Euro spikes to near two year high as Draghi hints at QE discussion

- Go back to blog home

- Latest

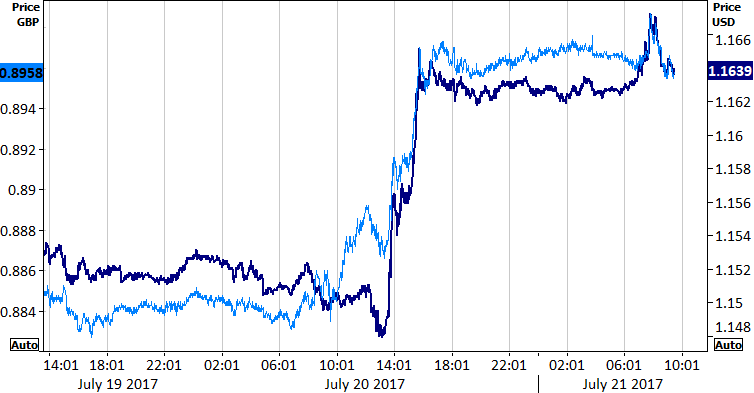

The Euro jumped by over one percent to its strongest position against the US Dollar since August 2015 during London trading on Thursday (Figure 1) after comments from ECB’s president.

Figure 1: EUR/USD & EUR/GBP (19/07/17 – 21/07/17)

Yesterday’s sharp upward move in the Euro came as somewhat of a surprise given Draghi maintained his fairly dovish rhetoric during his press conference. The central bank chief highlighted the need for the bank to remain both “persistent” and “patient” with its large scale stimulus programme. Draghi reiterated that the risks to growth in the Eurozone remained “broadly balanced”, although underlying inflation was yet to show any convincing signs of a pick-up and that a “substantial degree of accommodation” was still needed. The Governing Council were also unanimous in their decision to keep guidance unchanged.

The rather aggressive upward move in the common currency can instead be largely attributed to his claim that discussions on changes to the QE programme should take place in the autumn and perhaps his apparent lack of concern regarding the recent appreciation in the Euro.

The ECB’s next meeting in early September is now therefore likely to take on added importance and we could see the first real hint that a tapering in the quantitative easing programme is on the way. However, as we have been saying for a while, we think we would need to see a more sustained rebound in core inflation in the Euro-area before the central bank commits to winding down its stimulus programme. Regardless, sentiment towards the common currency has shifted dramatically in the past few months. The currency has already appreciated by a massive 11% so far in 2017.

Hot June weather boosts UK retail sales

Sterling had a fairly up and down day on Thursday. The currency received some decent support yesterday morning following the release of an impressive set of retail sales figures that suggested the UK economy may have picked up pace in the second quarter following a dismal start to 2017.

Retail sales increased by a better-than-expected 2.9% in the year to June, above the 2.5% consensus and a considerable improvement on the 0.9% recorded in May. A particularly warm June month contributed to much of the bounce and lifted the three month moving average to a more respectable 1.5% versus the 1.4% contraction recorded in the first quarter.

Sterling volatility could be limited today, with public sector borrowing data the only economic release in the UK today.

Dollar index sinks after ECB, jobless claims tick lower

The Dollar slipped further into the doldrums on Thursday, extending its losses against its major peers to almost 10% for the year after the European Central Bank meeting.

With Mario Draghi dominating proceedings, yesterday’s impressive jobless claims data went completely under the radar. Claims fell to a near five month low 233,000 last week, reinforcing the view that the US labour market is in strong enough shape to warrant another interest rate hike by the Federal Reserve before the year is out.