What to expect in the currency markets in 2019

- Go back to blog home

- Latest

2018 has been another particularly eventful year in the currency markets.

Figure 1: GBP/USD (YTD)

As always, monetary policy has played a significant role. The Federal Reserve has continued to raise interest rates on a regular basis this year, with their latest hike in December marking their fourth hike this calendar year. In Europe, the European Central Bank has been far less active. While the ECB will officially end its quantitative easing programme at the end of the month, it has kept interest rates steady and continued to reiterate that the first hike since 2011 remains a long way off. This has contributing to a much weaker Euro, which also fell to a more than one-year low in November. As for the Bank of England, Governor Mark Carney and co. voted in favour of another UK rate increase in August, although future policy changes hinge squarely on Brexit.

President Trump has also continued to dominate the newswires. His increased protectionist rhetoric has heightened fears over a US-China trade war, leading to a ramping up in safe-haven flows into the greenback, Japanese Yen and Swiss Franc.

Worst G10 performers year-to-date (YTD):

Swedish Krona (SEK), Australian Dollar (AUD)

Worst EM performers YTD:

Argentine Peso (ARS), Turkish Lira (TRY)

Best G10 performers YTD:

USD Dollar (USD), Japanese Yen (JPY)

Best EM performers YTD:

Thai Baht (THB), Mexican Peso (MXN)

But what does 2019 hold for the foreign exchange market?

US Dollar

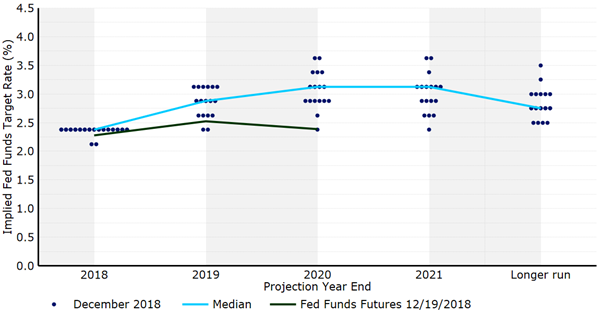

Despite raising rates again in December, the Federal Reserve has taken an unambiguously more dovish tone in recent weeks. Chair Jerome Powell has stated that interest rates are now nearing the neutral level, which leads to stable inflation and an economy growing at its long-term trend rate. US growth forecasts were revised lower by the Fed in December, while the latest ‘dot plot’ showed an average of just two hikes in 2019 compared to the three pencilled in back in September (Figure 2). The market is now not pricing in a hike at all in 2019, while placing a higher chance of a rate cut in 2020 than a hike.

Figure 2: FOMC December ‘Dot Plot’

, Following these communications, we think that a pause in the Fed hike cycle in the first half of next year is likely, with the FOMC awaiting additional inflation prints before re-evaluating the need for hikes in the second half of 2019. This ensures that we may only see one Fed hike over the next twelve months towards the latter stages of next year. A much slower pace of hikes from the Fed next year support our call for a broad-based recovery in emerging market currencies against the greenback in 2019.

As for the US-China trade war, we think that fears are somewhat overblown. Trump’s bombastic declarations are, in our view, largely political theatre and a negotiating tactic rather than anything else. The calling of a 90-day truce between Trump and Xi at the latest G-20 meeting is an encouraging sign and we think that a US-China trade deal in the New Year is likely.

Euro

With political risk in Italy fading following the reaching of an agreement between the Italian government and the European Commission over the country’s budget deficit target, focus in the Eurozone in 2019 will largely turn to monetary policy. As mentioned, the ECB has continued to reiterate that higher rates remain some way off.

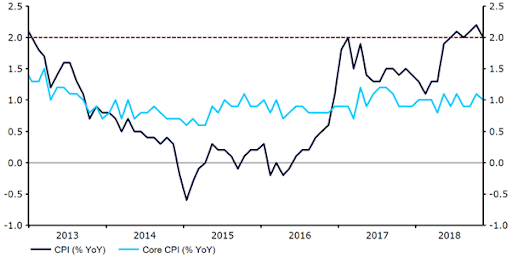

Euro-area core inflation, the key data point the central bank looks at when deciding on policy, remains well short of target at 1.0% (Figure 3). Until we see a sustained rebound in this measure, we can’t see how the ECB will even consider tightening policy. We are therefore not calling for a hike in the Euro-area until the fourth quarter of 2019 at the very earliest, more likely the first quarter of 2020 should inflation not show signs of an uptrend any time soon.

Figure 3: Eurozone Inflation Rate (2013 – 2018)

, With the Federal Reserve and ECB now, in our view, both likely to hold policy relatively steady next year, we are calling for a mostly flat EUR/USD in 2019 around the 1.15 level.

GBP

Macroeconomic news out of the UK has faded into irrelevance in the past few months, with all eyes firmly on Brexit. The first major hurdle for Theresa May will be getting her draft agreement through a government vote in mid-January. This vote, however, looks almost certain not to pass, barring a significant turnaround, with a host of Tory MPs already stating that they would not back the deal in its current form.

Should her vote fail to pass, the UK will be left in a very perilous position and faced with a number of alternatives – the likelihood of each are currently almost impossible to predict with any degree of accuracy:

- The UK leaves the EU without a deal on 29th March: This would undoubtedly lead to a sharp sell-off in Sterling that, we think, would test January 2017’s lows in GBP/USD. Trade would revert to WTO rules, tariffs would increase, prices would rise and growth would risk turning negative. GBP Negative.

- Negotiations re-opened with EU: The EU has repeatedly stated that no additional negotiations can take place, although if faced with a ‘no deal’ Brexit, additional concessions may be granted. GBP Neutral

- Article 50 is revoked: The ECJ ruling in December ensures that the UK government could simple pull Brexit. GBP Positive.

- Article 50 is delayed: This has also been recently ruled out by the EU, although remains a possibility. GBP Positive.

- Another referendum is called: There have been renewed calls for a ‘People’s vote’ within the UK parliament. Betting markets are now placing around a 40% chance of another referendum next year, although Theresa May has firmly ruled it out. This could first require a general election being called. GBP Positive – given 50/50 chance of remaining in EU.