Weak US manufacturing data weighs on greenback

- Go back to blog home

- Latest

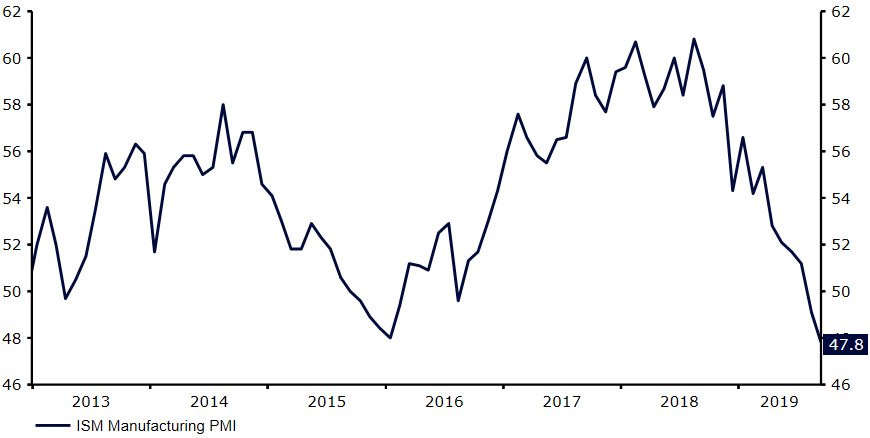

A much worse-than-expected set of US manufacturing data stopped the dollar in its tracks on Tuesday, while raising concerns regarding the overall health of the world’s largest economy.

Figure 1: US ISM Manufacturing PMI (2013 – 2019)

Investors didn’t get too carried away by the aforementioned weak data, with the greenback selling off by no more than half a percent for the day versus the euro at its peak. The main rationale for the lack of a more substantial sell-off is probably due to the relatively small size of manufacturing relative to total output. We should get a much more clear idea as to how the US economy is performing following this Thursday’s non-manufacturing PMI. A downside surprise here would be a clear red flag that a possible slowdown in the US is imminent.

The common currency itself was somewhat helped by a modest upward revision to the Eurozone manufacturing PMI from Markit. We did, however, see another downturn in headline inflation in the bloc to a meagre 0.9% YoY in September. ECB President Mario Draghi led calls for more European fiscal stimulus to lift the failing economy during a speech yesterday. Until this stimulus is actually announced, however, the euro could find meaningful gains from current levels hard to come by in the very near term.

Johnson to set out Tory’s Brexit plans

Sterling had yet another eventful day on Tuesday, trading within a 1% band, albeit ending the London session pretty much back where it started.

Yesterday’s UK manufacturing PMI was surprisingly more upbeat than expected, with the contraction in the sector in September not as severe as investors had braced for. Traders are, however, growing increasingly nervous regarding what’s next for Brexit, keeping the pound pinned around its lowest level in a month. Boris Johnson is expected to announce his proposals for an amended Brexit agreement today in the hope of forcing a deal through parliament by the end of the month. Investors remain fairly sceptical that this can actually be achieved, with an extension to the deadline followed by a general election looking far more likely.