Sterling slides to fresh lows on calls for May to quit as PM

- Go back to blog home

- Latest

Heightened pressure on Theresa May’s position as Prime Minister has sent Sterling sharply lower in the past 24 hours.

May’s fresh proposals are seemingly dead before the next parliamentary vote even takes place, if it even does. There had been rumours that May was ready to quit last night, with the Times now reporting that this could happen on Friday. The scale of the opposition to May means that her time as PM could well be up.

Sterling has reacted negatively to the increased uncertainty, falling sharply to its lowest level in four months, having now shed over 4% in three weeks. As we said yesterday, more losses for the Pound look likely the longer this drags on.

Euro edges lower on EP election uncertainty, soft PMIs

Amid the uncertainty over Brexit, today’s European Parliament elections have gone completely under the radar. We’re unlikely to see any meaningful moves in the Euro in relation to the election until next week, with the results not expected to be known until Sunday. Increased support for the anti-EU populist parties within the 751-seat parliament is expected. With that being the case, it will likely be the degree to which support for these parties increases that impacts what kind of reaction we’ll see in the common currency.

For now, the Euro continues to be pinned below the 1.12 level and was sent even lower this morning following some pretty underwhelming PMI data out of the Eurozone. The key composite index showed a modest improvement, although at 51.6 was less than consensus. Weakness remains in German manufacturing activity, in particular. The index declined again in May to just 44.3 from 44.4, well below the level of 50 that indicates flat growth. This is a worrying sign that suggests uncertainty from abroad is continuing to influence business decision making in the currency bloc.

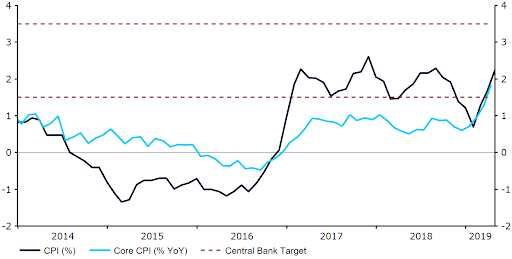

Figure 1: Eurozone Composite PMI (2014 – 2019)

Fed continues to urge patience, rate move long way off

Last night’s Federal Reserve meeting minutes also went under the radar, with the US Dollar continuing to be driven largely by investors appetite for risk. Heightened political and geopolitical tensions in Europe and Asia ensures that the greenback is currently trading around a one month high in trade-weighted terms.

The FOMC minutes themselves were broadly in line with the message from the May meeting, suggesting that no policy move would be warranted for ‘some time’, even if global economic conditions improve. Financial markets are currently placing around a three-in-four chance of a rate cut from the Fed this year. We think that this is a significant overpricing, particularly given a number of policymakers noted that some risks to the outlook have actually moderated.