Single currency soars after Merkel claims Euro “too weak”

- Go back to blog home

- Latest

The Euro jumped to a fresh six month high against the US Dollar on Monday after German Chancellor Angela Merkel claimed that the currency was “too weak”.

Yesterday’s comments from Merkel will no doubt ramp up speculation that Germany will pressure the European Central Bank into adopting a less accommodative monetary policy stance when it next meets in June. Many analysts and traders are already predicting the ECB will alter its forward guidance next month in preparation for a dialling back in its stimulus programme.

Sterling temporarily dipped back below the 1.30 level against the US Dollar yesterday after the release of the latest opinion poll suggested that support for the Conservative Party was waning somewhat ahead of next month’s election. The Tories advantage was slashed to just 9% in the Survation poll amid perceived weakness in the party’s campaign and a mixed reception to the release of their manifesto last week.

Major currencies in detail

GBP

The Pound ended London trading modestly higher against the US Dollar on Monday despite the release of a number of polls that showed support for the Conservative Party had tailed off in the past few days.

Reaction to last week’s manifesto launch from the Tories was decidedly mixed, which seems to have been reflected in the latest opinion polls. Meanwhile, news over the weekend that the UK would walk away from Brexit discussions should it be forced to pay up as much as 100 billion Euros led to no more than a temporary sell-off in the currency on Monday.

Mark Carney will be presenting the Bank of England’s inflation report at the quarterly hearing in London this morning, in what is generally a heavily scrutinised event. With much of this month’s major economic data now out of the way, the Pound will continue to be driven by election expectations and developments abroad.

EUR

The Euro spiked back above the 1.12 level against the US Dollar on Monday, buoyed by Merkel’s speech and an increase in Euro long position to its highest level in over three years.

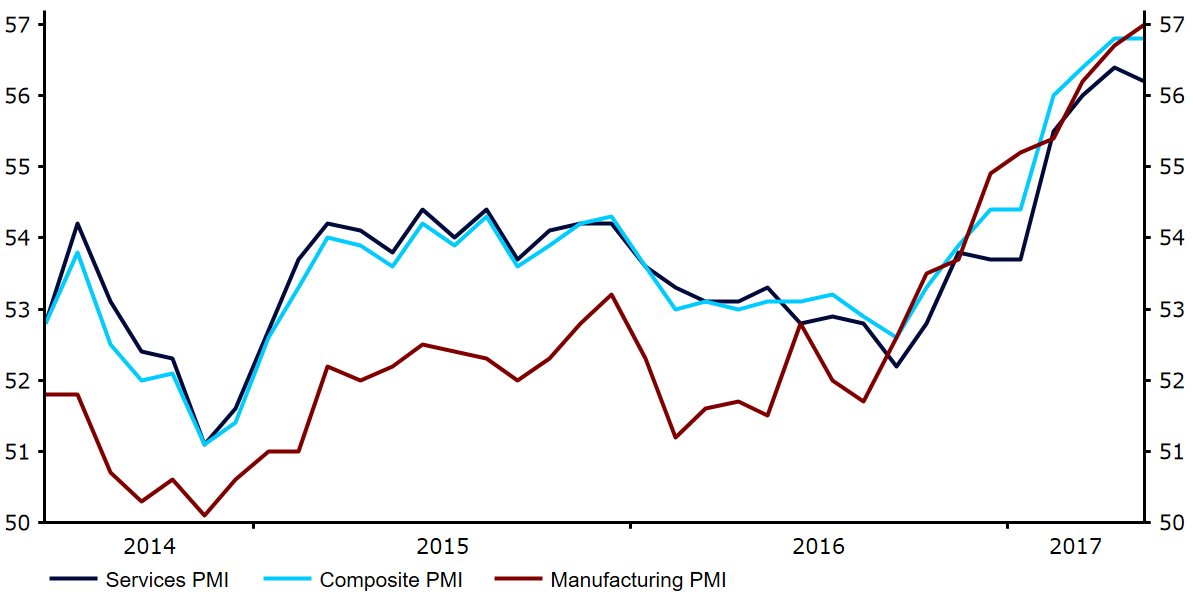

This morning’s Euro-wide PMIs were also, on the whole posite, with the composite PMI remaining unchanged at an above forecast 56.8 versus 56.6 consensus. A modest decline in the services PMI to 56.2 was offset by a jump in the manufacturing PMI to a fresh six year high 57.0 from 56.7 (Figure 1).

Figure 1: Eurozone PMIs (2014 – 2017)

This positive surprise will no doubt heap even more pressure on the European Central Bank to begin altering its dovish tone at its next monetary policy meeting in June.

USD

Concerns over Donald Trump’s ability to push through economic stimulus in the US this year continued to keep the Dollar on the back foot on Monday. The Dollar index fell to a fresh seven month low, largely off the back of broad Euro strength, with almost no major economic releases in the US whatsoever.

We’ll see a string of economic data releases in the US today, although most are second tier and unlikely to materially shift the greenback. The manufacturing and services PMIs will be worth looking out for at 14:45 UK time. Federal Reserve members Kashkari and Harker will also be speaking this afternoon.