Pound retreats from new highs after Farage election announcement

- Go back to blog home

- Latest

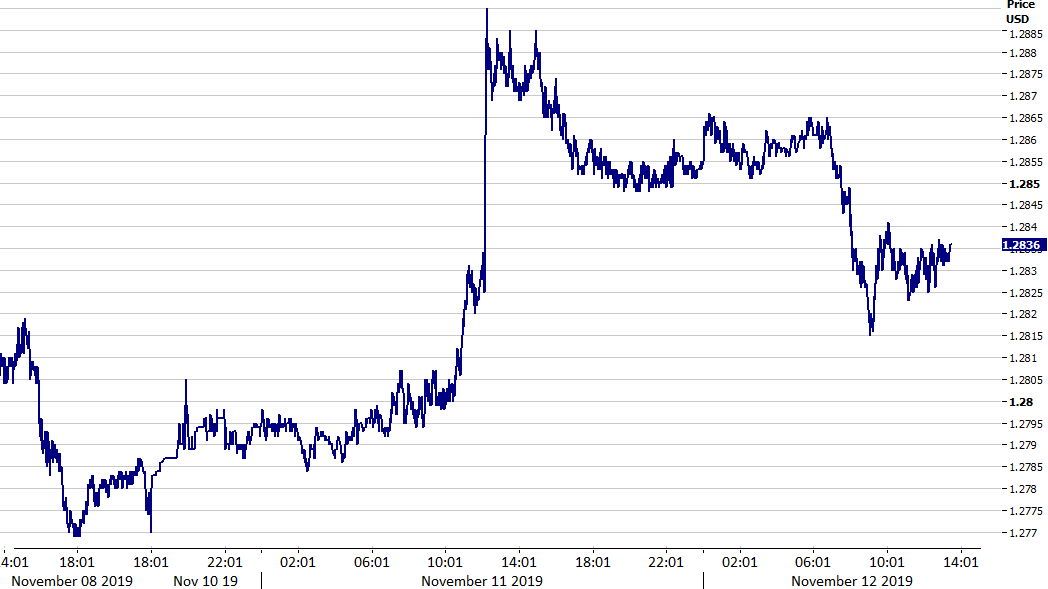

Sterling has had a very up and down past 24 hours or so.

The pound reacted as one would expect, rallying by around half a percent against its major peers and in the process hitting its strongest position versus the euro in six months. As we mentioned last week, investors are perceiving a Conservative majority government as positive for the pound, given that it would avert the worse-case ‘no deal’ scenario.

Figure 1: GBP/USD (08/11 – 12/11)

As you can see, much of the gains for the UK currency were, however, given up this morning. It is clear that a Tory majority is still far from a foregone conclusion and investors are therefore not getting too carried away.

News on Monday morning that the UK economy grew at a slower-than-expected pace in the third quarter of the year barely moved the pound. The UK economy expanded by 0.3% in the three months to September after investors had eyed a 0.4% print. This morning’s labour report was also a little underwhelming, with average earnings growth undershooting expectations by falling to 3.6% year-on-year. This does, however, remain at a very healthy level, while the jobless rate actually fell again to 3.8%.

Investors are, however, paying very little attention to macro data in the UK and will probably continue to do so until the Brexit saga eventually settles down.

What’s next for the US-China trade war?

US markets were closed due to Veterans Day on Monday, so activity across the pond was very limited.

EUR/USD has spent all of the week so far in a very narrow range, with the common currency stabilising itself following a drop in excess of one percent over the past seven days. Activity will no doubt pick-up today with a number of speeches on the economic calendar, none more important than President Trump. Optimism that the US and China could be ready to remove tit-for-tat tariffs swept through the markets last week, only for Donald Trump to pour cold water over the prospect on Friday. Any signs today that his view on the matter is drastically changed would undoubtedly lift risk appetite.

Aside from that, the latest ZEW economic sentiment indicators are due for release in the Eurozone. Expectations for this heavily watched measure are incredibly low, meaning we think that there is room for an upside surprise. This could provide some much needed assistance to the euro, which continues to lag around its lowest level in almost a month.