US sheds 701,000 jobs in March with worst yet to come

- Go back to blog home

- Latest

This afternoon saw the release of some more worrisome labour market data out of the US that gives a taste of just how significant of an impact the COVID-19 virus is set to have on the US economy.

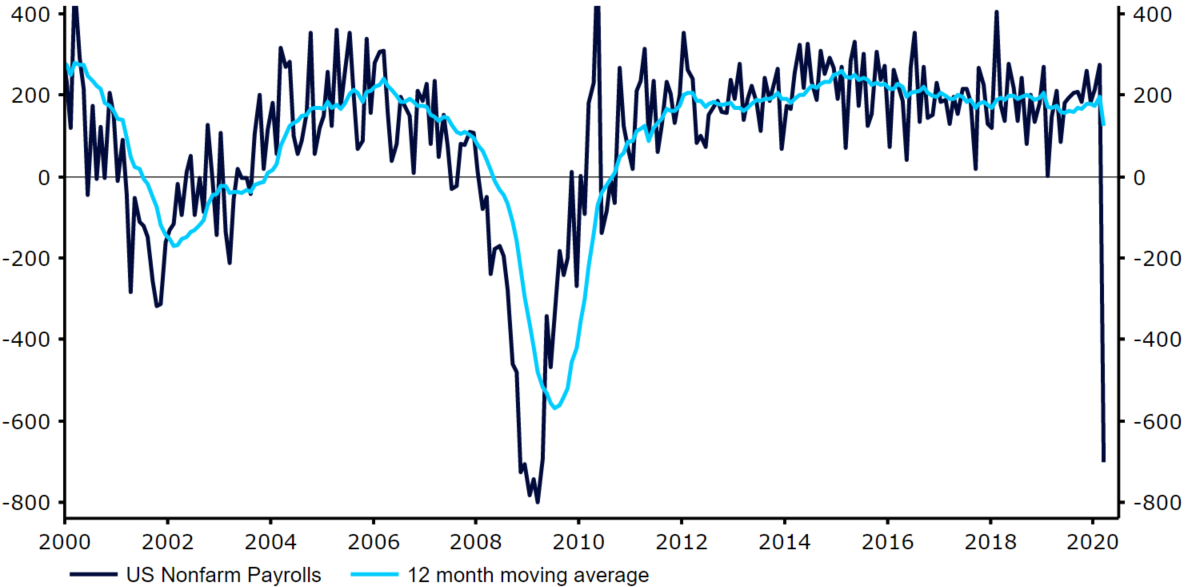

Figure 1: US Nonfarm Payrolls (2000 – 2020)

It is, however, vitally important to note that this is but the tip of the iceberg given that the above data only covers the period up to 12th March and does not include the last three weeks or so. During that time, initial claims for unemployment benefits have skyrocketed, with 10 million Americans filling for jobless benefits in the two weeks to 27th March alone – approximately 6% of the total workforce. Assuming zero hiring during that time, that would take the actual unemployment rate to in excess of 10% and very close to its highest level since World War II. Today’s data reaffirms our suspicion that the April labour report will be a total disaster. As things stand, the largest monthly fall in employment in the US was 1.9 million in September 1945. This looks set to be comfortably eclipsed when next month’s report is released on the first Friday of May.

The reaction in the FX market to the report was fairly limited, suggesting that traders are already bracing for the worst. Investors will now be trying desperately get some sense of how long the containment measures designed to halt the spread of the virus will remain in place in the key economic areas around the world. Both the relative length and severity of these measures will be crucial in determining when, and to what extent, economies bounce back once the worst of the virus is over.