Bank of England and Brexit ruling send Sterling sharply higher

- Go back to blog home

- Latest

The Pound soared by more than 1% against both the US Dollar and Euro after a busy day of action in the UK that eased concerns Britain was heading for a ‘hard’ exit from the European Union.

Even though the government has said it will appeal within the next month and bring the case to the Supreme Court, this is a major setback for PM May. We think this lessens the risk of a ‘hard Brexit’ that could have had severe negative implications for the UK economy.

Yesterday the Bank of England also voted to keep interest rates unchanged following its two day monetary policy meeting, as expected. All nine members of the committee voted in favour of holding rates steady, defying some expectations for a 8-1 vote. Crucially, the central bank took the market slightly by surprise by also dropping its easing bias and all but confirmed it won’t be cutting rates again this year.

As part of its Quarterly Inflation report, the central bank also sharply raised its growth and inflation forecasts. Policymakers expect inflation to hit 2.7% this time next year, with growth to hit 1.4% in 2017 rather than its previous 0.8% estimate.

The major announcements in the currency markets continue to come thick and fast. Today we’ll see the monthly nonfarm payrolls report this afternoon, generally seen as the most important single data release on the economic calendar. Consensus points to a healthy reading around the 175,000 mark which would, in our view, be more than enough to strengthen the case for a December interest rate increase by the Federal Reserve.

Major currencies in detail:

GBP

Sterling ended the day as the best performing currency in the world, surging 1% against the US Dollar and Euro.

Concerns of a Bank of England rate cut were almost completely dispelled yesterday after Governor Mark Carney’s statement claimed that the ‘BoE has neutral bias on policy going forward’. With Sterling weak, inflation expected to increase and growth proving resilient, we see little evidence to suggest rates will be lowered from current levels in the short term.

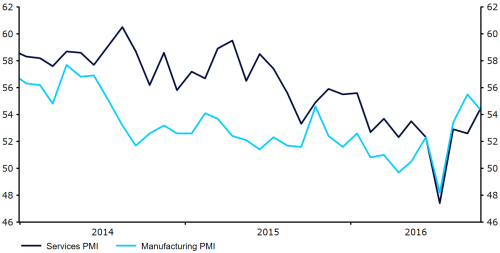

Traders almost entirely overlooked Thursday’s normally heavily scrutinised services PMI, which went completely under the radar. The PMI rose sharply to 54.5 in October from 52.6 in September, its highest reading since February.

Figure 1: UK Purchasing Managers’ Indexes (2014 – 2016)

With no economic releases in the UK today, focus will be on politics and this afternoon’s US labour report.

EUR

Early gains for the Euro proved short lived yesterday, with the currency ending unchanged versus the Dollar.

Unemployment in the Euro-area came in better-than-expected for September, continuing to point to a firming in labour market conditions in the single currency bloc. The jobless rate came in at 10%, its lowest level in 5 years.

The European Central Bank also released its economic bulletin on Thursday. The bulletin was mostly in line with previous ECB statements that the Eurozone was growing at a moderate pace with downside risks still present.

The Euro will largely be driven by this afternoon’s US data, although the services PMI from Markit this morning will be worth looking out for.

USD

The Dollar had a mixed session yesterday, ending the day 0.1% higher.

Attention remains on next week’s Presidential Election, with polls close and just a few days to go. Prediction website fivethirtyeight.com has lowered its probability of a Clinton win to around 65% from closer to 90% last week.

Jobless claims were strong again last week, albeit rising slightly to 265,000 from 258,000. However, the ISM’s non-manufacturing PMI was slightly less encouraging and a significant disappointment following a bumper figure for September. The index slumped unexpectedly to 54.8 from 57.1, although still remained comfortably above the level of 50 that denotes expansion.

This afternoon’s labour report at 13:30 UK time will be the main event today. The nonfarm payrolls figure is expected to rise to 175,000 in October, while unemployment is forecast to dip to 4.9% from 5%.

Receive these market updates via email