Sterling tumbles to 1985 low after PM May sets Brexit deadline

- Go back to blog home

- Latest

The Pound fell sharply across the board as markets opened for the week on Monday and again this morning, on weekend comments from Britain’s Prime Minister Theresa May about the timing of Britain’s exit from the European Union. Sterling crashed to a fresh 3 decade low against the US Dollar.

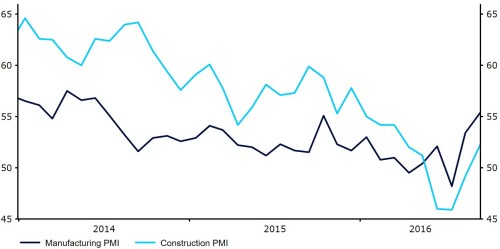

Sterling’s losses yesterday were briefly tempered by a remarkably strong manufacturing PMI, which showed that in September the sector grew at its fastest pace since June 2014 boosted by the effect of a weaker Pound. This morning’s construction PMI also far exceeded expectations, suggesting that the UK economy is bouncing back well following its post-Brexit slump (Figure 1).

Figure 1: UK Manufacturing PMI (2014 – 2016)

A similarly strong reading in yesterday’s ISM manufacturing PMI in the US provided good support for the US Dollar yesterday, which also ended the session higher against both the Euro and the Japanese Yen.

Commodity driven currencies also continued to strengthen after oil prices held firm above $50 a barrel, having surged last week on the news that OPEC had cut production for the first time since 2008. The Russian Ruble and Norwegian Krone both hit their strongest position so far in 2016.

Trading today will no doubt continue to be fixated by concerns surrounding the effect of Britain’s exit from the EU on the UK economy. This morning’s construction PMI in the UK will be the main economic announcement in an otherwise data light day.

Major currencies in detail:

GBP

Concerns surrounding Britain’s Brexit process caused the Pound to trade 1.2% lower this morning from Monday’s open.

Monday’s manufacturing data provided some much needed relief for Sterling, which looked dead set on crashing back below its three decade low yesterday morning. The index increased sharply to 55.4 from 53.3 and will no doubt alleviate concerns surrounding a possible economic slowdown following the Brexit vote.

The UK’s manufacturing sector is currently enjoying the best of both worlds, maintaining its access to the EU in the short term, while benefitting from growing demand as a result of the weaker Pound.

This week looks set to be a fairly busy one in the UK economy. Wednesday’s services PMI is expected to dip slightly from previous, although we could see this surprising to the upside if the recent manufacturing and construction data is anything to go by.

EUR

The Euro fell 0.5% on Monday and during Asian trading this morning following better-than-expected US manufacturing data.

Economic data in the Euro-area yesterday came in mostly in line with expectations and therefore did little to shift the single currency. The manufacturing PMI for September was unchanged as expected at 52.6, with Germany continuing, almost exclusively, to drive growth in the sector. Germany’s manufacturing index came in at a fairly healthy 54.3 last month, while the same measure in both Italy and France continues to closely tread the line between expansion and contraction.

The ECB’s meeting accounts on Thursday could shed more light on the possible timing of further monetary stimulus in the Eurozone. In the meantime, producer prices this morning and retail sales on Wednesday could drive sentiment towards the Euro this week.

USD

The US Dollar gained against every non-commodity dependent currency yesterday, with the Dollar index trading this morning around 0.6% higher for the week.

US manufacturing rebounded strongly in September, having fallen below the level of 50 that denotes contraction in August. The PMI increased to 51.5 from 49.4, providing some rare good news for the sector that has been battered by weak demand from abroad and a strong US Dollar. The ISM’s gauge of new orders performed particularly impressively, jumping to 55.1 from 49.1 the month previous.

Friday’s nonfarm payrolls report will undoubtedly be the main event in the US this week. With mostly second tier economic releases in the meantime, the US Dollar will likely be driven by announcements elsewhere.

Receive these market updates via email