Emerging market currencies rally sharply as low US inflation tempers hike expectations

- Go back to blog home

- Latest

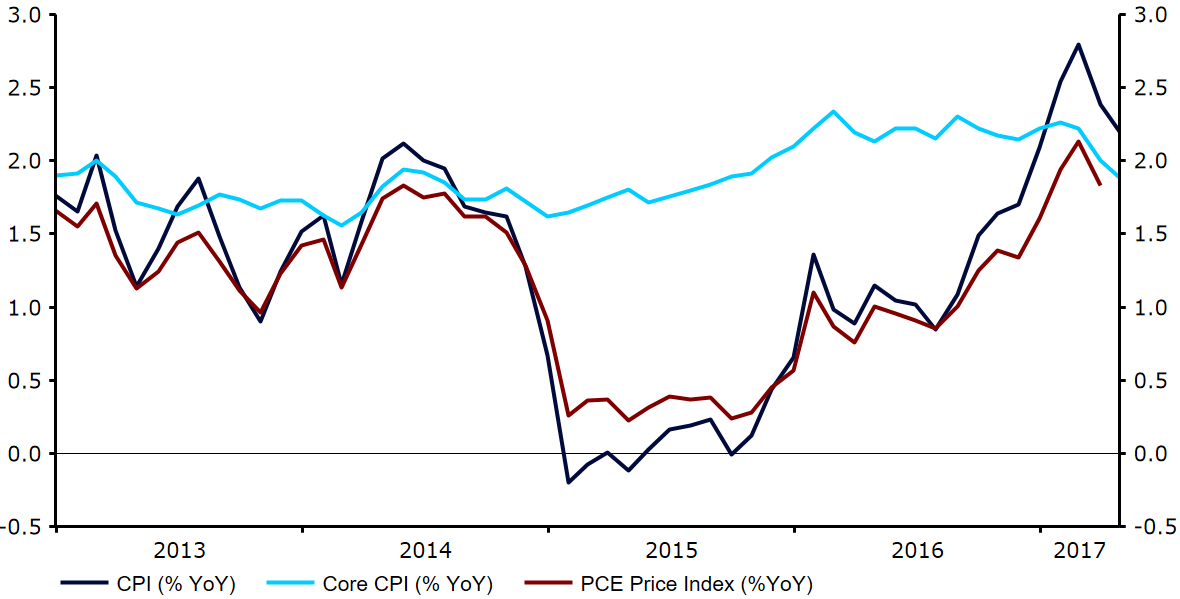

A nascent Dollar rally last week was stopped in its tracks by the second consecutive downward surprise in US inflation numbers.

Figure 1: US Inflation Rate (2013 – 2017)

The biggest beneficiaries were emerging market currencies, all of which posted sharp gains as US long term interest rates fell across the board, igniting a serious bid for all risk assets. The Mexican Peso, South African Rand and Brazilian Real topped the list, rising over 2% against all major G10 currencies.

We now go into a rather quiet week in terms of macroeconomic data and policy announcements. UK inflation data for April on Tuesday and the monthly labour market report on Wednesday will be the most important economic releases among the G4 currencies. We expect next week to be a rather volatile one for Sterling.

Major currencies in detail

GBP

The Pound’s second assault against the 1.30 level vs. the US Dollar was firmly driven back last week after the Bank of England failed to sound the hawkish note markets had been expecting.

No other MPC member joined Kristin Forbes in voting for an immediate interest rate hike. Aside from that, the message from the May meeting was not particularly dovish, especially since the MPC seemed to be looking past recent weakness in UK economic data. Changes to forecasts were marginal. Further, their explicit statement that the bank rate may have to rise further than expected should be regarded as a medium term Sterling positive. We therefore believe that the recent rally against Euro has still further to run.

EUR

The Euro failed to sustain its late Sunday push above the 1.10 level against the Dollar in the aftermath of Macron’s electoral victory. In the end, it proved just another case of “buy the rumour, sell the news”.

Last week’s speech from President of the ECB Mario Draghi proved to be a non-event, and Draghi did little more than reiterate his wait-and-see stance. While weak US inflation data and the Bank of England meeting together halted the slide in the common currency, Eurozone March industrial production disappointed and the Euro ended the week more or less where it had finished on Friday night, before the lopsided Macron victory was known.

USD

US inflation undershot consensus expectations for the second month in a row last week. Both the headline and the core annual prints retreated from their March levels to 2.2% and 1.9% respectively. Soft medical prices and lower airfares accounted for much of the surprise.

This number does not change our view that the Federal Reserve is on track for a June hike. However, our base case is now that the Fed will only hike once more for the remainder of the year, for a total of three hikes in 2017.