Federal Reserve hikes rates, cuts economic growth forecasts

- Go back to blog home

- Latest

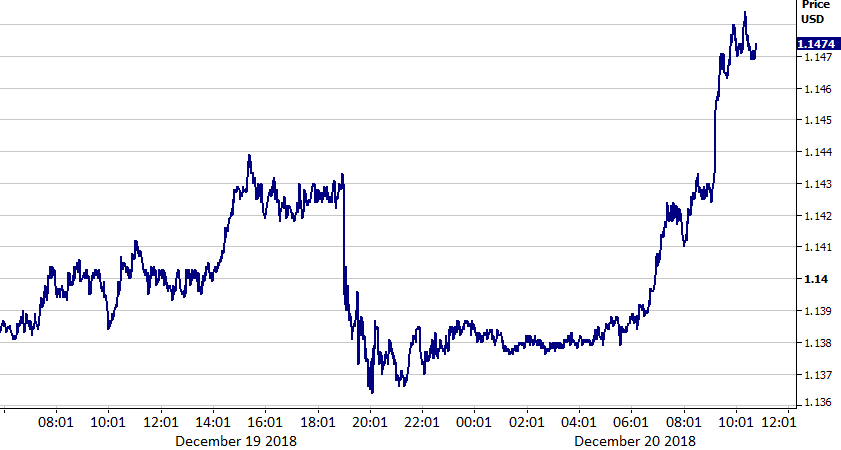

The US Dollar fell sharply to a more than five-week low against the Euro this morning (Figure 1), in large part due to investors selling the greenback on expectations of a slower pace of interest rate hikes from the Federal Reserve in 2019.

Figure 1: EUR/USD (19/12/18 – 20/12/18)

, The US currency actually initiated a modest rally immediately following Wednesday evening’s FOMC meeting after a less-dovish-than-expected policy message from the Federal Reserve. Currency markets had been preparing for the worst prior to the meeting, with some bracing for no rate hike at all and others expecting a sharp downward revision in both economic and interest rate hike projections. In the end, none of these scenarios came to pass.

As we anticipated, rates were raised by an additional 25 basis points to a range between 2.25-2.5%, the fourth hike in the calendar year, with all members of the committee voting for an immediate hike. Chair Jerome Powell’s press conference was relatively optimistic. He reiterated that the US economy had been strong, stating that the jobs market has continued to improve. Powell stated that while financial market conditions had tightened, these developments had not fundamentally changed the outlook. Additional rate increases also remain on the horizon, although the language was altered slightly to ‘some’ further rate hikes.

Growth forecasts were tweaked lower, although not to the magnitude that the market had been expecting. Policymakers now think that the world’s largest economy will grow by 2.3% in 2019, down from the previous 2.5% projection. Inflation has also ‘surprised to the downside’ and provides the ‘ability to be patient going forward’ according to Powell. The central bank is now expecting annual inflation to dip from 2% to a below target 1.9% at the end of 2018 and remain around this level for the next twelve months.

As for the Fed’s heavily scrutinised ‘dot plot’, while this was also revised lower, the magnitude of the downgrade was again to a lesser extent than many had feared. The median dot for 2019 now shows that the committee expects to raise rates on two occasions in 2019, compared to the three that it had pencilled in back in September (Figure 2). These fresh forecasts now lower the long-run level of rates to 2.8% from the previous 3.0%. Many analysts, ourselves included, had expected this to show just one median hike for next year.

Figure 2: FOMC December ‘Dot Plot’

, Powell noted that rates were now at the ‘lower end’ of the neutral rate range, further indicating that a slower pace of hikes ahead is likely. This alteration in language can be attributed to much of the softness in the US Dollar this morning. The greenback fell by three-quarters of a percent against the Euro as investors began dialling back expectations for hikes over the next few years. The market is now not pricing in a hike at all in 2019, while placing a higher chance of a rate cut in 2020 than a hike.

Wednesday’s communications from the Fed make it clear that additional rate increases in the US next year will occur at a much slower pace than they have done in 2018. Powell’s indication that rates are nearing the neutral level, of which leads to stable inflation and the economy growing at its long-term trend rate, is significant. We continue to think that a pause in the hike cycle in the first half of next year is likely, with the Fed await additional inflation prints before re-evaluating the need for hikes in the second half of 2019.

A much slower pace of hikes from the Fed next year support our call for a roughly stable EUR/USD and a broad-based recovery in emerging market currencies against the greenback in 2019.