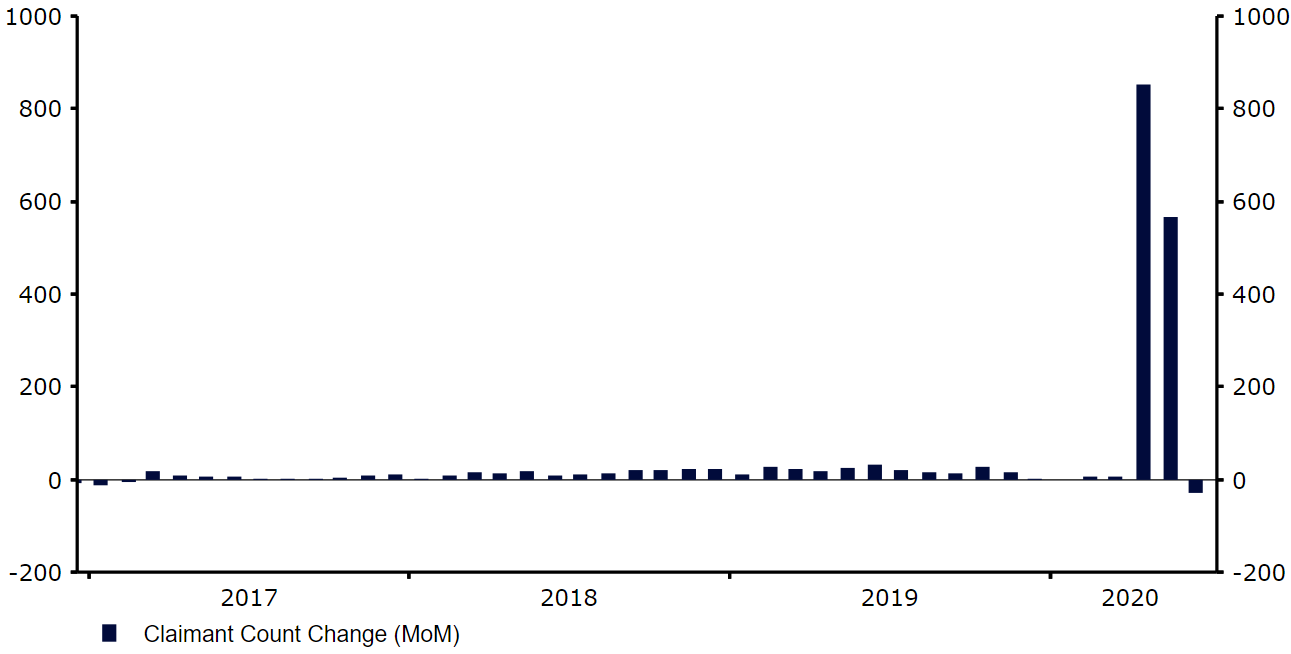

According to this morning’s UK labour report, unemployment remained unchanged in the three months to May at 3.9%, after economists had eyed a modest uptick to 4.2%. Arguably even more encouraging was the decline in unemployment benefit claims witnessed in June. The claimant count number actually declined last month, with 28,100 less people claiming benefits last month than in May. This is a vast improvement on the 566,400 increase in claims in May and much better than the +250,000 number that the market had priced in.

Figure 1: UK Claimant Count Change (2017 – 2020)

While these numbers are of course a step in the right direction, they do not take into account the millions of workers placed on the government’s furlough scheme. The 28.1k decrease in claims also only represents a modest correction, with the vast majority of those made unemployed since the start of the crisis still out of work. Regardless, we’ll only really get a true read on how the labour market is actually holding up once the dust has settled and the furlough scheme has ended.