Sterling rises off three week lows after inflation data

- Go back to blog home

- Latest

The Pound rallied off its recent three week lows against the US Dollar on Tuesday morning ahead of a host of economic data releases in the UK this week.

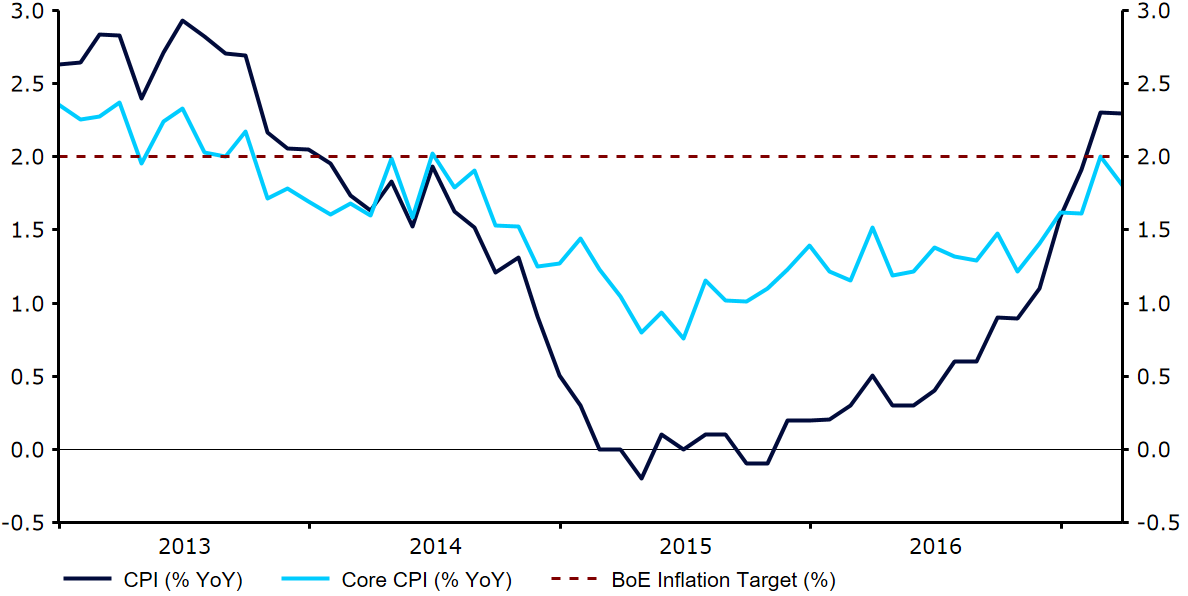

Figure 1: UK Inflation Rate (2013 – 2017)

These numbers, combined with the monthly labour data on Wednesday morning, should give traders a decent idea as to the state of the UK economy going into the long and likely protracted period of Brexit negotiations. Tomorrow’s labour data may also give us a better idea as to the likelihood that the BoE will hike interest rates before the end of the year. This remains something that financial markets are continuing to under-price in our view.

Concerns regarding the outcome of the French Presidential Election kept the Euro pinned around its weakest position in a month against the US Dollar yesterday. Despite a fairly mixed labour report last week, including a very underwhelming nonfarm payrolls number, some hawkish comments from New York Fed Chair William Dudley late on Friday has given the Dollar rally some legs.

Chair of the Federal Reserve Janet Yellen also spoke yesterday evening, although her comments failed to inspire any sort of rally out of the Dollar. Yellen claimed that productivity growth has been disappointing, while citing lackluster GDP growth in the US, re-emphasising the likelihood that interest rate hikes in the country this year are likely to be gradual.

Meanwhile, the South African Rand continued on its recent volatile ride, falling by over one percent against the Dollar following the sudden firing of the country’s finance minister earlier this month.

Major currencies in detail

GBP

No news was good news for the Pound on Monday, with a complete lack of economic or political developments allowing Sterling to strengthen against both the Dollar and the Euro during London trading. Currency market positions for last week suggested that investors are beginning to dial back bets for weakness in the currency in the coming months. Net Sterling shorts were scaled back somewhat, although remained around their highest level on record.

Inflation data will be released at 9:30 UK time, with the latest labour numbers to follow on Wednesday. Governor of the Bank of England Mark Carney will be speaking for the second time in a week on Wednesday, although will likely remain tight lipped on his expectations for future monetary policy in the UK.

EUR

The latest confidence data out of the Eurozone for April helped provide a timely boost for the Euro on Monday. The monthly index from Sentix rose to 23.9 from 20.7, its highest level in a decade, owing in part to the general improvement in economic conditions within the Euro-area economy.

Industrial production numbers will be released in the Eurozone this morning, with production growth forecast to print flat for February. With a little under two weeks to go until polls open, the French Election is beginning to take on added attention. Polls over the weekend continued to show Le Pen and Macron as neck-and-neck going into the first round of voting.

USD

Federal Reserve member James Bullard struck a surprisingly less hawkish tone than anticipated while speaking in Melbourne, Australia yesterday morning. The St. Louis Fed President claimed that he saw the case for just one additional interest rate hike this year, significantly less than the Fed’s latest ‘dot plot’ and that currently priced in by the market.

With economic data at a premium in the US today, investors will instead focus on a speech from Federal Reserve member Kashkari, the only member of the FOMC to vote against raising interest rates at the Central Bank’s most recent meeting in March.