Sterling spikes on hopes that Brexit deal could pass today

- Go back to blog home

- Latest

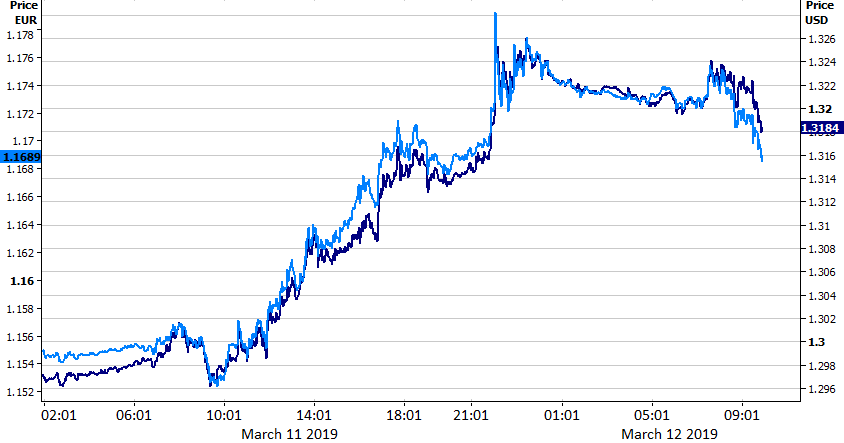

The Pound soared by almost two percent against the US Dollar on Monday (Figure 1), buoyed by the news that Theresa May had secured ‘legally binding’ assurances from the EU ahead of today’s critical parliamentary vote.

Figure 1: GBP/USD & GBP/EUR (11/03/2019 – 13/03/2019)

, Optimism that the PM’s deal could conceivably pass in today’s vote was given an unexpected boost late yesterday evening. The changes, according to May, ensured that the so-called Northern Irish ‘backstop’, the key sticking point to the entire Brexit process, will not become permanent after the UK leaves the European Union. The apparent permanency of the backstop was one of the main reasons why May’s deal was so resoundingly rejected in January. Last night’s development is therefore a significant one and opens up the possibility that MP’s could vote in favour of the PM after all today, something that seemed inconceivable a matter of 24 hours ago.

That being said, the market is not getting too carried away – the passing of the WA today would still take the market by surprise and lead to a sizable upward move in the Pound. Should the vote once again be rejected, as is still looking slightly more likely than not, May is set to reaffirm plans for MPs to vote on whether to leave to EU without a deal tomorrow, Wednesday 13th March. Should this then be rejected, as is very probable given the lack of appetite for a ‘no deal’ among UK politicians, a vote on whether to extend Brexit will be held on Thursday.

A vote in favour of an extension would be good news for the Pound, in our view, with the magnitude of the rally to be dependent on the length of the extension. A three month extension or more should, we believe, lead to a sharp upward move in the Pound. Anything less than that risks a sell-off in the UK currency, given the already high expectations for an Article 50 delay and the little time such a delay would give Theresa May to hash out concessions to her deal. Regardless, the next few days bode to be among the most volatile and unpredictable we’ve seen in major currency trading in a good while.

US retail sales mixed, Euro rises on Brexit optimism

EUR/USD spent much of yesterday fairly range bound just above the 1.12 level, albeit the pair did rally on last night’s Brexit news. The common currency remains just above its lowest level in over a year-and-a-half, with the currency still nursing its beatings following last week’s very dovish set of communications from the European Central Bank.

Markets mostly overlooked Monday’s US retail sales data, which were actually fairly mixed. A better-than-expected headline number for January (0.2% MoM increase versus the 0.0% expected) was offset by a downward revision to the December number. This is a relatively soft reading that reaffirms expectations that the US economy is likely to be slowing so far in 2019.

The main EUR/USD pair is likely to be driven, in large part, by the outcome of today’s Brexit vote in the UK. That being said, this afternoon’s US inflation data will also take on high importance, given its impact on Fed monetary policy. The market is eying an unchanged headline number of 1.6%, a confirmation of which would continue to cause investors to discount the possibility of higher interest rates from the Fed in 2019. A key date in the calendar is next Wednesday’s FOMC monetary policy announcement, in which the central bank is expected to revise lower its interest rate hike projections for this year.