Euro rallies on less-dovish-than-expected ECB meeting

- Go back to blog home

- Latest

The Euro briefly jumped to its strongest position against the US Dollar since mid-April on Thursday afternoon after the European Central Bank defied some of the more dovish onlookers by failing to hint at a potential interest rate cut following its June meeting.

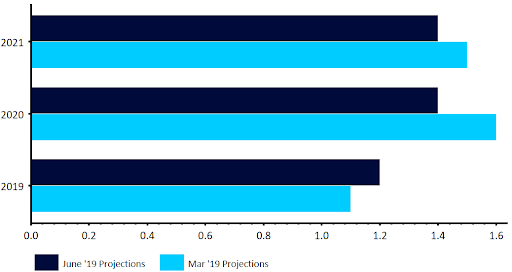

The growth forecast for this year was revised downwards, with risks, according to Draghi, remaining ‘tilted to the downside’. Inflation forecasts were tweaked, albeit only modestly, with headline price growth expected to hit 1.3% in 2019 and 1.4% in 2020, versus the 1.2% and 1.5% forecasts respectively from the March meeting.

Figure 1: Eurozone Growth Forecasts (2019 – 2021)

We did get some more details on the bank’s TLTRO programme, although they were slightly less generous than we had anticipated. The statement also suggested that some members of the rate setting council had raised the possibility of rate cuts and additional QE. These comments reinforce our view that global market conditions are currently not conducive of higher interest rates in most major economic areas.

USD set for worst week of 2019 ahead of payrolls report

With the Euro pretty buoyant following the ECB meeting, the US Dollar looks set for its worst weekly performance so far in 2019. Heightened expectations for Federal Reserve rate cuts amid trade uncertainty has been chiefly to blame for the weakness in the greenback so far this week, with the market now placing more than a 90% implied probability of a cut from the Fed this year.

Attention now shifts to this afternoon’s nonfarm payrolls report. Economists are eyeing another solid job creation number around the 185k mark.

Pound trades in narrow range as May departs as PM

Meanwhile, Sterling was relatively rangebound yesterday, with the lack of clarity over who would take over from Theresa May when she departs as Prime Minister today causing investors to avoid placing any sizable trades in either direction.

The next significant date in the calendar will now be 18th June, with those Tory candidates vying to be the next PM set to debate live on TV. As we have mentioned in the past few weeks, we think that growing support for pro-Brexit Boris Johnson could weigh on the Pound in the lead up to the end of October Brexit deadline.