ECB July Meeting Preview: Lagarde to adopt ‘wait-and-see’ mode

( 2 min )

- Go back to blog home

- Latest

This week’s European Central Bank meeting is expected to be one of the more low-key that we’ve seen from the Governing Council in a number of months.

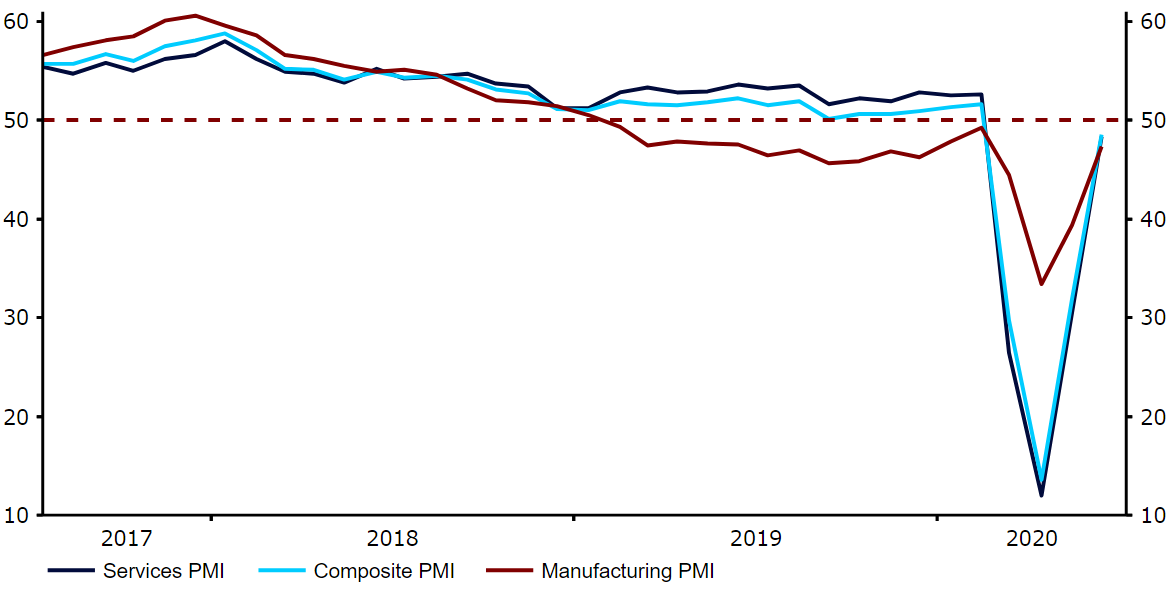

Given the extensive stimulus measures already unveiled in the bloc, we don’t expect any change in policy from the ECB this week. An improvement in both European economic data and contagion numbers since the last meeting ending on 4th June lessens the need for extra monetary accommodation, in our view. Amid an unwinding in lockdown measures across almost all of Europe, we have witnessed encouraging rebounds in both business and consumer activity data, notably sharp improvements in the PMIs (Figure 1) and retail sales. While still very early days, this has so far been evidence that the recovery in the Euro Area economy may be closer to a ‘V-shape’ than initially anticipated. A return of European bond yields back to where they were prior to the crisis, particularly among the peripheral countries, will also be a very welcome development for the ECB.

Figure 1: Euro Area PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 10/07/2020

Speaking during an interview with the Financial Times last week, ECB President Christine Lagarde effectively ruled out any additional action at this month’s meeting. She stated ‘we [the ECB] have done so much that we have quite a bit of time to assess incoming data carefully’. With no immediate need to change policy, President Lagarde is likely to instead use this week’s meeting as an opportunity to again pressure European authorities to do more to support the bloc’s economy. EU leaders will be holding a face-to-face summit the day after this week’s ECB meeting, with the European Commission’s €750 billion fiscal rescue plan set to be top of the agenda. While there appears sufficient support to get the plan over the line, there remains stiff opposition to the proposals from the so-called ‘Frugal Four’ countries – Austria, Denmark, the Netherlands and Sweden.

Should Lagarde both talk up the recent improvements in Euro Area economic data and forcefully signal that it is now the government’s turn to do more, then we think we may see a bit of strength in the euro during Thursday’s press conference. A more downbeat message that highlights the enormity of the risks facing the economy, by contrast, would likely see the common currency sell-off. Looking further ahead, the main question is whether another increase in the PEPP will be required later in the year. We think that it is far too soon to judge whether this will be needed, with the economic outlook far too uncertain. The bank will likely wait until either the September or October meetings to discuss whether this would be appropriate, when much more economic data will be available for policymakers to digest.

The ECB’s policy decision will be announced at 12:45 BST (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.