Sterling unimpressed despite six month Brexit extension

- Go back to blog home

- Latest

The Pound edged modestly higher yesterday evening, albeit by a fairly negligible amount, after the UK and EU struck a deal over another delay to Brexit.

Somewhat surprisingly, the reaction in the Pound was very muted. Many investors that had hoped for a longer, one-year delay would have undoubtedly been left disappointed. This was seen as the best case scenario for Sterling given that it would have opened up the possibility of a second referendum, something that the six month extension seemingly provides inadequate time for.

Secondly, the market remains very wary over whether such a delay is even sufficient to break the current impasse. The EU remains opposed to reopening negotiations, while there remains a sizable chunk of Tory MPs that are against the Prime Minister’s deal. Moreover, the UK government’s strong opposition to taking part in the EP elections on 23rd May means that a ‘no deal’ Brexit in the summer is still on the table, while many investors may now be fearing the possibility of a general election.

Sterling is far from out of the woods just yet and we now think that we may have to wait until we actually see a majority in the House of Commons for a Brexit deal before the heavily anticipated sustained upward move in the UK actually commences.

Draghi notes weak data during dovish ECB presser

Wednesday’s European Central Bank meeting was, as we had anticipated, mostly a non-event, with President Mario Draghi mostly sticking to the script from the previous meeting.

Draghi continued to talk up downside risks to the outlook, while stating that the bank remains ready to use all instruments available to meet its inflation mandate. While he talked down the risk of a recession in the bloc and stated that no discussions had taken place regarding an alteration in the bank’s forward guidance, the market latched onto his comment regarding recent ‘weak’ incoming data. This was enough to send the EUR/USD rate around 40 pips lower, albeit the cross quickly recovered all of these losses as the day progressed.

Fed keeps options open for 2019 rate hike

The release of yesterday evening’s FOMC meeting minutes also went largely under the radar and had little impact on EUR/USD. Investors were instead fully focused on Brexit developments.

The minutes provided some fairly mixed messages, stating that slower growth was on the horizon although failing to rule out another interest rate hike in the US later this year. We believe that the ‘patient’ stance adopted by the bank allows them to hold policy steady for the foreseeable future, with the option to hike should economic conditions worldwide take a turn for the better.

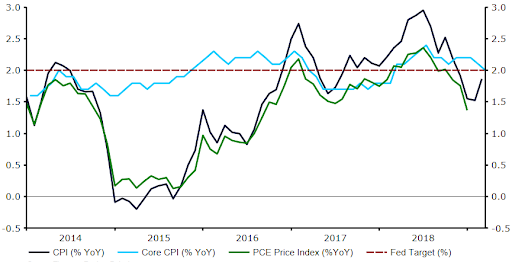

Meanwhile, Wednesday’s inflation numbers provided little clarity on the state of the US economy. The main headline measure unexpectedly rose back to 1.9% from the 1.8% priced in, although the core measure undershot expectations, coming in a 2.0% (Figure 1)

Figure 1: US Inflation Rate (2014 – 2019)